By July 2025, the U.S. government made two opposing moves that reshaped how businesses and crypto users interact with Syria and Cuba. One country got a massive sanctions relief. The other got tighter restrictions. And cryptocurrency? It’s caught right in the middle.

What Changed in Syria?

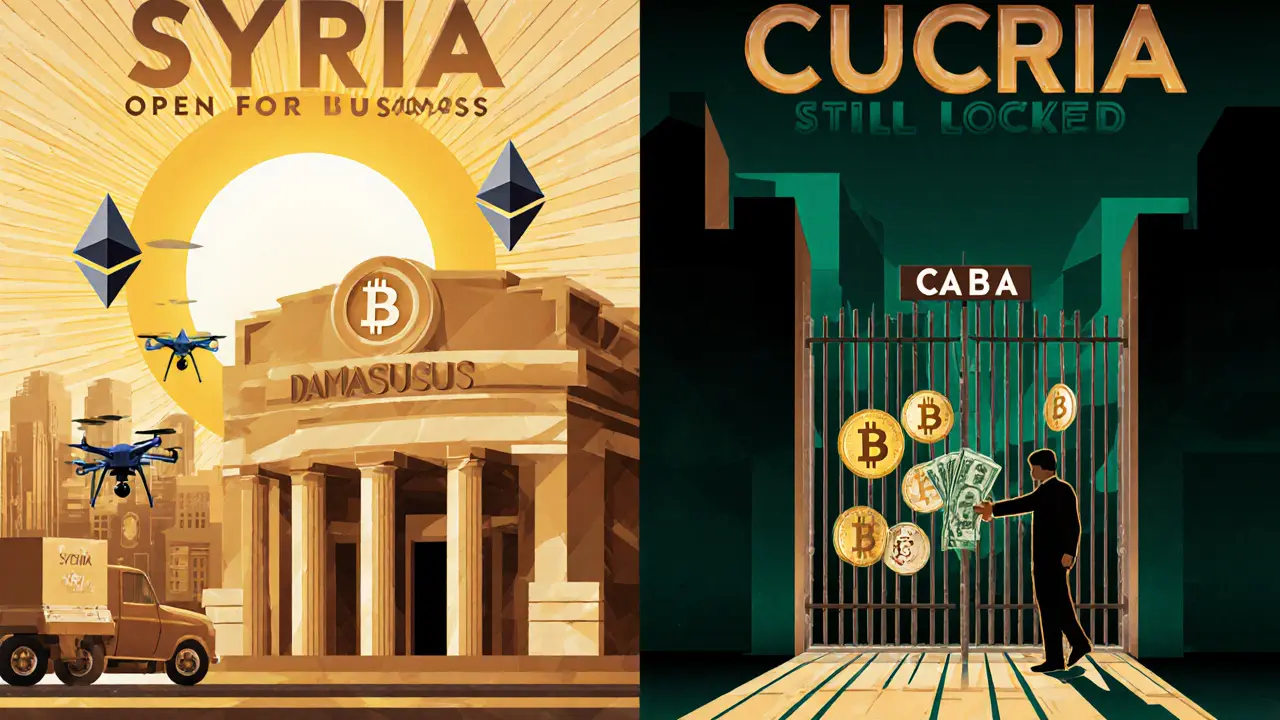

On July 1, 2025, the U.S. lifted nearly all economic sanctions on Syria. Executive Order 14312 revoked six decades-old orders that had blocked American companies from doing business there. That meant no more bans on exporting services, making investments, or sending money. The Central Bank of Syria was removed from the SDN List. U.S. banks could finally open accounts with Syrian institutions. For the first time in over 20 years, international payments to Syria became legally possible without a special license. But it wasn’t a blanket clearance. The Assad family, key regime officials, and anyone tied to the captagon drug trade or human rights abuses are still on sanctions lists. If you’re sending crypto to Syria, you can’t send it to someone linked to those groups. The rules didn’t disappear-they just got more focused.Crypto in Syria: Legal Gray Zone

Syria doesn’t have any laws that say crypto is legal or illegal. That means there’s no official framework. No licensing. No reporting rules. No central bank oversight. It’s a free-for-all, legally speaking. After the sanctions lifted, platforms like Binance and Kraken started allowing Syrian users to trade more freely. Wallets became easier to access. Peer-to-peer trading picked up. But here’s the catch: international banks and payment processors still hesitate. Why? Because they don’t know who they’re dealing with. Even if you’re sending $500 to a Syrian family member, your bank might freeze the transaction. Why? Because Syria used to be a high-risk country. Old flags linger. Compliance teams don’t want to risk a fine, even if the sanctions are gone. They’re still checking if the recipient’s name matches any of the remaining targeted individuals. That’s why tools like Lightspark’s Grid Switch are gaining traction-they let businesses move money through local payment rails without touching crypto directly.

