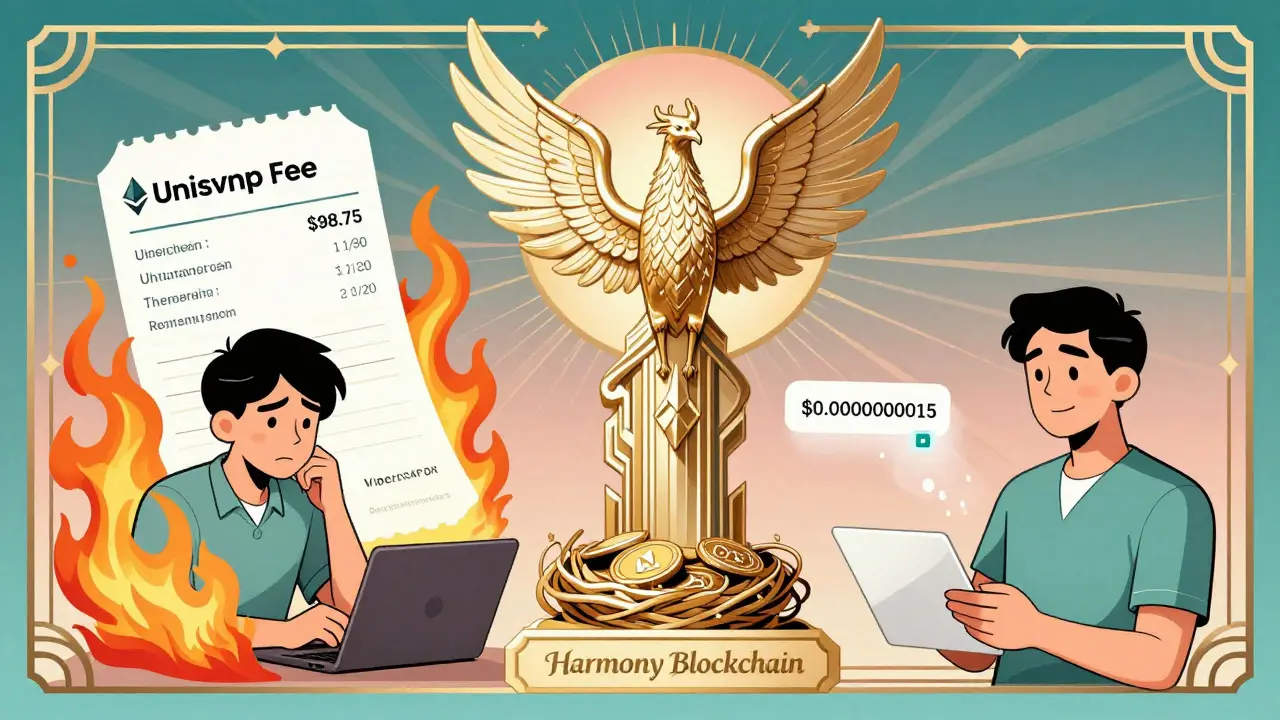

ViperSwap isn't another big-name crypto exchange you’ve heard about on YouTube ads. It doesn’t have a celebrity spokesperson or a flashy mobile app with animations. But if you’ve ever paid $15 in gas fees to swap $20 worth of tokens on Ethereum, you’ll understand why ViperSwap matters. This is a decentralized exchange built entirely on the Harmony blockchain - and it’s engineered for one thing: making tiny trades affordable.

How ViperSwap Works (No Fluff)

ViperSwap runs on an automated market maker (AMM) model, just like Uniswap. That means there are no buyers and sellers matching orders. Instead, you trade against pools of tokens locked in smart contracts. You drop in one token, and you get another out - instantly. No middleman. No order book. Just code. What makes it different? The cost. A standard swap on ViperSwap costs about $0.0000000015. That’s not a typo. It’s less than one-billionth of a dollar. Compare that to Uniswap, where fees during busy times hit $10-$100. On ViperSwap, you can swap $0.50 in tokens and pay less than a penny in fees. For people who trade small amounts daily - buying a bit of this, selling a bit of that - this isn’t a luxury. It’s the only way DeFi makes sense.Why Harmony Blockchain Matters

ViperSwap doesn’t work on Ethereum. It doesn’t work on Solana or BNB Chain. It only works on Harmony. That’s not a bug - it’s the whole point. Harmony was built for speed and low cost. Its blockchain finalizes transactions in 2 seconds. Ethereum takes 13-15. BNB Chain takes about 3 minutes. ViperSwap rides that speed. Swaps feel instant. No waiting. No frustration. It also uses HRC-20 tokens, Harmony’s version of ERC-20. That means you need a Harmony-compatible wallet. Math Wallet and SafePal are the most popular. If you’re used to MetaMask, you’ll need to switch. You can’t just connect your usual wallet and start trading. That’s the first hurdle.Fees: Who Gets Paid?

