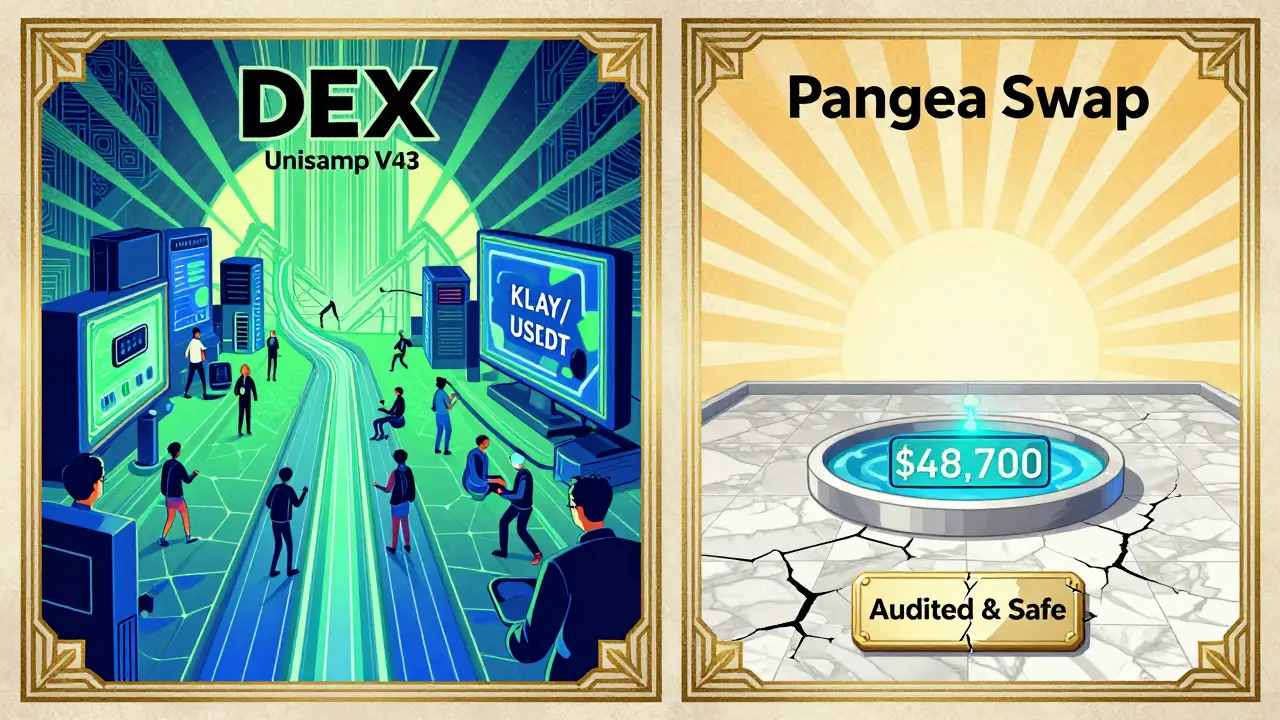

When you’re trading crypto on a blockchain that doesn’t get much attention, you need a DEX that actually works. That’s where Pangea Swap came in - a decentralized exchange built just for the Klaytn network, and the first one to bring concentrated liquidity to the chain. It launched with big promises: higher yields for liquidity providers, lower slippage for traders, and a clean, no-nonsense design. But two years later, things look different.

What Makes Pangea Swap Different?

Most DEXs on smaller blockchains use old-school automated market makers (AMMs) that spread your liquidity across every possible price. That means 90% of your funds sit idle while trades happen in a narrow range. Pangea Swap changed that. It lets you pin your liquidity to specific price ranges - like putting your money only where the market is actually moving. This is the same model Uniswap V3 uses on Ethereum, but Pangea Swap was the first to bring it to Klaytn. That small tweak made a huge difference. Liquidity providers saw up to 40x more capital efficiency. Traders got better prices because there was more money where it mattered. Within two months of launch, Pangea Swap hit $10 million in total value locked (TVL) and became the top DEX by volume on Klaytn. For a network that wasn’t exactly buzzing with DeFi activity, that was a big win.Why No Governance Token? (And What Happened to STONE?)

Most DeFi projects launch a token on day one. Pangea Swap didn’t. The team said they didn’t want to sell a token before proving the platform had real value. They planned to release the STONE governance token in Q1 2023 - once the system was stable and users were already benefiting from concentrated liquidity. But here’s the problem: there’s no sign of STONE today. No announcement. No airdrop. No roadmap update. The website still lists it as "coming soon," but it’s been over two years since that promise. That silence raises red flags. If the team had the resources to build a sophisticated DEX, why couldn’t they launch a token? Were they waiting for regulatory clarity? Did they run out of funding? Or did they just lose momentum? The lack of a governance token isn’t inherently bad - some DeFi protocols run fine without one. But when users can’t vote on fees, pool incentives, or upgrades, the platform becomes centralized by default. That’s a big risk in crypto, where trust is everything.Is Pangea Swap Still Active in 2026?

