Since January 2025, if you’re holding USDT in the European Union, you can’t trade it on any licensed exchange. Not anymore. Not even a little. That’s the reality under the EU’s new MiCA regulation - and it’s not just about USDT. It’s about every stablecoin that doesn’t meet Europe’s strict new rules.

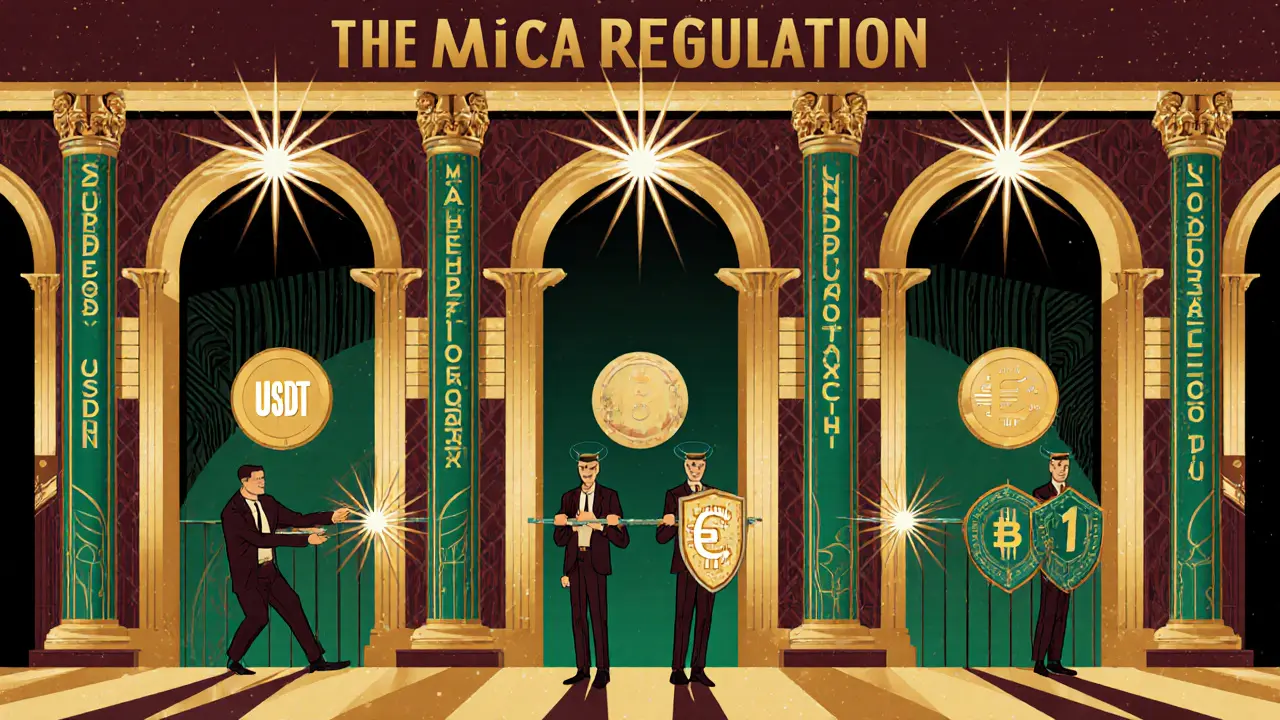

What MiCA Actually Does

The Markets in Crypto-Assets Regulation, or MiCA, didn’t just tweak the rules. It rewrote them. Starting in 2025, every stablecoin operating in the EU had to prove it was safe, transparent, and backed properly. No more vague promises. No more hidden reserves. No more relying on trust alone. MiCA splits stablecoins into two buckets: Asset-Referenced Tokens (ARTs) and E-Money Tokens (EMTs). ARTs are pegged to a mix of assets - like a basket of currencies or commodities. EMTs are simpler: they’re pegged 1:1 to a single fiat currency, like the euro or dollar. Both types must meet the same core rules:- 1:1 backing - every token must have a real euro, dollar, or other asset sitting in reserve

- Reserves must be held in bankruptcy-protected accounts - so if the issuer goes under, your money isn’t lost

- Users must be able to redeem their tokens for the full value at any time

- Issuers must publish daily reports showing exactly what’s backing the tokens

Why USDT Got Blocked

Tether, the company behind USDT, says it’s fully backed. But MiCA doesn’t care what Tether says. It cares about proof. And here’s the problem: Tether’s reserves aren’t structured the way MiCA demands. MiCA requires reserves to be held in segregated, bankruptcy-protected accounts. Tether’s reserves are held in a mix of cash, commercial paper, bonds, and even loans to affiliated companies. That’s not the same thing. In 2024, the Bank for International Settlements flagged USDT’s peg as “fragile,” citing moments where it dropped below $0.99 - something that shouldn’t happen if it’s truly 1:1 backed. Plus, Tether doesn’t publish daily, audited reserve reports. MiCA does. And because Tether hasn’t applied for EU authorization under MiCA’s strict licensing system, EU exchanges had no choice: delist USDT by January 31, 2025. No exceptions. No grace period. You can still hold USDT in your personal wallet. You can still send it. But you can’t buy it, sell it, or trade it on any platform regulated by the EU. That cuts off 90% of its liquidity in Europe.Who’s Still Allowed?