Cuba Got Worse, Not Better

While Syria opened up, Cuba tightened. In June 2025, the Trump administration rolled back Biden’s easing policies and doubled down on the Cuba Assets Control Regime (CACR). Travel restrictions returned. U.S. companies can’t invest. Even non-U.S. subsidiaries of American firms can’t do business with Cuba without risking penalties. In July 2025, a Delaware logistics company, Key Holding, LLC, paid over $600,000 to settle OFAC charges. Their subsidiary shipped goods from Colombia to Cuba. No one lied. No one hid the destination. But it still violated the CACR. The message was clear: ignorance isn’t an excuse. Even accidental violations carry heavy fines. Crypto isn’t banned in Cuba, but it’s practically useless for cross-border business. Most exchanges still block Cuban users. Wire transfers from U.S. banks to Cuban accounts? Impossible. The only way Cubans access crypto is through informal networks-friends abroad sending Bitcoin, peer-to-peer trades via Telegram, or cash-in-hand swaps. There’s no legal infrastructure. No regulated exchanges. No banking support.Why the Difference?

The U.S. isn’t acting randomly. Syria’s sanctions were lifted because the government agreed to dismantle the al-Nusrah Front (HTS), a group once labeled a terrorist organization. The U.S. recognized political shifts and saw an opening to rebuild ties in the Middle East. Cuba? No such shift. The regime stayed the same. The U.S. still views it as a threat to regional stability and democracy. This isn’t about human rights alone-it’s about geopolitics. Syria’s location, its role in regional oil and gas routes, and its alignment with Russia and Iran made it a strategic target for re-engagement. Cuba, isolated and politically unchanged, became a symbol of resistance to U.S. policy.

What This Means for Crypto Users

If you’re in Syria and want to use crypto: you can. But you’re still in a legal gray zone. No one’s policing you, but no one’s protecting you either. If you’re sending funds from the U.S., make sure the recipient isn’t on any OFAC list. Use KYC-compliant platforms. Avoid mixing crypto with sanctioned entities-even indirectly. If you’re in Cuba: crypto is a lifeline, but it’s risky. You’re likely using informal channels. Don’t expect support from exchanges. Don’t assume your transactions are secure. The U.S. government doesn’t care if you’re buying medicine or food with crypto. The rules still apply. For businesses: Syria is now a market to explore. But compliance is harder than it looks. You need to screen every counterparty. You need to document everything. You need to train your team. Cuba? Stay away. Even indirect involvement can cost you hundreds of thousands.What’s Next?

The U.S. is watching how crypto is used in both countries. If Syria starts using crypto to evade remaining sanctions-say, by laundering money through decentralized exchanges-expect new rules. If Cuba’s underground crypto networks grow too big, OFAC might start targeting wallet providers or node operators. Meanwhile, the EU is still hammering Russia. Iran is under maximum pressure. Venezuela and North Korea are still locked out. The U.S. isn’t backing off sanctions-it’s just picking its battles. The takeaway? Sanctions aren’t static. They’re political tools. One day, a country is off-limits. The next, it’s open for business. Crypto moves faster than governments. But in 2025, the rules still matter. And ignoring them-even in a gray zone-can still get you in trouble.Can I send crypto to Syria now?

Yes, but only if the recipient isn’t linked to the Assad regime, captagon traffickers, or anyone still on OFAC’s targeted sanctions list. Major exchanges like Binance now allow Syrian users, but you must verify identities and keep records. Don’t assume it’s completely free-compliance still applies.

Is crypto legal in Cuba?

Cuba has no official laws banning crypto, but U.S. sanctions make it nearly impossible to use legally. Most exchanges block Cuban users. Bank transfers from the U.S. are forbidden. Cubans rely on informal peer-to-peer networks, cash trades, or family abroad sending Bitcoin. There’s no legal protection or banking support.

Can a U.S. company do business with Syria now?

Yes, but with limits. You can export services, invest, and transfer funds. But you must screen every person or entity you deal with against OFAC’s remaining targeted sanctions list. If you accidentally send money to a sanctioned individual-even unknowingly-you can still be fined.

Why did Syria get sanctions relief but Cuba didn’t?