This is the million-dollar question. If you check CoinMarketCap, Pangea Swap shows up as an "Untracked Listing." That means their trading volume and liquidity data aren’t being verified. The reserve data? Marked as unavailable. That’s not normal for a live, functioning DEX. Real DEXs - even small ones - report their TVL and volume through on-chain analytics tools like DeFiLlama or Dune Analytics. Pangea Swap doesn’t. That could mean one of three things:- The team stopped updating their data feeds.

- The platform’s activity dropped so low that it’s no longer worth tracking.

- There’s no real volume - and what was reported early on was inflated.

Who Should Still Use Pangea Swap?

If you’re deeply embedded in the Klaytn ecosystem - maybe you’re a gamer using a Klaytn-based game, or you hold KLAY as a long-term bet - then Pangea Swap might still be your only real option for swapping tokens on-chain. There aren’t many alternatives on Klaytn, and the network still has a loyal niche user base. But if you’re looking for a reliable, high-volume DEX with transparent data, you’re better off going elsewhere. Uniswap V3 on Ethereum, PancakeSwap on BSC, or even SushiSwap on Polygon all have more liquidity, better tracking, and active communities. Pangea Swap doesn’t compete with them - it’s a different beast entirely.Security and Tax Compliance

On the bright side, Pangea Swap isn’t shady when it comes to compliance. All trades are recorded on the Klaytn blockchain, which means tax agencies can trace them. If you’ve traded on Pangea Swap, you’re required to report those gains or losses on your crypto taxes. That’s actually a good sign - it means the platform operates within standard regulatory frameworks. There’s no evidence of money laundering, hidden wallets, or anonymous operators. The smart contracts have been audited (by a third party, though the report isn’t publicly linked), and there haven’t been any known exploits. So technically, your funds are safe - if they’re still there.

The Bigger Picture: Is Klaytn Even Alive?

Pangea Swap’s fate is tied to Klaytn’s. Klaytn was once backed by Kakao, the Korean tech giant behind KakaoTalk. It had big ambitions to bring blockchain to everyday users. But since 2022, its ecosystem has slowed down. Developer activity is low. New projects aren’t launching. Wallet adoption is flat. If Klaytn fades, Pangea Swap dies with it. No matter how good the concentrated liquidity model is, it doesn’t matter if no one’s trading. The platform’s early success was built on hype and novelty. Now, without updates, transparency, or growth, it’s just a relic.Final Verdict: Use With Caution

Pangea Swap had a strong start. It solved a real problem on Klaytn. But two years later, it’s stuck in limbo. The lack of a governance token, untracked volume, and near-zero liquidity make it a risky bet. Use Pangea Swap only if:- You’re already using Klaytn for other apps.

- You’re comfortable with low liquidity and potential slippage.

- You’re not expecting to earn meaningful yield from liquidity provision.

- You need reliable, high-volume trading.

- You want governance rights or future token rewards.

- You’re looking for a DEX with active development.

Is Pangea Swap still operational in 2026?

Yes, the website and smart contracts are still live, and you can connect your wallet to trade. But liquidity is extremely low, most trading pairs have under $50,000 in reserves, and trading volume is no longer tracked by major platforms. It’s functional, but not active in any meaningful way.

Why doesn’t Pangea Swap have a governance token?

The team intentionally delayed the STONE token launch until the platform proved its value. That was supposed to happen in early 2023, but the token has never been released. No official reason has been given, and there’s been no update since. This lack of transparency has damaged trust among users.

Is Pangea Swap safe to use?

The smart contracts have been audited and there have been no known hacks. Transactions are on-chain and traceable, meaning it complies with standard crypto tax rules. But safety also depends on liquidity and activity - with near-zero reserves in most pools, your trades may not execute as expected, and your funds could be stuck.

Can I earn yield on Pangea Swap as a liquidity provider?

Technically yes - you can add liquidity and earn trading fees. But with most pools having less than $100,000 in total value, and volume being untracked, your potential returns are minimal. You’re also at risk of impermanent loss if the price moves outside your chosen range, and there’s no incentive program to boost yields.

How does Pangea Swap compare to Uniswap V3?

Pangea Swap uses the same concentrated liquidity model as Uniswap V3 - but on a much smaller network. Uniswap V3 has billions in TVL, thousands of liquidity providers, and active development. Pangea Swap has a fraction of that, with no updates in over a year. It’s the same technology, but Uniswap V3 is alive; Pangea Swap is fading.

Should I invest in Pangea Swap’s future?

Not unless you’re betting on Klaytn’s revival. Pangea Swap’s innovation was real, but execution has stalled. Without a governance token, transparency, or new features, there’s no reason to believe it will grow. Investing here means betting on a dead project coming back to life - which rarely happens in crypto.

Will Pimblett

January 26, 2026 AT 10:15So Pangea Swap is basically a ghost town with a working wallet connector? Cool. I’ll keep my KLAY in a drawer and wait for the ghost to come back with a STONE token. Or maybe it’s just a honeypot for early adopters who believed the hype. 🤷♂️

Christopher Michael

January 28, 2026 AT 06:41Let’s be real: concentrated liquidity on Klaytn was a brilliant idea-until the team vanished. The smart contracts are fine, but without on-chain analytics, without updates, without a governance token? It’s not a DEX-it’s a digital monument. Like a statue of a man holding a wallet, frozen mid-trade. And no one’s even paying attention anymore.