Institutional Crypto Adoption

When we talk about institutional crypto adoption, the process by which large organizations like banks, pension funds, and governments begin using cryptocurrencies and blockchain technology in their operations. Also known as enterprise crypto integration, it’s no longer about speculation—it’s about infrastructure, compliance, and scale. This isn’t just Elon Musk tweeting about Dogecoin. This is BlackRock filing for a Bitcoin ETF. This is Switzerland’s central bank testing digital francs. This is Japan’s Financial Services Agency requiring exchanges to lock up 99% of user funds in cold storage.

Crypto regulations, government rules that define how digital assets can be traded, taxed, and held by institutions. Also known as digital asset legal frameworks, it’s what makes or breaks adoption. Countries like Japan and Singapore have built clear, predictable systems. Others, like Venezuela and Russia, have turned crypto into a survival tool under state control. The result? Institutions won’t touch crypto unless they know exactly where the lines are drawn. That’s why you see so many posts here about exchange safety, delistings, and sanctions—because institutions need certainty.

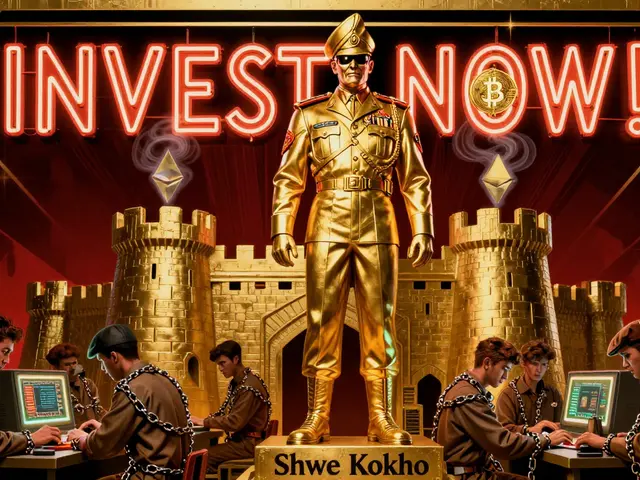

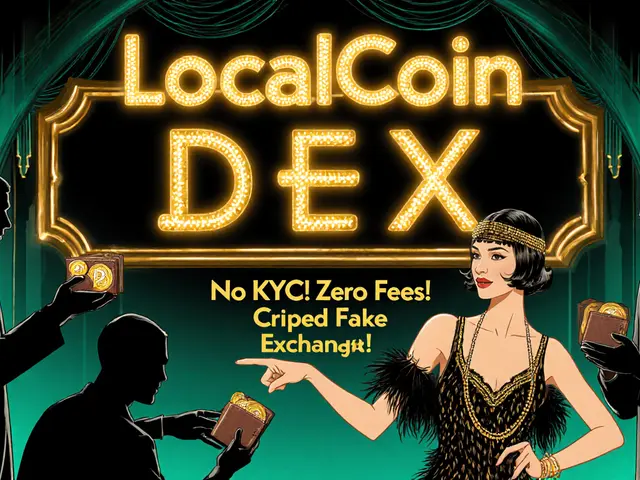

Crypto exchanges, platforms where institutions buy, sell, and store digital assets with institutional-grade security and compliance. Also known as regulated crypto trading platforms, they’re the bridge between traditional finance and blockchain. But not all exchanges are built the same. Some, like OMGFIN and Nominex, lack liquidity or reviews. Others, like Garantex, operate in legal gray zones. Institutions avoid these. They pick platforms that segregate funds, audit their reserves, and pass KYC checks. That’s why posts on Japan’s cold storage rules or Russia’s withdrawal limits matter—they’re the hidden rules institutions follow.

And then there’s blockchain enterprise, the use of private or hybrid blockchains by corporations to track supply chains, automate contracts, or reduce fraud. Also known as business blockchain, it’s where real value gets built—outside of price charts. Walmart uses it for food tracking. Estonia uses it for health records. These aren’t experiments. They’re operational systems. That’s why hybrid blockchain posts exist here: because institutions don’t care about meme coins. They care about reliability.

What you’ll find below isn’t a list of hype coins or get-rich-quick schemes. It’s a map of how the real world is changing. From Venezuela’s state-run mining pools to Japan’s strict consumer protections, from Russian banks blocking crypto withdrawals to the slow death of privacy coins under regulatory pressure—this is institutional adoption in action. Not in boardrooms. Not in press releases. In the messy, complicated, real-life ways people and governments are using crypto to survive, adapt, and move money.

What Is Institutional Grade Crypto Infrastructure and Why It Matters for Banks and Asset Managers

Institutional grade crypto infrastructure enables banks and asset managers to safely hold, trade, and manage digital assets under strict compliance and security standards. Learn how it works, why it's different from retail wallets, and what it takes to implement.