AML Compliance in Crypto: What You Need to Know About Regulations, Seizures, and Exchange Rules

When you trade crypto, AML compliance, Anti-Money Laundering rules designed to stop criminals from using digital assets to hide illegal funds. Also known as know-your-customer (KYC) rules, it's the invisible guardrail that keeps exchanges from getting shut down and your wallet from getting frozen. This isn’t optional—it’s the reason why you can’t buy Bitcoin on a major exchange without uploading a photo of your ID, and why platforms like Bybit or Binance get hit with billion-dollar fines when they slip up.

AML compliance ties directly to crypto regulation, government frameworks that force crypto businesses to track users, report suspicious activity, and freeze assets tied to crime. The EU’s MiCA regulation, for example, doesn’t just ban non-compliant stablecoins like USDT—it forces every exchange operating there to prove they’re doing real AML checks. In the U.S., the SEC’s 2024 crackdown—where penalties jumped over 3,000%—wasn’t just about unregistered tokens. It was about unregulated exchanges skipping AML steps to attract high-risk traders. And in Nigeria, even after lifting its ban, the government now requires all approved platforms to follow ISA 2025 rules, meaning users must pass identity checks before trading.

It also connects to crypto seizures, when law enforcement takes control of digital assets linked to fraud, hacking, or drug trafficking. The $1.5 billion heist from Bybit? North Korean hackers stole it, but governments are now seizing billions more from criminals worldwide—not just selling it off, but holding it as evidence or even converting it into fiat. These seizures only happen because exchanges and wallets are required to flag suspicious transfers under AML rules. Without those rules, those funds would vanish into mixers and never be tracked.

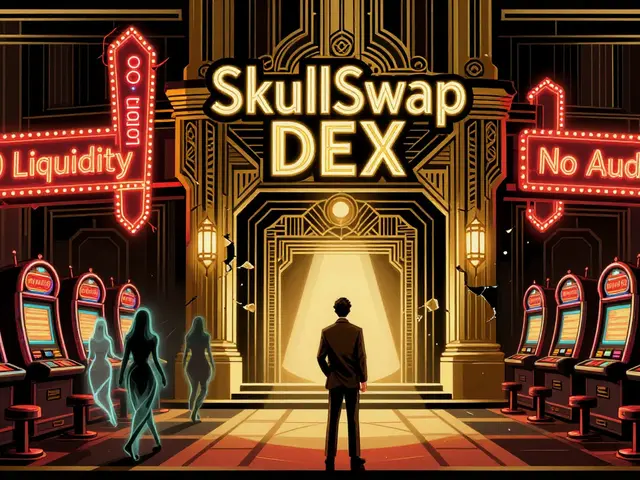

And it’s why you see posts about crypto exchange rules, the specific policies platforms must follow to stay licensed and avoid being blocked by banks or regulators. Whether it’s India’s strict FEMA rules forcing you to declare overseas crypto transfers, or Georgia’s Cryptal Exchange offering simple GEL purchases because it’s fully compliant, every platform you use is shaped by AML. Even fake DEXs like LocalCoin DEX exist because scammers know most people don’t understand how real exchanges are monitored—and they exploit that gap.

What you’ll find here isn’t a list of legal jargon. It’s real-world stories: how Nigeria’s underground crypto economy survived a ban, why the SEC fined companies billions for skipping AML checks, how seized crypto is handled across countries, and what happens when a stablecoin like USDT gets banned in Europe because it doesn’t meet transparency standards. These aren’t abstract concepts—they’re the rules that determine whether your trade goes through, whether your wallet gets flagged, or whether you lose everything to a scammer because a platform cut corners.

Below, you’ll see how these rules play out in real crypto projects—from meme coins with no team to DeFi protocols that automate compliance, from exchange reviews that call out shady platforms to deep dives on how governments track your transactions. This isn’t about fear. It’s about clarity. Know the rules. Understand the risks. Trade smarter.

How to Get a Crypto Exchange License in 2025

Learn how to legally obtain a crypto exchange license in 2025, including federal MSB registration, state MTL requirements, compliance costs, and how to avoid shutdowns from regulators.