Crypto Value Calculator

Calculate Your $1IQ Value

Results

$0.00

At current price: $0.00000000000123 per token

Important Insights

Top 15 wallets hold 90% of $1IQ supply

Why This Matters

With the current price:

• You need 812,000,000,000 $1IQ tokens to equal $1 USD

Compare to Dogecoin: At $0.073 per DOGE, you'd need only 13.7 tokens for $1

This high supply concentration means a small number of holders can drastically impact price. If top holders sell, value could crash to near zero.

People with 1 IQ, or $1IQ, isn’t a serious investment. It’s not a project with a whitepaper, team, or roadmap. It’s a meme coin - a joke token built on the Solana blockchain that exists purely for attention, shock value, and speculative chaos. If you’re wondering whether this is the next Bitcoin or even the next Dogecoin, the answer is a clear no. $1IQ trades at around $0.00000000000123 per token, meaning you’d need over 800 billion of them to make a single dollar. That sounds cheap, but it’s a trap.

How $1IQ Works (And Why It’s Dangerous)

$1IQ is an SPL token on Solana, which means it runs on the same network as Solana’s native coin (SOL). It doesn’t have its own blockchain. It doesn’t have smart contracts beyond basic token transfers. It’s not used for payments, apps, or services. It’s just a number on a ledger, with a name designed to provoke.

You can buy $1IQ only on Raydium, a decentralized exchange on Solana. You won’t find it on Coinbase, Binance, or Kraken. Even Phemex, which lists it, treats it as a footnote. There’s no official website. No Twitter account. No Telegram group. No GitHub repo. No team. No updates. Nothing.

That’s not unusual for meme coins - Dogecoin started as a joke too. But Dogecoin grew a community, got adopted by Elon Musk, and even became a payment option on platforms like Twitter. $1IQ has none of that. Its only purpose is to be bought by people who think, “I can get billions of coins for a few cents,” not realizing that low price per token doesn’t mean high value.

The Numbers Don’t Add Up

Here’s what the data says as of November 2023:

- Price: Between $0.000000000000307 and $0.00000000000124 (varies by exchange)

- Total Supply: 100 trillion tokens (100,000,000,000,000)

- Market Cap: Around $34,000 USD (some platforms show $0 due to data errors)

- 24-Hour Volume: $32,520 - mostly from a single DEX

- Wallet Holders: Only 27 unique wallets, with 15 controlling over 90% of the supply

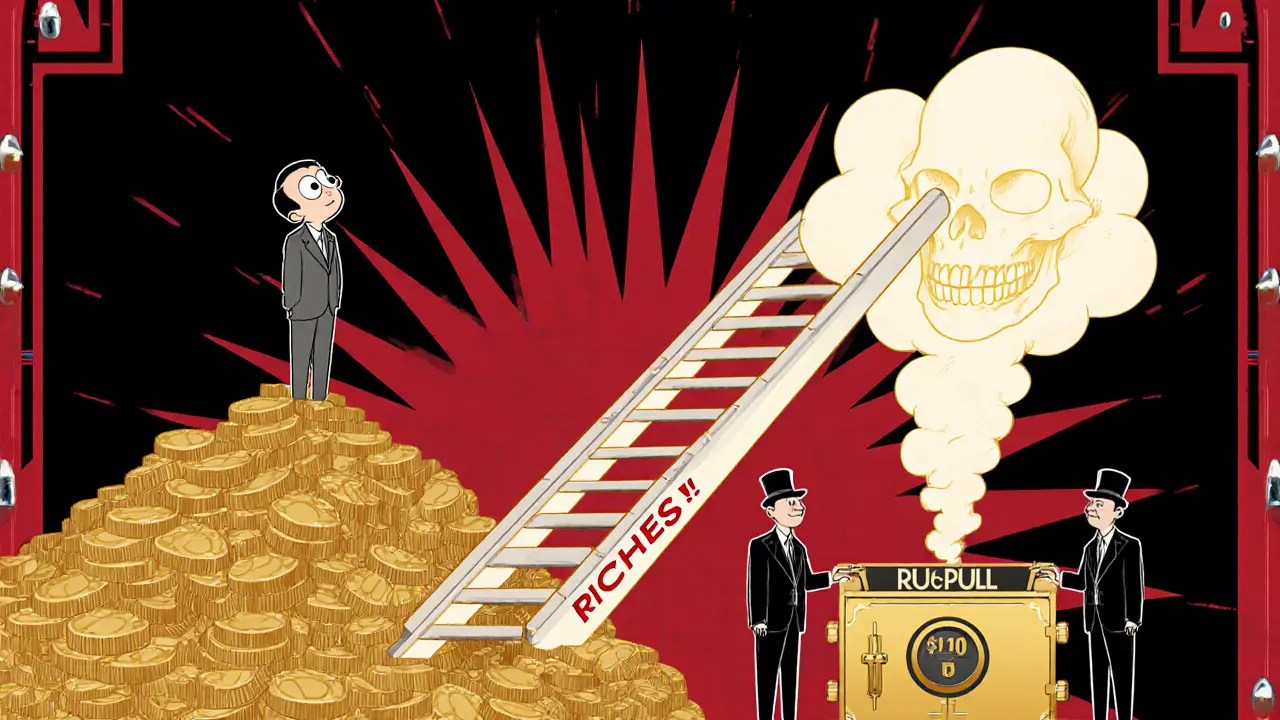

That last point is critical. When 15 wallets hold 92% of a token, it’s not a decentralized community - it’s a pump-and-dump waiting to happen. Those holders can sell their entire stake in minutes, crashing the price to near zero. And they have no incentive to hold. There’s no utility. No reason to believe anyone else will buy it tomorrow.

