Uniswap v2 Review: What It Is, How It Works, and Why It Still Matters

When you trade crypto without a middleman, you're using a decentralized exchange, a blockchain-based platform that lets users swap tokens directly from their wallets without relying on a company to hold their funds. Also known as a DEX, it’s the backbone of modern DeFi—and Uniswap v2 was the version that made it mainstream. Before Uniswap v2, swapping tokens meant trusting a centralized exchange like Binance or Coinbase. That meant giving up control of your keys, paying high fees, and waiting for withdrawals. Uniswap v2 flipped that. It let anyone trade any ERC-20 token on Ethereum with just a wallet, no sign-up, no KYC, and no approval needed from a CEO.

What made Uniswap v2 special wasn’t just the tech—it was the simplicity. It used something called an automated market maker, a system that sets prices based on math, not buy-sell orders from traders. Also known as AMM, it replaced order books with liquidity pools—pairs of tokens locked in smart contracts by users like you and me. If you added ETH and USDT to a pool, you became a liquidity provider and earned a cut of every trade that used that pool. That idea sparked a wave of copycats, but none matched Uniswap v2’s speed, reliability, or community trust. It also introduced token-to-token swaps without needing a middleman like WETH, which made trading anything on Ethereum way easier.

Uniswap v2 didn’t just enable trades—it changed how people thought about ownership. You didn’t need to believe in a company. You just needed to believe in code. That’s why, even after Uniswap v3 came out with concentrated liquidity and advanced features, v2 is still used by millions. It’s the version that powered early DeFi yield farming, the one that launched thousands of meme coins, and the one that taught the world you could trade crypto without asking permission.

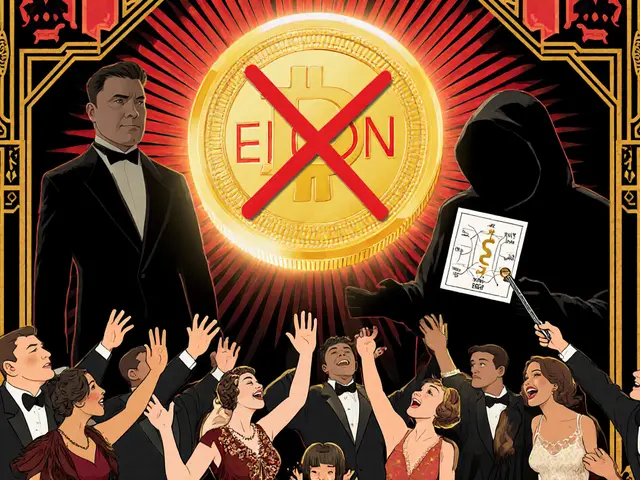

Today, you’ll find posts here that compare Uniswap v2 to newer DEXs like OraiDEX and Astroport, break down how liquidity pools work, and even warn about fake exchanges pretending to be Uniswap. You’ll see how scams copy its name, how gas fees shaped its use, and why some traders still stick with v2 because it’s predictable. This isn’t a history lesson—it’s a practical guide to understanding what made one of the most important tools in crypto tick, and why it still matters if you’re trading, staking, or just trying to avoid scams.

Uniswap v2 on Soneium Crypto Exchange Review: What You Need to Know in 2025

Uniswap v2 on Soneium brings low-cost, entertainment-focused trading to Sony's Layer 2 blockchain. Learn how it works, what tokens you can trade, and why it could change how millions interact with crypto.