DYP Token: What It Is, Why It Matters, and What to Watch For

When you hear DYP token, a reward token built for DeFi users who earn yield through staking and liquidity provision. Also known as DYP Finance, it’s not just another crypto coin—it’s a mechanism designed to keep users engaged in decentralized finance ecosystems by rewarding participation. Unlike meme coins that ride hype, DYP was built to align incentives: the more you stake, the more you earn, and the more the network grows. But here’s the catch—its value doesn’t come from speculation alone. It comes from real activity on the chain.

Related to DYP are yield farming, the practice of locking crypto in protocols to earn interest or rewards, and tokenomics, the economic design behind how a token is distributed, burned, and rewarded. These aren’t buzzwords—they’re the backbone of how DYP stays alive. If the farming slows down, the rewards drop. If the token supply floods the market without demand, the price follows. That’s why users track not just the price, but the total value locked, the number of active wallets, and how often tokens are burned.

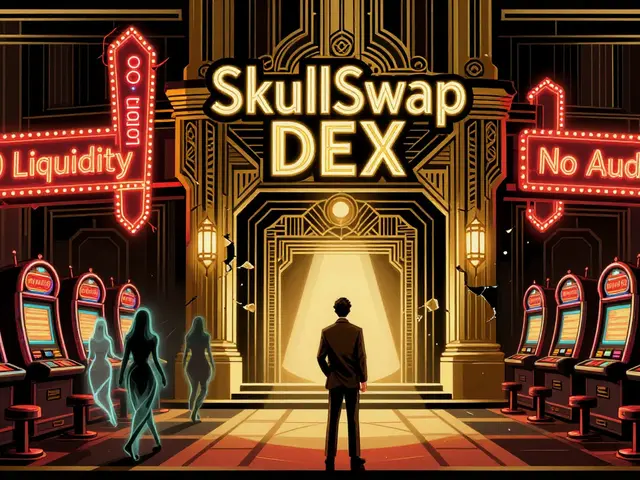

Many people think DYP is just another high-yield gamble. But look closer: the same communities using DYP also trade tokens like HIFI for fixed-rate lending or earn GMEE by playing games. They’re not chasing quick flips—they’re building habits around DeFi. That’s why you’ll find DYP mentioned alongside wallets, staking dashboards, and cross-chain bridges in the posts below. Some of these articles expose risky projects hiding behind flashy names. Others show how real users track rewards over months, not minutes.

What you’ll find here isn’t a list of winners. It’s a collection of real stories—some cautionary, some practical—about what happens when you put your crypto to work. Whether you’re curious about how DYP compares to other reward tokens, or you’re trying to figure out if staking it is worth the risk, the articles below give you the unfiltered truth. No fluff. Just what’s actually happening on-chain.

What is Dypius [New] (DYP) Crypto Coin? A Real-World Breakdown

Dypius (DYP) is a DeFi-gaming crypto token that lets you earn yield by staking NFTs in a metaverse game. It’s complex, volatile, and unproven - but offers real utility for experienced crypto users.

![What is Dypius [New] (DYP) Crypto Coin? A Real-World Breakdown](/uploads/2025/11/what-is-dypius-new-dyp-crypto-coin-a-real-world-breakdown.webp)