DeFi Gaming: What It Is, How It Works, and Which Tokens Are Worth Your Time

When you hear DeFi gaming, a mix of decentralized finance and video games where players earn crypto by playing. Also known as GameFi, it’s not just about fun—it’s about turning hours spent gaming into real digital assets. Unlike traditional games where you spend money on skins or levels, DeFi gaming lets you earn tokens just by playing. Some platforms even let you lend your in-game assets to others for interest, or stake them to earn more. It’s finance built into the gameplay, not tacked on after.

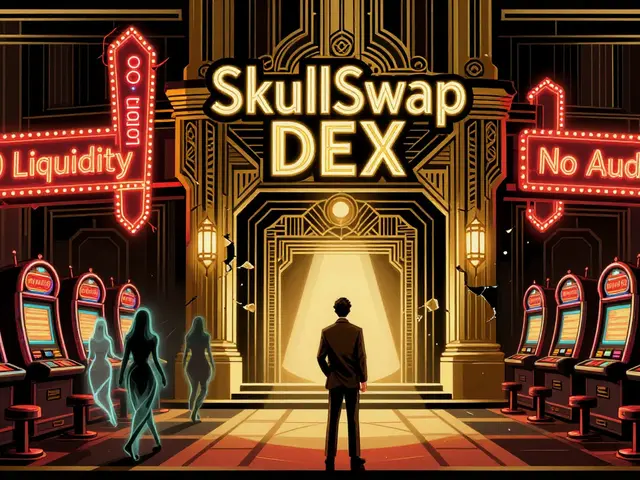

But not all DeFi gaming projects are real. Many are just tokens with a cartoon mascot and no actual game. GAMEE (GMEE), a token earned by playing casual mobile games on Arc8, actually has over 100 million users because it pays out for time played. Meanwhile, tokens like Magical Blocks (MBLK), a low-cap ERC20 token with no real game behind it and Sunny Side Up (SSU), a Solana-based token that crashed 99.9% with no team or community are ghosts—no players, no utility, just price charts made up by bots. The difference? One rewards real activity. The others rely on hype and empty promises.

DeFi gaming doesn’t need flashy NFTs or celebrity endorsements. It needs a working game, real players, and a token that has a reason to exist beyond trading. If you’re playing a game and getting paid in crypto, that’s DeFi gaming. If you’re just buying a token hoping someone else will pay more for it tomorrow, you’re not gaming—you’re gambling. The projects that last are the ones where you earn by doing, not by waiting. Below, you’ll find real breakdowns of tokens that actually pay, ones that vanished overnight, and the scams pretending to be the real thing. No fluff. Just what works, what doesn’t, and what to avoid.

What is Dypius [New] (DYP) Crypto Coin? A Real-World Breakdown

Dypius (DYP) is a DeFi-gaming crypto token that lets you earn yield by staking NFTs in a metaverse game. It’s complex, volatile, and unproven - but offers real utility for experienced crypto users.

![What is Dypius [New] (DYP) Crypto Coin? A Real-World Breakdown](/uploads/2025/11/what-is-dypius-new-dyp-crypto-coin-a-real-world-breakdown.webp)