Virtual Assets Law Jordan: What You Need to Know About Crypto Regulations in Jordan

When it comes to Virtual Assets Law Jordan, a 2023 regulatory framework that officially recognizes digital assets as legal property and sets rules for their use, trading, and taxation. Also known as Jordan’s Crypto Law, it’s the first clear legal structure for cryptocurrency in the country—moving past bans and ambiguity into a system of licensing, oversight, and compliance. Before this law, Jordanians could trade crypto, but they did so in a gray zone. Now, exchanges, wallets, and even mining operations must register with the Central Bank of Jordan (CBJ) and follow strict KYC and AML rules.

This law doesn’t just target businesses—it affects everyday users too. If you hold crypto, you’re now required to report taxable gains, just like you would with stocks or real estate. The Central Bank of Jordan, the government body responsible for issuing licenses, monitoring transactions, and enforcing penalties under the Virtual Assets Law works closely with the Securities Commission to track suspicious activity. It also ties into global standards, meaning Jordanian exchanges must align with FATF guidelines to avoid being flagged as high-risk by international partners.

One of the biggest shifts is how virtual assets, a legal term covering cryptocurrencies, NFTs, and other digital tokens that hold value and can be transferred or traded are treated. They’re not considered legal tender—so you can’t pay for groceries with Bitcoin—but they’re recognized as property. That means they can be inherited, seized in court cases, or frozen if linked to crime. This is why recent cases involving crypto seizures and asset forfeiture in Jordan now follow clear legal procedures, unlike before when authorities had no official footing.

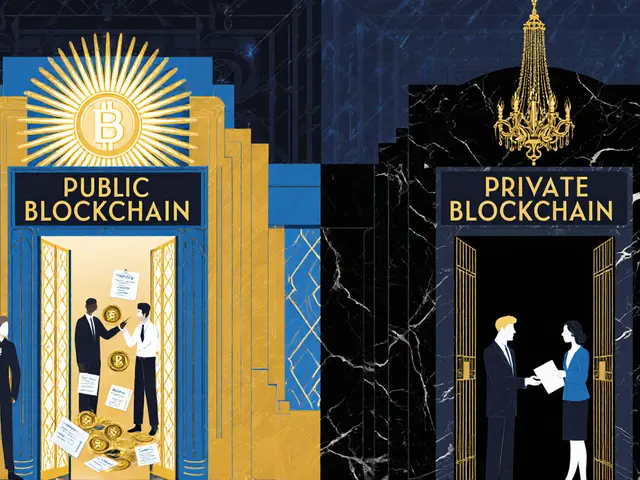

The law also created two types of licenses: one for service providers like exchanges and wallets, and another for entities that issue or manage tokenized assets. Only licensed platforms can legally operate in Jordan. That’s why you’ll see local platforms like Cryptal Exchange adapting to meet these rules—while unlicensed foreign sites are blocked or reported. It’s not about stopping crypto—it’s about making sure it’s done safely, with accountability.

For users, this means less risk from scams and more clarity when choosing where to trade. For businesses, it means higher costs to enter the market—but also legitimacy and access to banking services. The CBJ has been clear: no licensing, no operations. And they’re enforcing it. In 2024, several unregistered platforms were shut down, and fines were issued to those who ignored the rules.

What you’ll find in the posts below are real examples of how this law plays out in practice. From how Nigerian crypto restrictions compare to Jordan’s approach, to how asset seizures work when governments target crypto, to why exchanges like ByBit get hacked and how regulators respond. You’ll see how legal frameworks like this shape everything—from DeFi platforms to airdrops to token listings. There’s no fluff here—just the facts on what’s allowed, what’s banned, and what’s changing right now in Jordan’s crypto landscape.

How Jordanians Traded Crypto Despite Banking Restrictions Before the 2025 Law

Before Jordan's 2025 crypto law, citizens traded Bitcoin and USDT through underground P2P networks to bypass banking bans. Now, licensed exchanges offer safe, legal access-ending years of risk and uncertainty.