Banking Restrictions Crypto: What’s Blocked, Why, and How to Navigate It

When you try to buy crypto and your bank blocks the transaction, it’s not a glitch—it’s policy. banking restrictions crypto, policies imposed by financial institutions that limit or block transactions involving cryptocurrency. These aren’t random decisions—they’re responses to regulatory pressure, money laundering fears, and unclear legal status. In some places, like Nigeria before 2025, banks were ordered to cut off crypto-related accounts entirely. In others, like Turkey, you can trade crypto but can’t use it to pay for coffee or rent. The problem isn’t just about banks saying no—it’s about governments telling banks what to do.

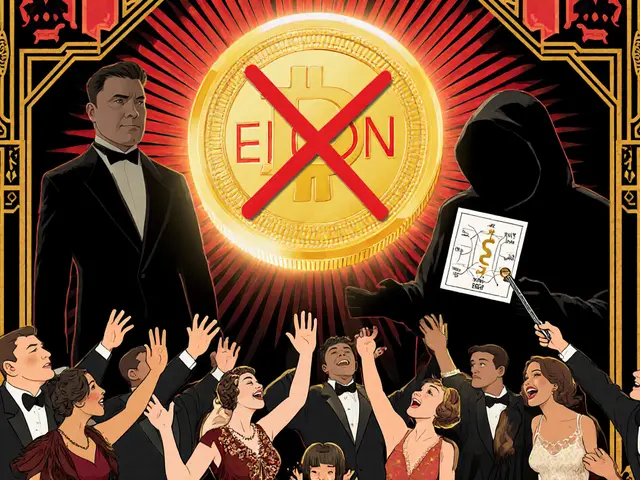

crypto exchange regulations, government rules that dictate how platforms can operate, who they can serve, and what compliance steps they must follow are forcing banks to act. When the SEC fined crypto firms $5 billion in 2024, banks got nervous. When North Korea hacked Bybit and stole $1.5 billion, regulators doubled down. Now, exchanges in Singapore must hold licenses, and Turkish users face account freezes under MASAK rules. Even if you’re not doing anything illegal, your bank might still block your crypto purchase because they’re scared of getting fined themselves.

It’s not just about access—it’s about control. government crypto seizure, the legal process where authorities take possession of cryptocurrency linked to criminal activity or regulatory violations has become common. Countries like the U.S. and Germany now hold billions in seized crypto, not just selling it off but keeping it as assets. That means if you’re flagged—even mistakenly—your funds could be frozen before you even know why. And while some users turn to peer-to-peer trades or decentralized exchanges to bypass these blocks, those come with their own risks: scams like BITKER and fake DEXs like LocalCoin DEX prey on people trying to go around the system.

What’s clear is that banking restrictions crypto aren’t going away. They’re evolving. Countries like Nigeria lifted their ban but replaced it with strict licensing. Others, like Turkey, tightened rules while allowing trading. The common thread? Banks are caught in the middle. They want customers, but they don’t want regulators breathing down their necks. That’s why you see inconsistent rules—even within the same country. One bank might let you buy Bitcoin through a third-party app, while another shuts down your account for using a crypto wallet.

Below, you’ll find real stories from people who’ve hit these walls. From Nigerian traders still getting harassed by police despite new laws, to Turkish users watching their lira drop while crypto stays accessible but unusable for daily spending. You’ll see how exchanges like Cryptal and OraiDEX adapt to local rules, and how scams exploit the confusion. Whether you’re trying to buy crypto, send it abroad, or just keep your funds safe, understanding these restrictions isn’t optional—it’s survival.

Ecuador Banking Ban on Crypto Transactions: What It Means for Users and the Market

Ecuador bans banks from processing crypto transactions to protect dollarization, forcing users into risky P2P trades and stablecoin workarounds. With no legal exchanges and rising remittance demand, the ban creates financial friction-while a new bill may soon change everything.

How Jordanians Traded Crypto Despite Banking Restrictions Before the 2025 Law

Before Jordan's 2025 crypto law, citizens traded Bitcoin and USDT through underground P2P networks to bypass banking bans. Now, licensed exchanges offer safe, legal access-ending years of risk and uncertainty.