Most DEXs take a 0.3% fee on every trade. Uniswap keeps it all. SushiSwap gives 0.05% back to stakers. ViperSwap gives 0.1% - that’s one-third of the total fee - to people who stake VIPER tokens in the ViperPit. That’s the highest fee-sharing rate among major AMMs. If you hold VIPER and stake it, you earn a cut of every trade on the platform. No other DEX gives you that much. SushiSwap gives you 1/6th. ViperSwap gives you 1/3rd. That’s a big deal if you’re long-term holding the token. But here’s the catch: VIPER token details are fuzzy. Maximum supply? Distribution schedule? Locked tokens? No official documentation spells it out. You’re trusting the team - who operate anonymously as ViperDAO - to do the right thing.

What You Can Trade (And What You Can’t)

ViperSwap lists around 127 trading pairs. That sounds like a lot - until you compare it to Uniswap’s 12,843. Most of the tokens on ViperSwap are Harmony-native. If you want to trade Shiba Inu, Chainlink, or Polygon? You can’t. Not directly. You have to bridge them in. That means sending your tokens from Ethereum, BNB Chain, or another network to Harmony using a cross-chain bridge. That’s an extra step. And yes - bridging costs money. Sometimes more than the swap itself. One Reddit user summed it up: “Great fees but can’t find half the tokens I need - had to bridge assets from Ethereum first which cost more than the swap itself.” If you’re trading only Harmony tokens like ONE, HRC-20 stablecoins, or tokens from Harmony-based projects, ViperSwap is perfect. If you want access to the broader crypto market? It’s not the place.How Much Liquidity Is There?

Total value locked (TVL) on ViperSwap is around $1.2 million as of October 2025. That’s tiny. Uniswap has $4.7 billion. SushiSwap has $823 million. Low TVL means shallow liquidity. For popular pairs like ONE/USDT, you’re fine. But for obscure tokens? Slippage can be brutal. You might ask for 100 tokens and only get 85 because there’s not enough in the pool. This isn’t a problem for micro-traders. If you’re swapping $10 or $50, you won’t notice. But if you’re moving $5,000? You’ll get wrecked by slippage. ViperSwap isn’t built for big players. It’s built for people who trade small, often, and want to keep fees near zero.Real User Experience

User reviews are split but telling. On Trustpilot, 4.2 out of 5 stars from 37 reviews. 78% of positive reviews say: “unbeatable transaction costs.” That’s the main reason people stick with it. But 63% of negative reviews complain about limited tokens. One user wrote: “I spent 20 minutes trying to find a token I knew existed. Turned out it wasn’t listed. Had to bridge from Ethereum. Lost $1.50 in bridge fees. I could’ve just bought it on Binance for $0.30.” The community is active - 12,458 on Telegram, 4,281 on Discord. But response times are slow. Average 22 minutes for help. The GitHub wiki is only 68% complete. You’ll often find yourself Googling “how to bridge to Harmony” or checking Reddit threads for workarounds.

Who Is This For?

ViperSwap is not for everyone. It’s not for traders who want hundreds of tokens. It’s not for people who want to move large sums. It’s not for those who hate extra steps. It’s for:- People who trade under $500 per transaction (92% of users on ViperSwap fit this)

- Harmony ecosystem participants who hold ONE or HRC-20 tokens

- Micro-traders who want to swap small amounts without paying $10 in fees

- Stakers who want the highest fee-sharing rate in DeFi

What’s Next for ViperSwap?