Not many. So far, only a handful of stablecoins have cleared MiCA’s bar:- EURC - Circle’s euro-backed stablecoin, fully compliant and licensed in Luxembourg

- EURe - Issued by the European bank consortium, expected to launch in late 2026

- USDC - Circle’s dollar stablecoin, compliant under MiCA since late 2024

The U.S. vs. Europe Divide

While Europe tightened the screws, the U.S. went the other way. In July 2025, President Trump signed the GENIUS Act - a law that treats stablecoins as electronic money, not securities. It’s simpler. It’s faster. And it gives companies more room to move. Under the GENIUS Act:- Stablecoins can be issued by banks or non-banks, as long as they’re 1:1 backed

- Reserves don’t need to be held in bankruptcy-protected trusts - just in safe, liquid assets

- Redemption timelines are flexible - you don’t need instant cash-out

- There’s no mandatory daily public reporting

What European Banks Are Doing About It

Europe isn’t just banning USDT - it’s trying to replace it. Nine major banks - including ING, UniCredit, Danske Bank, and KBC - formed a consortium to build a new euro-denominated stablecoin called EURe. It’s not just a copy of USDT. It’s designed for European finance: fast, programmable, 24/7 settlement, and fully compliant with MiCA. The consortium set up a new company in the Netherlands and applied for a license as an e-money institution. The Dutch central bank is reviewing it now. If approved, EURe will launch in late 2026. This isn’t just about money. It’s about sovereignty. As Floris Lugt from ING put it: “Digital payments are key for new euro-denominated payments and financial market infrastructure.” Europe doesn’t want to rely on U.S. companies for its digital cash.

What This Means for You

If you’re in the EU and you’re holding USDT:- You can’t trade it on exchanges like Binance, Kraken, or Bitpanda anymore

- You can still store it in your wallet - but you can’t easily convert it to euros or spend it

- If you want to cash out, you’ll need to use a peer-to-peer platform or a non-EU exchange - which carries higher risk

- Your DeFi apps in the EU may stop accepting USDT - many have already switched to USDC or EURC

- Start moving your stablecoin holdings to USDC or EURC if you need EU compliance

- Don’t assume “it’s just a stablecoin” - the legal status matters now

- Watch for EURe’s launch in 2026 - it could become the new standard for euro payments

What’s Next?

MiCA isn’t done. In 2026, regulators will start looking at non-stablecoin crypto assets - like Bitcoin and Ethereum - under the same framework. But for now, the focus is clear: stablecoins must be safe, transparent, and regulated - or they’re out. The EU isn’t trying to kill crypto. It’s trying to fix what it sees as a dangerous, unregulated wild west. Whether that’s the right approach? That’s still up for debate. But right now, if you’re in Europe and you’re using USDT - you’re operating on borrowed time. The rules have changed. And they’re not going back.Can I still hold USDT in the EU after the MiCA ban?

Yes, you can still hold USDT in your personal wallet. The MiCA ban only stops licensed exchanges and service providers from trading, listing, or offering services for non-compliant stablecoins. You’re not breaking any law by keeping it - but you won’t be able to easily convert it to euros or use it on EU-based platforms.

Is USDC allowed in the EU?

Yes, USDC is fully compliant with MiCA. Circle, its issuer, obtained the necessary licenses from EU regulators and meets all reserve transparency and redemption requirements. USDC is currently the most widely used compliant stablecoin in the EU.

Why didn’t Tether apply for MiCA compliance?

Tether has not publicly applied for MiCA authorization. Experts believe this is because its reserve structure - which includes commercial paper, corporate bonds, and loans - doesn’t meet MiCA’s strict requirements for bankruptcy-protected, fully liquid reserves. Applying would require major changes to its business model, which Tether has so far avoided.

What happens if I try to trade USDT on a European exchange?

You won’t be able to. All licensed crypto exchanges in the EU were required to delist non-compliant stablecoins like USDT by January 31, 2025. If you find a platform still offering USDT, it’s likely unregulated - meaning you have no legal protection if something goes wrong.

Will the EU ban other stablecoins like DAI or BUSD?

Yes. DAI, which uses an algorithmic mechanism alongside collateral, doesn’t fully meet MiCA’s 1:1 reserve requirement. BUSD was already delisted globally in 2023 after its issuer, Paxos, stopped minting it. Any stablecoin that doesn’t prove full, transparent, and liquid backing will be banned from EU trading platforms.

Is there a European alternative to USDT?

Yes - the European bank consortium is developing EURe, a euro-backed stablecoin expected to launch in late 2026. It’s designed to be fully MiCA-compliant and serve as a European alternative to U.S.-dominated stablecoins like USDT and USDC. Until then, EURC and USDC are the only widely available compliant options.

Becca Robins

November 7, 2025 AT 10:36Meagan Wristen

November 8, 2025 AT 16:54Janna Preston

November 9, 2025 AT 14:58gerald buddiman

November 11, 2025 AT 07:08Arjun Ullas

November 12, 2025 AT 20:51Steven Lam

November 14, 2025 AT 14:49Sierra Rustami

November 16, 2025 AT 13:51Glen Meyer

November 16, 2025 AT 17:57Colin Byrne

November 16, 2025 AT 20:54Brian Webb

November 17, 2025 AT 04:07Whitney Fleras

November 18, 2025 AT 10:44Leo Lanham

November 18, 2025 AT 20:40Noah Roelofsn

November 20, 2025 AT 13:31Alexa Huffman

November 21, 2025 AT 22:34