If you're thinking about setting up a crypto mining operation in Kazakhstan, you need to know one thing upfront: it's not as simple as plugging in a rig and turning it on. The country has built one of the most tightly controlled mining environments in the world - and if you don't follow the rules, you won't get past the first step. Since 2023, Kazakhstan has moved from a loose notification system to a full licensing regime, and by 2026, the bar is higher than ever.

Only One Place to Get a License: The AIFC

You can't just walk into any government office in Kazakhstan and apply for a mining license. There's only one place that handles this: the Astana International Financial Center (a sovereign financial zone with its own legal system, separate from Kazakhstan’s national laws, AIFC). Every single crypto miner - whether you're a solo operator or a corporate entity - must register through the AIFC. No exceptions. No workarounds. If you're not in the AIFC, you're operating illegally.

This isn't just a formality. The AIFC acts as both regulator and gatekeeper. It controls who gets in, what they can do, and how they must report their activity. Other countries might let miners operate freely or require scattered state permits. Kazakhstan? Everything flows through this one hub.

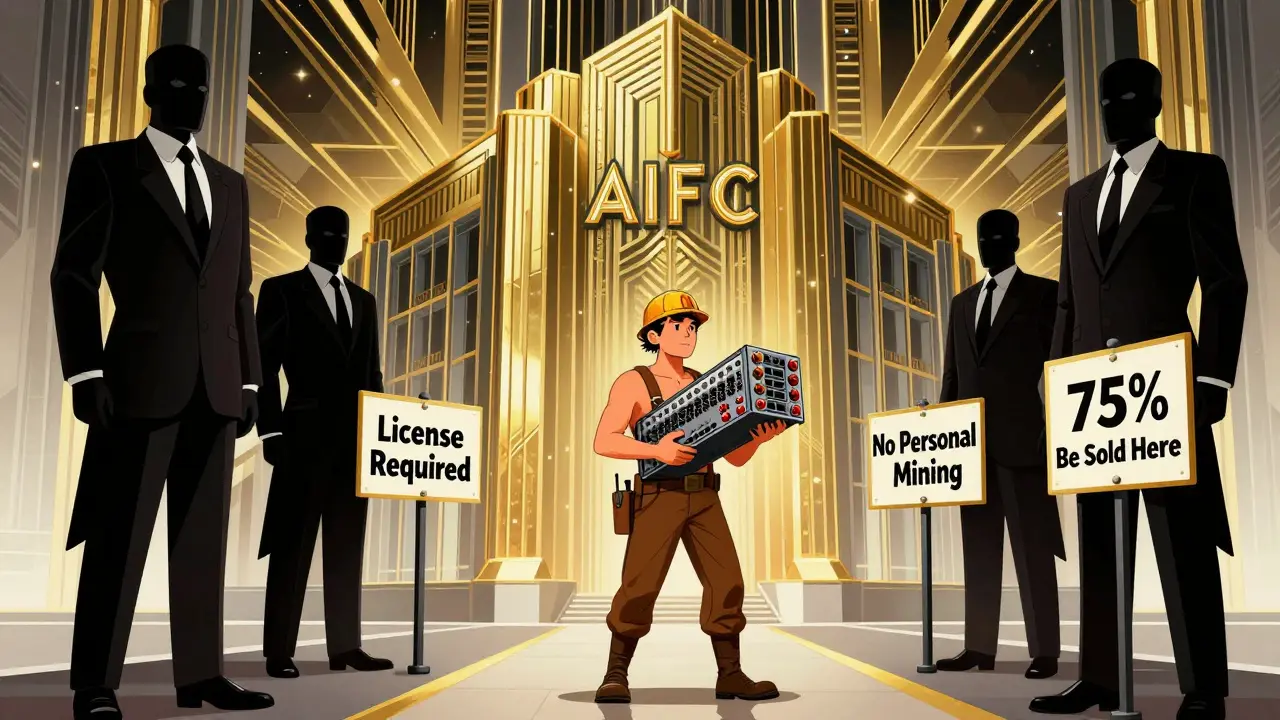

You Must Be a Legal Entity in Kazakhstan

You can't mine under your personal name if you're a foreigner. You must form a legal entity - either a company or an individual entrepreneur - registered within Kazakhstan. This means you need to incorporate in the AIFC jurisdiction, not just open a bank account or hire a local agent. The AIFC requires real presence: a physical office space rented inside its premises, and at least two local employees hired full-time as your AML officer and compliance officer.

