Crypto Aquatorium Archive: January 2025 Crypto Trends and Tools

When you’re trying to make sense of Crypto Aquatorium, a curated hub for real crypto insights, not hype. Also known as a knowledge-first crypto guide, it’s where people go to find out what’s actually moving in digital assets—not just what’s trending on social media. January 2025 brought a quiet but powerful shift in how people interact with crypto. No wild pumps, no meme coins dominating headlines. Instead, users focused on tools that stick: wallets that don’t lose funds, exchanges that actually execute trades without slippage, and airdrops that rewarded real participants, not bots.

That’s why the posts from this month centered on blockchain, the underlying tech that makes crypto secure and transparent—not as theory, but as practice. People asked: Which chains are still cheap to use? Which smart contracts are actually audited? And why does it matter if your wallet supports EIP-4844? We broke down the real differences between Layer 2s like Arbitrum and zkSync, not just their token prices. Then there’s DeFi liquidity, the lifeblood of decentralized exchanges and yield protocols. January saw major shifts in where capital flowed: Uniswap V3 pools got restructured, Curve’s stablecoin swaps saw new volume spikes, and farmers started avoiding protocols that promised 50% APY but had no real revenue. This wasn’t speculation—it was recalibration.

And then there were the airdrops, free token distributions that reward early adopters and active users. Not the kind you sign up for with a fake email. The real ones. Like the one from a privacy-focused ZK-rollup that gave tokens only to users who’d sent at least five transactions on testnet. Or the one from a new DEX aggregator that tracked wallet activity across six chains. These weren’t giveaways—they were selective rewards for people who understood the ecosystem. We covered exactly how to qualify, what to watch for, and which airdrops were likely to be scams.

January 2025 didn’t have fireworks. But it had substance. The posts here aren’t about getting rich quick. They’re about getting better at using crypto—safely, smartly, and with real understanding. Whether you’re tracking wallet security updates, comparing exchange fees, or checking if a token’s on-chain activity matches its claims, you’ll find it here. No fluff. No noise. Just what worked, what didn’t, and what to watch next.

International Sanctions and Crypto Restrictions in Syria and Cuba in 2025

In 2025, the U.S. lifted most sanctions on Syria but tightened them on Cuba. Crypto use in Syria is now more accessible but still legally unclear, while Cuba remains isolated with no formal crypto infrastructure. Compliance remains critical.

What is SHIBUSSY (SHIBUSSY) Crypto Coin? The Memecoin Built for Rug Pull Survivors

SHIBUSSY is a memecoin built for crypto investors tired of rug pulls. With burned liquidity, transparent tokenomics, and a strong educational community, it’s not about profit - it’s about trust. But with near-zero trading volume, selling is extremely difficult.

How Microgrids and Blockchain Technology Are Reshaping Local Energy Markets

Microgrids powered by blockchain enable peer-to-peer energy trading, cutting costs and boosting renewable use. Learn how smart contracts, local energy markets, and decentralized tech are transforming electricity.

Best Spot Trading Strategies for 2025: Proven Methods for Crypto and Stocks

Discover the most effective spot trading strategies for 2025, including day trading, swing trading, and breakout methods. Learn how to choose the right approach, use AI tools, and manage risk to trade crypto and stocks profitably.

EQ Equilibrium X Republic Airdrop: How It Worked and What You Missed

The EQ Equilibrium X Republic airdrop distributed 3 million EQ tokens to 1,000 winners in 2025. Learn how it worked, why Equilibrium’s DeFi ecosystem matters, and what your next move should be.

Crypto Exchange Restrictions for Nigerian Citizens: What’s Really Allowed in 2025

Nigeria lifted its crypto ban in 2025 and now regulates exchanges under ISA 2025. Learn what’s legal, which platforms are approved, and why police still harass users despite new laws.

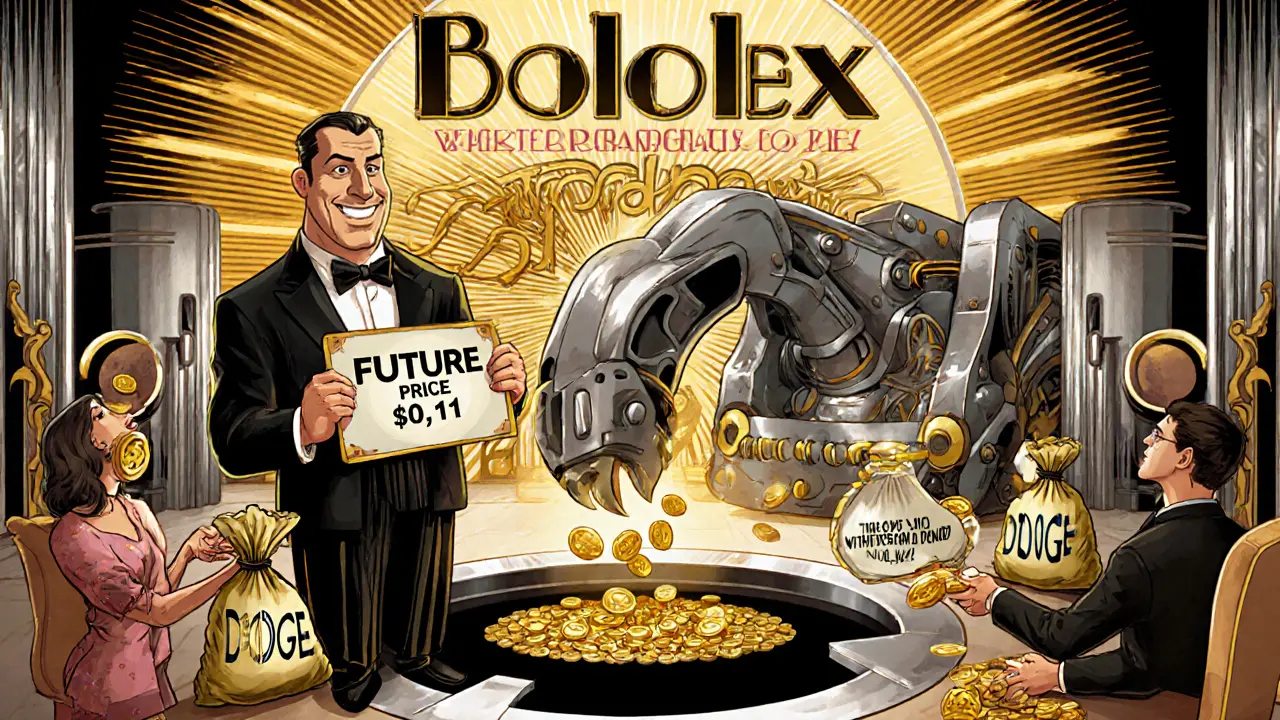

Bololex Crypto Exchange Review: A Red Flag Scam You Must Avoid

Bololex is not a real crypto exchange - it's a scam that tricks users with fake future pricing. Learn how it steals funds, why it's flagged by regulators, and which safe alternatives to use instead.

Cryptal Crypto Exchange Review: Is It Right for You in 2025?

Cryptal Exchange is a Georgia-based crypto platform offering direct GEL trading, OTC services, and a simple dual-system interface. Ideal for local users seeking regulated, low-fee crypto purchases without complex tools.