BitLicense: What It Is, Who It Affects, and How It Shapes U.S. Crypto Rules

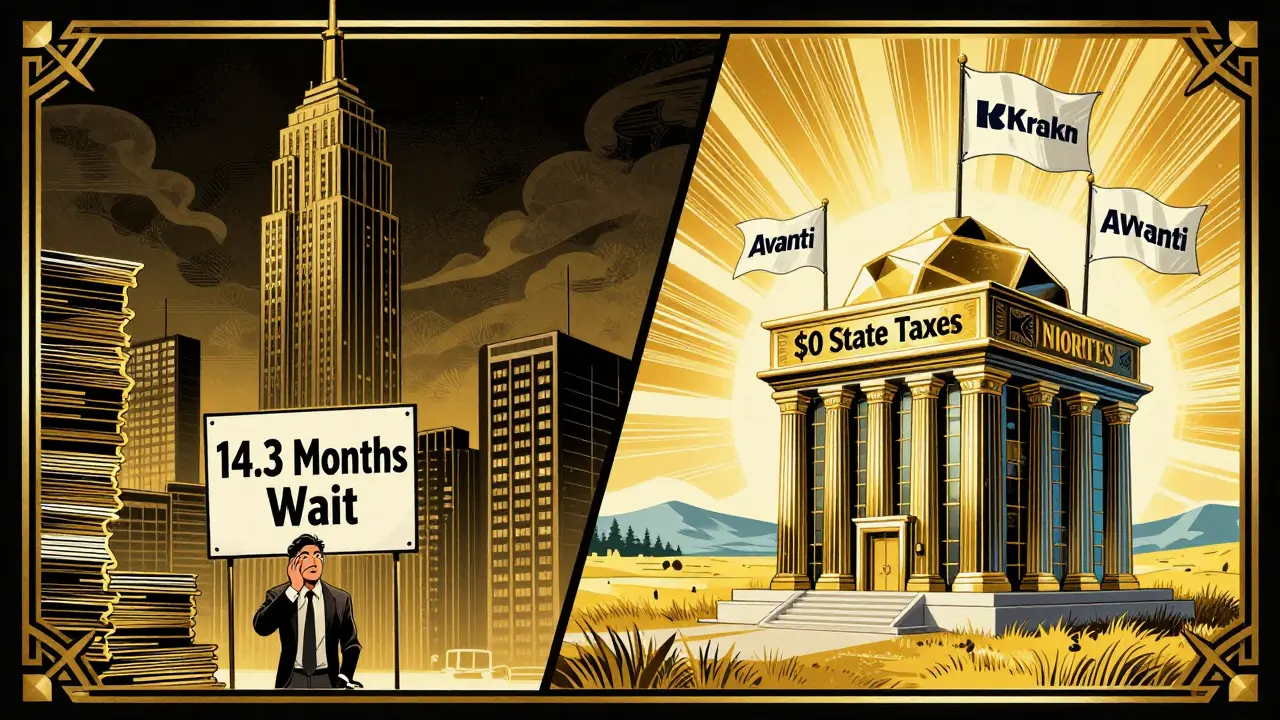

When you hear BitLicense, a state-level cryptocurrency licensing requirement issued by New York’s Department of Financial Services (DFS). Also known as DFS crypto regulation, it was the first major U.S. rule to treat digital asset businesses like banks—requiring background checks, capital reserves, and detailed compliance reports just to operate in one state. It didn’t just add paperwork—it reshaped the entire crypto landscape. In 2015, when BitLicense launched, dozens of exchanges shut down their New York operations overnight. Some, like Coinbase, paid millions to comply. Others, like Kraken and Binance, simply left. The message was clear: if you want to serve New Yorkers, you play by their rules—or don’t play at all.

BitLicense isn’t just about licensing—it’s about control. It requires companies to track every transaction, report suspicious activity, and keep millions in reserve, even if they’re just selling Bitcoin. This made it nearly impossible for small startups to enter the market. Meanwhile, big players adapted, but at a cost. The New York Department of Financial Services, the state agency that created and enforces BitLicense became the most powerful crypto regulator in the U.S., even though it only covers one state. Its rules influenced federal agencies like the SEC and CFTC, which later copied its enforcement playbook. Today, if a crypto firm says it’s "compliant," chances are they’re following BitLicense standards—even if they’re based in Texas or California.

And it’s not just exchanges. BitLicense also applies to wallet providers, custodians, and even some DeFi platforms that interact with New York residents. If you’re a user in New York and you’re using a crypto app, it’s likely that app had to jump through BitLicense hoops to serve you. That’s why you won’t find many niche tokens or experimental DeFi tools on platforms accessible to New Yorkers—they’re too risky, too unregulated, and too expensive to comply with. The result? A quieter, more cautious crypto market in New York compared to the wild west elsewhere.

BitLicense didn’t stop innovation—it just pushed it out of state. Many crypto teams moved to Wyoming, which offers a more flexible regulatory sandbox. Others built offshore structures to avoid the rule entirely. But here’s the catch: if you’re a New Yorker, you still have to deal with the fallout. Your options are limited. Your fees are higher. Your access to new tokens is slower. And if you try to use a non-compliant platform, you’re breaking state law.

What you’ll find in this collection are real stories about how BitLicense changed lives—exchanges that shut down, traders who lost access, and companies that fought back. You’ll read about the legal battles, the loopholes, and the quiet ways people still trade in New York despite the rules. These aren’t theoretical debates. These are people who lived through it. And their experiences show why BitLicense still matters—even as other states try to build something better.

US Crypto Regulations by State: What You Need to Know in 2026

Understand how crypto regulations vary across U.S. states in 2026, from New York's strict BitLicense to Wyoming's crypto-friendly bank model. Know where you can operate, what it costs, and how to stay compliant.

How to Get a Crypto Exchange License in 2025

Learn how to legally obtain a crypto exchange license in 2025, including federal MSB registration, state MTL requirements, compliance costs, and how to avoid shutdowns from regulators.