The team behind ViperSwap - ViperDAO - has announced plans to launch concentrated liquidity pools, similar to Uniswap V3, by late 2025. That means users can choose where their liquidity is placed, improving capital efficiency. It’s a smart move. They’ve also integrated Harmony’s new Horizon Bridge, which cut cross-chain bridging fees by 63%. That helps - but doesn’t solve the core issue: ViperSwap is still locked to one chain. The future of ViperSwap depends entirely on Harmony. If Harmony hits its goal of 100,000 transactions per second and attracts more developers, ViperSwap could grow. If Harmony stalls - as many single-chain projects have - ViperSwap will stay a niche tool for a small group.Final Verdict

ViperSwap is the cheapest DEX you’ll ever use. If you’re trading small amounts on Harmony, it’s unbeatable. The fees are practically zero. The speed is instant. The staking rewards are the best in the space. But it’s also the most limited. You can’t trade most tokens. You need to bridge assets. Liquidity is thin. Documentation is patchy. It’s a tool for a very specific use case. Think of it like a gas station on a desert highway. It’s the only one for 100 miles. The prices are fair. The pumps work perfectly. But you can’t buy snacks, coffee, or a tire. You’re there for one thing: fuel. If that’s what you need, it’s perfect. If you need more? You’ll have to drive elsewhere. If you’re already in the Harmony ecosystem, try ViperSwap. Swap $10. Feel how little you pay. Then ask yourself: Do I need more than this? If not - you’ve found your DEX.Is ViperSwap safe to use?

Yes, but with caveats. ViperSwap is non-custodial, meaning you keep control of your keys. The smart contracts have been audited by third parties, and there have been no major exploits. However, the team is anonymous (ViperDAO), and the tokenomics aren’t fully documented. Use only what you’re willing to lose. Never deposit large sums.

Can I use MetaMask with ViperSwap?

No. ViperSwap runs only on the Harmony blockchain, which MetaMask doesn’t support natively. You need a Harmony-compatible wallet like Math Wallet or SafePal. You can add Harmony’s network to MetaMask manually, but many users report connection issues. Stick with the recommended wallets for reliability.

How do I get VIPER tokens?

You can earn VIPER by staking liquidity in ViperSwap pools or by buying it directly on the exchange using other tokens like ONE or USDT. There’s no public sale or airdrop. The token supply is controlled by the protocol, and distribution is tied to trading volume and staking activity. Don’t trust third-party sites claiming to sell VIPER - only trade on the official site.

Why is ViperSwap’s TVL so low?

Because it’s limited to the Harmony blockchain. Most liquidity in DeFi lives on Ethereum, BNB Chain, or Solana. Harmony has a smaller user base, so less capital flows into ViperSwap. It’s not a failure - it’s a reflection of Harmony’s current market share. If Harmony grows, so will ViperSwap’s TVL.

Should I stake my tokens in ViperPit?

If you’re already using ViperSwap regularly and holding VIPER, yes. You get 0.1% of every trade fee - the highest rate in DeFi. But if you’re not trading on the platform, staking VIPER won’t give you much benefit. It’s not a passive income play like staking ETH. It’s a reward for being active in the Harmony ecosystem.

Is ViperSwap better than PancakeSwap?

Only if you’re trading Harmony tokens. PancakeSwap has over 1,000 trading pairs, deeper liquidity, and supports BNB Chain. ViperSwap has lower fees and faster finality, but far fewer tokens. If you’re on BNB Chain, PancakeSwap wins. If you’re on Harmony, ViperSwap wins. They’re not direct competitors - they serve different chains.

Rod Petrik

January 16, 2026 AT 03:13Telleen Anderson-Lozano

January 18, 2026 AT 01:07Haley Hebert

January 19, 2026 AT 00:09Hailey Bug

January 20, 2026 AT 05:15Ashlea Zirk

January 21, 2026 AT 03:27Chris Evans

January 21, 2026 AT 06:26Pat G

January 21, 2026 AT 21:38Bryan Muñoz

January 22, 2026 AT 02:40Andre Suico

January 23, 2026 AT 22:32Chidimma Okafor

January 24, 2026 AT 03:17Bill Sloan

January 24, 2026 AT 13:56Nishakar Rath

January 25, 2026 AT 18:27kristina tina

January 27, 2026 AT 13:11Michael Jones

January 29, 2026 AT 11:11Jill McCollum

January 30, 2026 AT 23:26Sarah Baker

January 31, 2026 AT 05:15Kelly Post

February 1, 2026 AT 17:25ASHISH SINGH

February 2, 2026 AT 21:37Vinod Dalavai

February 4, 2026 AT 06:31Telleen Anderson-Lozano

February 4, 2026 AT 21:14