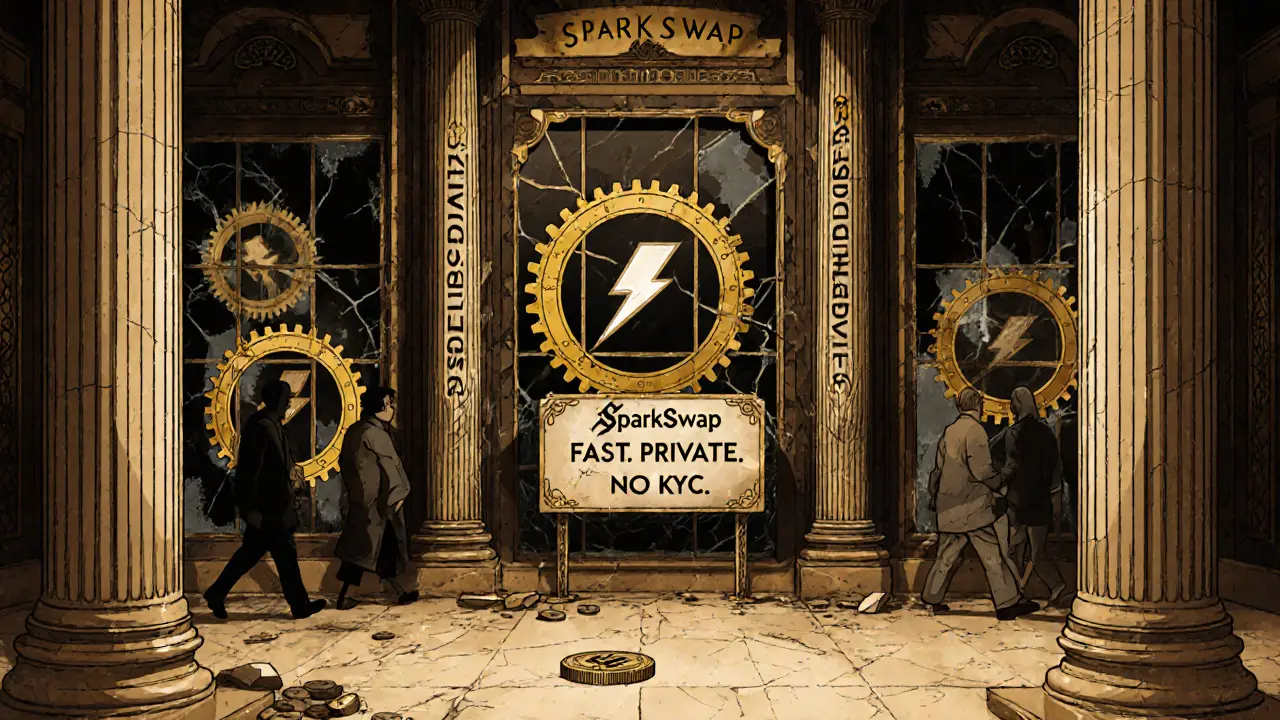

SparkSwap BSC: What It Is, How It Works, and What You Need to Know

When you hear SparkSwap BSC, a decentralized exchange built on the Binance Smart Chain that lets users swap tokens without intermediaries. Also known as SparkSwap on BSC, it’s one of many DEXs trying to offer fast, cheap trades on a network that’s faster and cheaper than Ethereum. But unlike big names like PancakeSwap or Uniswap, SparkSwap BSC doesn’t have a long track record, big team, or clear roadmap. It’s a small player in a crowded space—and that’s where things get risky.

What makes SparkSwap BSC different? It runs on Binance Smart Chain, a blockchain network that supports smart contracts and is designed for faster, lower-cost transactions than Ethereum. That means you can swap tokens for under $0.10 in gas fees, which is great if you’re trading small amounts often. But speed and low cost don’t mean safety. Many projects on BSC, including SparkSwap, launch with little more than a website and a liquidity pool. There’s no public audit, no verified team, and often no real community. You’re trusting code written by anonymous developers—and that’s a gamble.

Users of SparkSwap BSC usually look for one thing: access to new or obscure tokens that aren’t listed on major exchanges. It’s common to see tokens like SMOLE, a Solana-based meme coin with no utility and near-zero trading volume, or B3X, a token with zero circulating supply and no real use case, traded on platforms like SparkSwap. These aren’t investments—they’re speculative bets. And because SparkSwap doesn’t vet tokens, you could easily swap your BNB for a rug-pull coin with no way out.

Some users try to use SparkSwap BSC as a gateway to DeFi yields, staking, or farming. But without clear documentation or security proofs, those opportunities are often just traps. Compare that to Arbitrum One, a Layer-2 network that powers trusted DEXs like Uniswap V3 with $0.30 gas fees and strong community oversight. Arbitrum has audits, public governance, and real usage. SparkSwap BSC has… a website and a liquidity pool.

If you’re thinking of using SparkSwap BSC, ask yourself: Do you know who built it? Is the contract code open and audited? Is the liquidity locked? Are there more than 50 people talking about it on Twitter or Discord? If the answer to any of those is no, you’re not trading—you’re taking a blind shot. Most of the tokens you’ll find here are either dead before they start or already rug-pulled. The ones that survive? They’re usually the ones that get listed on bigger DEXs and leave SparkSwap behind.

There’s nothing wrong with exploring new tools—but when you’re dealing with a DEX that doesn’t even have a whitepaper, you’re not being a pioneer. You’re being a test subject. The posts below show you exactly how these platforms work, what to watch for, and which ones are worth your time. You’ll see real examples of tokens that vanished overnight, exchanges that vanished with them, and the quiet, reliable alternatives that actually protect your money.

SparkSwap Crypto Exchange Review: What Happened and What’s Still Active

SparkSwap refers to three different crypto projects - one shut down in 2023, one is inactive, and one is a yield farm on PulseChain. This review clarifies which is real, which to avoid, and what to expect if you're still considering it.