These aren't just titles. These are roles with legal responsibility. Your AML officer must be able to prove they understand Kazakhstan's anti-money laundering rules. Your compliance officer must be able to show they’ve trained staff, monitored transactions, and reported suspicious activity. If you can't hire qualified locals, your application gets rejected. This rule alone shuts out many small-scale operators who thought they could run things remotely.

Only Licensed Mining Pools Are Allowed

Here’s where Kazakhstan breaks from every other major mining country: Digital Mining Pools (DMPs) (regulated entities that aggregate mining power and manage payouts under state supervision) are mandatory. You can’t mine on your own, join a global pool like F2Pool or BTC.com, or even set up your own private pool. You must join one of the five state-approved DMPs.

Why? Control. The government wants to know exactly where every hash rate comes from, who owns it, and where the coins go. By forcing miners into approved pools, the state can track every transaction, monitor energy usage, and enforce the next big rule: selling most of your coins domestically.

75% of Your Mined Crypto Must Go Through AIFC Exchanges

In 2024, miners had to sell half their output on AIFC platforms. In 2025, that jumped to 70%. By 2026, it’s 75%. That’s not a suggestion. That’s a legal requirement. If you mine Bitcoin, Ethereum, or any other coin, you must sell 75% of what you produce on exchanges licensed by the AIFC.

This isn’t about taxation - it’s about currency control. The government wants to capture foreign currency inflows. Every time you sell crypto on a local exchange, it gets converted into Kazakhstani tenge or USD, and that money flows into the national banking system. It’s a way to keep capital within the country and prevent offshore outflows.

That means if you mine 10 BTC a month, you can only keep 2.5 BTC for yourself. The other 7.5 BTC must be sold on an AIFC-licensed platform like AIFC Exchange or another approved marketplace. If you try to send coins directly to an overseas exchange like Binance or Coinbase, you risk fines, license revocation, or criminal charges.

The Licensing Process Takes 6 to 9 Months

Don’t expect to get up and running in a few weeks. The licensing process has three phases - and each one takes months.

- Preparation: You need a full business plan, financial projections with bank statements, corporate documents from your parent company (if applicable), AML-CFT policies, KYC software setup, client onboarding rules, and a clear organizational chart with named management roles.

- Incorporation: You must physically rent office space in the AIFC, hire two local staff members, deposit share capital into a Kazakhstan bank account, and appoint a management board of at least four people. All board members must have verified experience in finance or tech.

- Application: You demonstrate your systems are live: show the AML software in action, prove your compliance officer is trained, present your mining pool contract, and run a test transaction through the AIFC exchange.

Most applicants take 6 to 9 months to complete this. Many fail because they underestimate the documentation. One company spent 8 months trying to get approved - and got rejected because their financial projections didn’t match their bank deposit history. There’s no room for guesswork.

Tax Rate Is 15% - But It’s Not the Full Story

Yes, the tax rate on mining profits is 15%. That’s lower than the U.S., Germany, or Canada. But don’t get fooled. The real cost isn’t just taxes - it’s compliance. You’ll need lawyers, local employees, office rent, software licenses, and ongoing audits. The 15% tax is just the tip of the iceberg.

Plus, there’s no tax exemption for energy costs. You pay full price for electricity, even if you’re using surplus power. The government has floated the idea of a 70/30 energy split - where 70% of new power plants go to the grid and 30% to miners - but that’s still a proposal. Right now, you pay market rates.

