Bangladesh Bank crypto warning: What it means for users and exchanges

When the Bangladesh Bank crypto warning, a formal directive issued by the central bank prohibiting all cryptocurrency transactions. Also known as Bangladesh crypto ban, it declared digital assets illegal for use as currency, payment method, or investment vehicle within the country. In 2021, this wasn’t just a caution—it was a legal shutdown. The bank made it clear: no bank, no payment processor, no exchange could touch crypto. Violators faced criminal charges under the Money Laundering Prevention Act. This wasn’t about fear of volatility—it was about control. The central bank didn’t want citizens bypassing the taka, avoiding taxes, or moving money outside its reach.

But here’s the twist: the ban never fully stuck. While banks still freeze accounts linked to Binance, Bybit, or local P2P traders, people keep trading. Crypto wallets aren’t regulated, so users shift to peer-to-peer apps like LocalBitcoins or WhatsApp groups. Some even use foreign SIM cards or offshore banks to move funds. The Bangladesh crypto regulation, the legal framework enforcing the central bank’s prohibition on crypto use. remains unchanged, but enforcement is inconsistent. Police raid homes over crypto transactions, yet traders in Dhaka and Chittagong still meet in cafes to swap BDT for USDT. Meanwhile, central bank crypto policy, the official stance of Bangladesh Bank rejecting decentralized finance and maintaining fiat monopoly. hasn’t evolved. No licensing path exists. No sandbox. No exceptions—even for DeFi or NFTs.

What’s left for users? A gray zone. You can’t legally buy crypto with a local bank account. You can’t cash out to a Bangladeshi bank without risking seizure. But if you know someone with a foreign wallet, or use a trusted P2P broker, you can still get in and out. The real risk isn’t the tech—it’s the law. One wrong message, one flagged transaction, and your account gets locked. No warning. No appeal. That’s why most people who trade here keep quiet. They don’t post screenshots. They don’t talk about it online. They treat crypto like cash under the mattress—useful, but dangerous to admit you have it.

What you’ll find in the posts below are real cases of people caught in this system—exchanges that got shut down, users who lost funds to scams pretending to be legal, and the quiet workarounds that keep crypto alive despite the ban. No fluff. No theory. Just what’s actually happening on the ground in Bangladesh today.

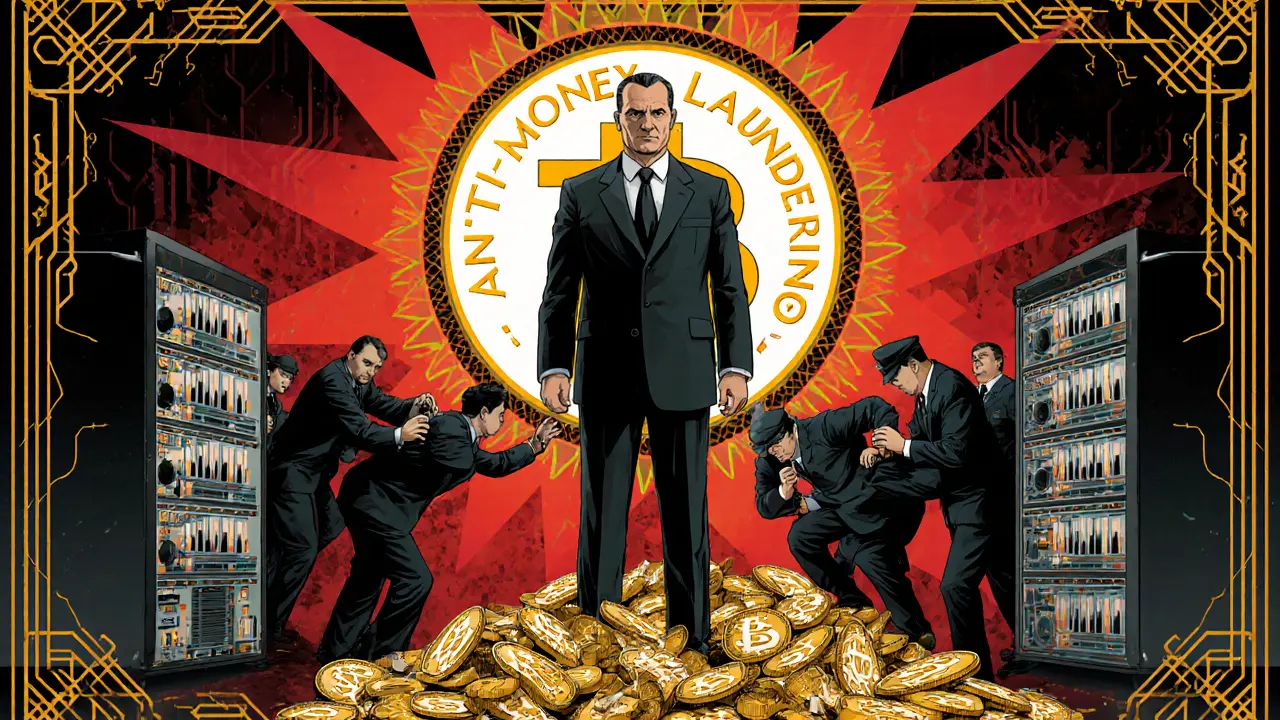

Anti-Money Laundering Crypto Enforcement in Bangladesh: What You Need to Know

Bangladesh enforces one of Asia's strictest crypto policies, banning trading and mining under anti-money laundering laws. Learn how arrests, fines, and hidden crypto use shape the real risks for users in 2025.