Regulated Crypto Platform: What It Means and Which Ones Actually Matter

When you hear regulated crypto platform, a digital asset service that operates under official financial oversight with licensed operations, audit trails, and user protection rules. Also known as licensed crypto exchange, it's not just a buzzword—it’s the difference between losing your money to a ghost site and knowing your funds are backed by real compliance. In 2025, over 70 countries have formal crypto rules, and the ones that matter most—Japan, the EU, Singapore, and Switzerland—require cold storage, fund segregation, and real-time reporting. These aren’t suggestions. They’re legal requirements.

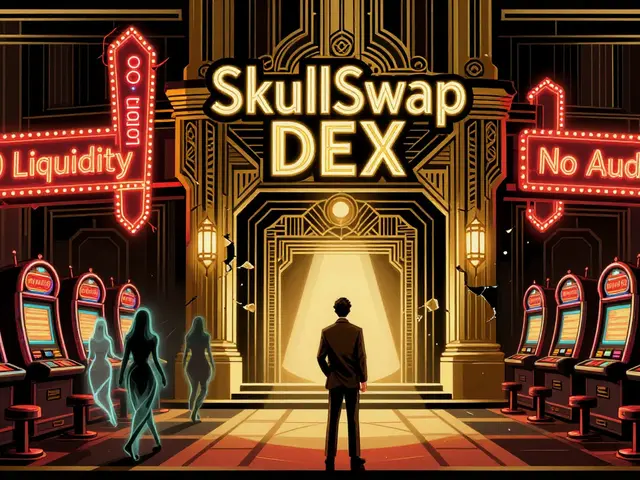

Not all exchanges play by the same rules. Some pretend to be regulated while hiding behind offshore shells. A true regulated crypto platform, a digital asset service that operates under official financial oversight with licensed operations, audit trails, and user protection rules. Also known as licensed crypto exchange, it's not just a buzzword—it’s the difference between losing your money to a ghost site and knowing your funds are backed by real compliance. doesn’t just say it’s compliant—it shows you the license number, publishes its audit reports, and clearly lists which countries it serves. Look at OKX: it blocks U.S. and UK users because it can’t meet their rules. That’s transparency. Compare that to CPUfinex or Bololex—fake names, fake interfaces, zero licenses. Regulation isn’t about stopping innovation; it’s about stopping fraud.

Behind every regulated crypto platform, a digital asset service that operates under official financial oversight with licensed operations, audit trails, and user protection rules. Also known as licensed crypto exchange, it's not just a buzzword—it’s the difference between losing your money to a ghost site and knowing your funds are backed by real compliance. is institutional crypto infrastructure, the secure, audited backend systems banks and asset managers use to hold, trade, and report digital assets under strict compliance standards. This isn’t just for big firms—it trickles down to you. When a platform uses MPC wallets, multi-sig approvals, and insurance-backed custody, your small deposit gets the same protection as a hedge fund’s portfolio. And then there’s crypto consumer protection, the legal framework that forces exchanges to refund stolen funds, freeze suspicious activity, and disclose risks before you trade. Japan’s system, for example, requires exchanges to return lost crypto within 30 days and keep user funds in separate bank accounts. That’s not luck. That’s law.

What you’ll find here isn’t a list of names. It’s a breakdown of what actually makes a platform safe. You’ll see real cases—like how Garantex operates under sanctions, how Venezuela’s state-run mining system works, and why privacy coins are getting delisted. You’ll learn why some exchanges vanish overnight while others stick around because they follow the rules. No fluff. No hype. Just what works, what doesn’t, and how to tell the difference before you deposit a single dollar.

HashKey Exchange Crypto Exchange Review: Regulatory Strength vs. Limited Features

HashKey Exchange is a licensed crypto platform in Hong Kong, offering strong security and regulatory compliance but limited coins and trading tools. Ideal for institutional users and those in Asia seeking safe, legal trading.