What Happens If You Don’t Comply?

Miners who operate without a license face serious consequences. The state has already shut down over 120 unlicensed operations since 2024. Equipment is seized. Bank accounts are frozen. Individuals can be fined up to 5 million tenge (about $11,000 USD). Repeat offenders may face criminal charges under Kazakhstan’s economic crime laws.

Even if you’re not in Kazakhstan, if you’re mining using hardware located there, you’re still under jurisdiction. The AIFC tracks IP addresses, hardware IDs, and pool connections. If your rig is in Kazakhstan, you’re regulated - whether you know it or not.

Who’s Actually Getting Licensed?

As of early 2026, the AIFC has issued 84 mining licenses. That’s not a lot - but it’s not meant to be. The system is designed for serious operators, not hobbyists. The 415,000 registered mining machines are all tied to those 84 licenses. That means the average license holder runs over 5,000 machines.

The majority of licensees are institutional investors: private equity funds, energy firms, and international mining conglomerates. Small miners? They’re being squeezed out. The system was built to attract big money, not to be a playground for crypto enthusiasts.

How Does Kazakhstan Compare to Other Countries?

Most countries either ban mining (like China) or leave it completely unregulated (like El Salvador). The U.S. is a patchwork - some states tax it, others don’t. Kazakhstan sits in the middle: legal, but with heavy control.

The mandatory digital mining pool is unique. No other country forces miners into state-approved pools. The 75% sale requirement is also extreme. Only a few nations, like Russia and Iran, have similar controls - but none with this level of institutional infrastructure.

Kazakhstan’s goal isn’t to become the next Bitcoin hub. It’s to become a financial gateway. By controlling how mining revenue flows out of the country, it’s building a bridge between crypto and its national economy.

What’s Next for Mining in Kazakhstan?

The government is already talking about a state-backed crypto reserve. That means the mined coins from licensed operators could eventually be used as collateral for national financial instruments. There are also talks of launching a sovereign digital currency backed by mining output.

Expect more changes in 2026. The 75% rule might go higher. The AIFC might require miners to use blockchain-based reporting tools. More oversight on energy usage is coming. The days of easy mining in Kazakhstan are over. This isn’t a free-for-all anymore - it’s a regulated industry.

Can I mine crypto in Kazakhstan without a license?

No. All mining activity must be conducted under an AIFC-issued license. Unlicensed mining is illegal and can lead to equipment seizure, fines, or criminal charges. Even if you’re a foreigner using hardware located in Kazakhstan, you’re still subject to these rules.

Do I need to move to Kazakhstan to get a mining license?

You don’t need to live there, but you must have a physical presence. You’re required to rent office space in the AIFC and hire two local employees - an AML officer and a compliance officer - who must be based in Kazakhstan. Remote management alone won’t cut it.

Can I use any mining pool I want?

No. You must join one of the five state-approved Digital Mining Pools (DMPs). Foreign pools like F2Pool or BTC.com are not allowed. This is one of Kazakhstan’s most unique and restrictive rules.

What happens if I don’t sell 75% of my mined crypto on AIFC exchanges?

You risk license suspension or revocation. The AIFC monitors all transactions through its reporting systems. If you transfer coins to non-approved exchanges, you’ll be flagged. Repeated violations can lead to legal action and asset forfeiture.

Is the 15% tax rate the only cost of mining in Kazakhstan?

No. The real costs are compliance: legal fees, local staff salaries, office rent, software licensing, and ongoing audits. Many operators spend more on compliance than on taxes. The 15% tax is low, but the administrative burden is high.

Can I apply for a license if I’m not a Kazakh citizen?

Yes. Foreign investors can apply, but they must establish a legal entity within the AIFC. You’ll need to follow the same steps as a local company: hire local staff, rent office space, and submit full documentation. Citizenship doesn’t matter - legal presence does.

Lisa Parker

February 19, 2026 AT 14:28