Blockchain Assets: What They Are, How They Work, and Which Ones Actually Matter

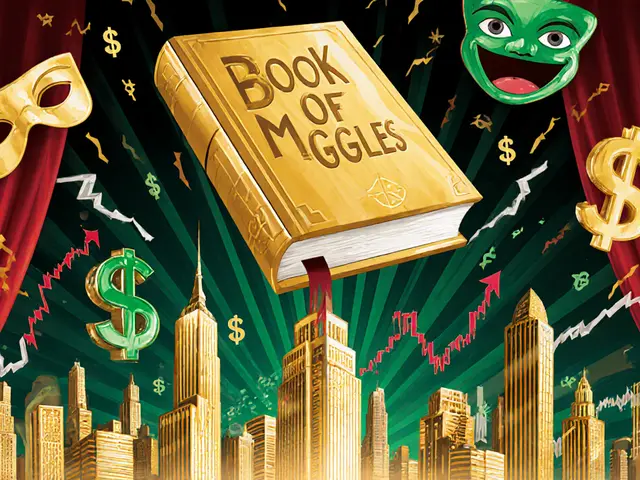

When you hear blockchain assets, digital items stored on a public, tamper-proof ledger that represent value, ownership, or access. Also known as digital assets, they include everything from Bitcoin to NFTs to tokens that give you a share in a DeFi protocol. These aren’t just fancy files—they’re coded claims backed by networks that run without banks, brokers, or middlemen. But not all blockchain assets are created equal. Some solve real problems. Others are just digital ghosts with no users, no code updates, and no future.

Behind every real blockchain asset is a blockchain network, the underlying system that records transactions, enforces rules, and keeps everything secure. Some, like Bitcoin and Ethereum, are public and open to anyone. Others, like Hedera’s hashgraph, use faster, private methods designed for companies. Then there are hybrid systems, used by governments and big businesses, mixing public transparency with private control. These networks decide how assets behave: how fast they transfer, how cheaply they trade, and who can even access them. That’s why a token on Solana behaves totally differently than one on a permissioned chain used by a bank. And then there are the tools and structures that make these assets useful: crypto mining, the process of validating transactions and securing the network by solving complex math problems. It’s how Bitcoin was born, and how miners still earn rewards. But mining isn’t just for Bitcoin—mining pools, reward systems like PPS and PPLNS, and even hash rate adjustments all shape how assets are created and distributed. If a network’s mining gets too hard or too centralized, the asset’s value can drop fast. Meanwhile, exchanges like HashKey and OMGFIN act as gateways, deciding which assets you can buy, sell, or trade. But even those platforms are regulated or blocked in places like the U.S. or Canada, meaning your access to certain blockchain assets depends on where you live.

What you’ll find here isn’t a list of hype coins or meme tokens with no purpose. It’s a real-world look at what’s actually working, what’s collapsing, and what’s being shut down by regulators. You’ll read about tokens tied to hashpower, DeFi gaming, enterprise blockchains, and even scams disguised as exchanges. Some projects have teams, real use cases, and active users. Others are just empty wallets with fake trading volume. This collection cuts through the noise. You’ll learn how to spot the difference—and what to avoid before you lose money.

Top Cryptocurrencies by Market Capitalization in 2025

As of 2025, Bitcoin leads the crypto market with a $2.4 trillion cap, followed by Ethereum, XRP, Tether, and Hyperliquid. These top coins dominate due to institutional adoption, real-world use cases, and proven scalability-not speculation.

![What is Dypius [New] (DYP) Crypto Coin? A Real-World Breakdown](/uploads/2025/11/thumbnail-what-is-dypius-new-dyp-crypto-coin-a-real-world-breakdown.webp)