Market Volatility in Crypto: What Causes It and How to Stay Safe

When you hear market volatility, the rapid and often unpredictable changes in cryptocurrency prices, it’s not just about charts going up and down. It’s about real money—yours—getting crushed by panic, rumors, or a single tweet. Unlike stocks, crypto doesn’t have earnings reports or dividends to anchor its value. Instead, it moves on emotion, regulation, and sometimes, nothing at all. This isn’t speculation—it’s survival.

crypto price swings, extreme fluctuations in digital asset values over short periods happen because the market is still young, fragmented, and full of small players. A single whale selling 500 BTC can drop a coin by 30% in minutes. That’s what happened with market volatility in tokens like MBLK and SSU—zero community, zero utility, and a price that collapsed faster than a house of cards. Even legit projects like HIFI or GMEE aren’t immune. When Bitcoin dips, altcoins don’t just follow—they dive. And when regulators crack down, like with privacy coins, cryptocurrencies designed to obscure transaction details like Monero and Zcash, exchanges delist them overnight. That’s not a bug—it’s the system working as designed.

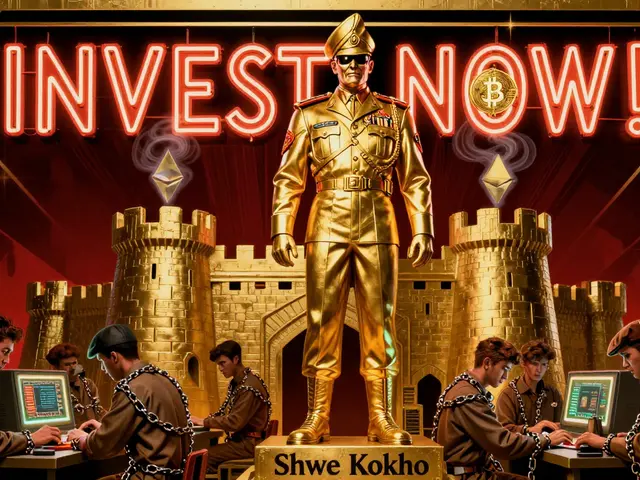

Some people think volatility is a chance to get rich quick. But look at the posts here: B3X has no circulating supply. Bololex is a fake platform. SWAPP airdrops don’t exist. These aren’t mistakes—they’re traps built for people who don’t understand how crypto trading, the act of buying and selling digital assets on exchanges or decentralized platforms really works. You don’t need to predict the next pump. You need to avoid the next crash. That means knowing when a coin has no team, no liquidity, or no reason to exist. It means recognizing when a country like Venezuela or Nepal forces people into crypto not for profit, but because their banks have failed. It means understanding that blockchain volatility, the instability caused by network changes, regulatory shifts, or market sentiment in crypto ecosystems isn’t just about price—it’s about trust.

The posts below aren’t here to sell you the next big thing. They’re here to show you what’s real. You’ll find breakdowns of dead tokens, scam exchanges, and regulatory traps. You’ll see how Russian traders bypass bank limits, how Japanese users are protected by law, and why even a meme coin like SMOLE can vanish in a week. This isn’t a guide to winning. It’s a guide to not losing. And in crypto, that’s the only edge that matters.

What Is Cryptocurrency Volatility and Why It Matters for Investors

Cryptocurrency volatility refers to the rapid and often extreme price swings in digital assets like Bitcoin and Ethereum. Learn why it's higher than stocks, how it's changed over time, and how to manage risk as an investor.