Why People Buy It (And Why They Lose)

The appeal of $1IQ is psychological. When you see a coin priced at $0.000000000001, it feels like you’re getting a bargain. You can buy 100 billion tokens for $1. That’s the illusion. But value isn’t about how many coins you own - it’s about how much those coins are worth in total.

Compare it to Dogecoin: one DOGE is worth about $0.073. If you spend $100 on DOGE, you get about 1,370 tokens. If you spend $100 on $1IQ, you get 80 trillion tokens. But $100 worth of DOGE is still worth $100. $100 worth of $1IQ? Also worth $100. The difference? DOGE has a $11.5 billion market cap. $1IQ has a $34,000 market cap. One is a joke with real traction. The other is a joke with no future.

Some sites, like Bitget, claim you could earn 5% by 2026 if you invest $100 in $1IQ. That’s a 1.6% annual return. Meanwhile, the S&P 500 averages 10% a year. Bitcoin returned over 230% annually from 2013 to 2023. $1IQ’s “prediction” isn’t a forecast - it’s a marketing trick to make a worthless token look like a steal.

It’s a Legal Time Bomb

The U.S. Securities and Exchange Commission (SEC) has been cracking down on tokens with no utility. In November 2023, SEC Chair Gary Gensler said tokens that exist only for speculation - with no real product, team, or purpose - are likely unregistered securities. $1IQ fits that description perfectly.

The European Union’s MiCA regulations, which took effect in 2024, require full transparency from crypto issuers: identity of creators, purpose of the token, and how funds are used. $1IQ has none of that. If any regulated exchange ever tries to list it, regulators will shut it down immediately.

And it’s not just legal risk. The Solana blockchain is flooded with these tokens. In Q3 2023, 83% of new Solana tokens were “rug pulls” - where developers create a token, attract buyers, then drain the liquidity pool and disappear. $1IQ has all the signs: no code repository, no developer activity, no community, and a supply concentrated in a few wallets.

What You Should Do Instead

If you’re curious about meme coins, look at ones with real traction: Dogecoin, Shiba Inu, or even newer ones with active development teams and community projects. Don’t chase low prices. Chase real value.

If you want to experiment with crypto, start with small amounts on platforms you trust. Learn how wallets work. Learn how to check contract addresses. Learn how to spot red flags - like no website, no team, no social media, and a market cap under $100,000.

There’s a reason $1IQ has only 27 wallet holders. Most people who bought it already sold it - and lost money. The ones still holding? They’re hoping for a miracle. That’s not investing. That’s gambling with your money.

Final Reality Check

$1IQ isn’t a coin you invest in. It’s a coin you avoid. It’s a digital prank with no punchline - just a bank account draining slowly. No expert, analyst, or financial institution recommends it. No serious investor holds it. Even the platforms that list it treat it like a warning label.

There are thousands of tokens like this on Solana. Most will vanish within a year. $1IQ isn’t special. It’s just one of many.

If you’re looking for crypto opportunities, focus on projects with transparency, community, and real use cases. Skip the jokes. They’re never funny when you’re the one paying.

Is $1IQ a real cryptocurrency?

Yes, technically. $1IQ is a real SPL token on the Solana blockchain. But "real" doesn’t mean valuable or legitimate. It’s a meme coin with no utility, team, or long-term plan. It exists only because people buy it hoping to get rich - which almost never happens.

Can I buy $1IQ on Coinbase or Binance?

No. $1IQ is not listed on any major centralized exchange like Coinbase, Binance, or Kraken. You can only buy it on decentralized exchanges like Raydium, which are unregulated and high-risk. That’s a major red flag - legitimate projects get listed on big exchanges after meeting strict standards.

Why is the price so low?

The low price is a trick. $1IQ has a total supply of 100 trillion tokens. When you divide the tiny market cap ($34,000) by that huge supply, you get a microscopic price per token. But price per token doesn’t reflect value. A coin worth $0.000000000001 is not cheaper than one worth $0.01 - it’s worth less. Don’t be fooled by the number of zeros.

Is $1IQ a good investment?

No. $1IQ has a market cap under $50,000, no development activity, no community, and no utility. Research shows that 99.7% of tokens with market caps under $100,000 fail within a year. Even the most optimistic projections show returns far below inflation and traditional investments. This is not investing - it’s gambling with near-certain loss.

What happens if I buy $1IQ?

You might see a small price spike if someone else buys in, but it’s likely temporary. The top 15 wallets hold over 90% of the supply - they can dump it anytime. When they do, the price will crash to near zero. You’ll likely lose your money. There’s no support team. No refund. No recourse. Once you send funds, it’s gone.

Can $1IQ ever become valuable?

Almost certainly not. For a token to gain value, it needs adoption, utility, and trust. $1IQ has none. It has no roadmap, no team, no website, and no community. Even if the price rises temporarily, it will collapse without any foundation. The only way it becomes valuable is if someone scams you into believing it will.