Malta Cryptocurrency Rules: What You Need to Know About Crypto Regulation in Malta

When it comes to Malta cryptocurrency rules, a clear, business-friendly legal framework for digital assets established by the Maltese government since 2018. Also known as Malta’s blockchain legislation, it was designed to attract crypto companies by offering legal certainty instead of crackdowns. Unlike countries that ban or ignore crypto, Malta built a full regulatory system around it—covering exchanges, token issuers, and blockchain service providers under one roof.

This system isn’t just talk. If you want to run a crypto exchange license Malta, a mandatory approval from the Malta Financial Services Authority (MFSA) for platforms handling customer funds or trading digital assets, you need to meet strict capital, security, and KYC standards. The same goes for blockchain legislation Malta, a trio of laws passed in 2018 that define how smart contracts, token offerings, and distributed ledger technology are treated legally. These laws don’t just protect users—they give businesses a roadmap. No guessing. No sudden bans. Just rules you can plan around.

And it’s not just for big firms. Even individuals trading crypto in Malta need to know how taxes work. Profits from crypto sales are taxed as capital gains, but only if you’re trading regularly—not just holding. The government doesn’t treat every casual trader like a bank. They focus on commercial activity, not personal wallets. That’s why so many crypto startups chose Malta over Switzerland or Singapore: it’s predictable. You know what you’re signing up for.

But here’s the catch: Malta’s rules only apply if you’re operating from within the country. If you’re a user in Nigeria, Turkey, or the U.S., those laws don’t change your local restrictions. What Malta did was create a safe harbor for businesses—not a global free pass. That’s why you’ll see so many crypto exchanges listed as "Malta-based" but still block users from certain countries. The rules are clear inside Malta. Outside? That’s up to your own government.

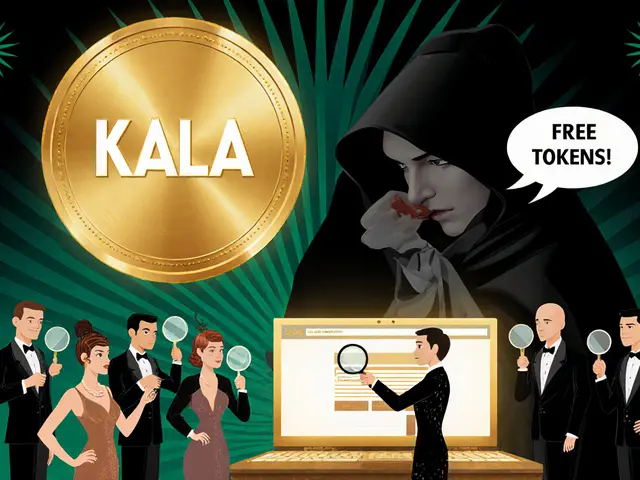

Below, you’ll find real-world examples of how these rules play out—from exchange reviews to regulatory crackdowns and token classifications. You’ll see what works, what doesn’t, and how the same laws that helped Malta become a crypto hub also exposed risky projects trying to hide behind its reputation. No fluff. Just what you need to know if you’re trading, building, or just trying to stay compliant.

Favorable Crypto Tax Framework in Malta: How to Legally Pay 0% on Crypto Gains

Malta offers a legal 0% crypto tax rate for non-domiciled residents who live there 183+ days a year and don't remit gains. Learn how to qualify, avoid common mistakes, and compare it to Dubai and Portugal.