Syria’s government agreed to dissolve the al-Nusrah Front (HTS) and took steps toward counterterrorism cooperation. The U.S. saw an opportunity to reset relations in the Middle East. Cuba’s government made no political changes. The U.S. continues to view it as a threat, so sanctions stayed-and got stronger.

Are crypto transactions to Syria or Cuba being monitored?

Yes. OFAC and FinCEN track crypto flows linked to sanctioned entities. Even if Syria’s broad sanctions are gone, any transaction involving a targeted person-like a regime official using a crypto wallet-can trigger an investigation. For Cuba, any U.S.-linked crypto activity is automatically suspect. Exchanges are required to block known Cuban users.

What happens if I accidentally send crypto to a sanctioned person in Syria?

You could face civil penalties, even if you didn’t know. OFAC doesn’t require intent to punish violations. If your transaction hits a sanctioned wallet-even through a mix of addresses-you may be required to report it and could be fined. Always use verified screening tools before sending funds.

![What is Dypius [New] (DYP) Crypto Coin? A Real-World Breakdown](/uploads/2025/11/thumbnail-what-is-dypius-new-dyp-crypto-coin-a-real-world-breakdown.webp)

gerald buddiman

November 4, 2025 AT 18:01This is wild, like, seriously wild… Syria gets a green light and Cuba gets locked in a cage?? I just sent $200 in BTC to my cousin in Damascus last week and my bank flagged it as ‘high-risk’-like, bro, the sanctions are GONE, but your compliance bot still thinks we’re in 2015?? 😭

Arjun Ullas

November 6, 2025 AT 13:12It is imperative to underscore that the regulatory framework governing cryptocurrency transactions remains subject to extraterritorial jurisdiction under U.S. sanctions law. The absence of domestic legislation in Syria does not equate to legal permissibility under international compliance obligations. Entities engaging in cross-border crypto flows must adhere to OFAC’s targeted sanctions list, irrespective of jurisdictional ambiguity.

Steven Lam

November 7, 2025 AT 03:49So Cuba’s still stuck in 1962 while Syria gets a VIP pass?? Typical. We lift sanctions on a regime that gassed its own people but keep squeezing a tiny island that never did anything to us? Wake up America. This isn’t about justice-it’s about power.

Noah Roelofsn

November 7, 2025 AT 04:48Let’s not romanticize Syria’s ‘opening’-it’s a carefully calibrated geopolitical recalibration, not a moral victory. The removal of broad sanctions was never about humanitarian relief; it was about extracting counterterrorism concessions and reinserting U.S. influence into a fractured regional oil-and-gas corridor. Crypto? It’s just the new vector for laundering, surveillance, and proxy leverage. The gray zone isn’t a loophole-it’s a trapdoor.

Meanwhile, Cuba’s crypto underground is the real story: a grassroots, decentralized lifeline built by nurses, teachers, and students trading Bitcoin via Telegram for insulin and rice. No banks. No exchanges. Just trust, risk, and desperation. And yet, we call it ‘illicit’ while ignoring the systemic violence of the embargo.

Sierra Rustami

November 9, 2025 AT 03:13U.S. sanctions aren’t about human rights. They’re about control. Syria bent the knee. Cuba didn’t. That’s it. Crypto doesn’t change that. It just makes it harder for the feds to pretend they’re still in charge.

Glen Meyer

November 9, 2025 AT 11:09So now we’re letting terrorists get Bitcoin? Great. Just great. Syria’s regime is still killing people, but hey, they can buy Dogecoin now? This is why America’s getting weaker. We give away power to our enemies and punish our allies. Cuba’s got more dignity than Syria right now.

Christopher Evans

November 11, 2025 AT 03:42The distinction between broad and targeted sanctions is critical to maintaining the integrity of the U.S. financial system. While the lifting of comprehensive sanctions on Syria represents a policy shift, the persistence of targeted designations ensures accountability. Financial institutions must continue rigorous due diligence, particularly in decentralized environments where attribution is non-trivial.

Ryan McCarthy

November 12, 2025 AT 22:41I get why Syria got relief-it’s a strategic play. But I also feel for the Cubans. They’re not asking for handouts. They’re just trying to feed their families. Crypto isn’t a rebellion for them-it’s survival. Maybe instead of punishing them, we should be building bridges. Not walls. Not sanctions. Bridges.

Abelard Rocker

November 14, 2025 AT 04:30Ohhhhhhh so now we’re giving a free pass to the Assad regime because they ‘disbanded’ a group that was already mostly dead? Like, what even IS this? The al-Nusrah Front? The same group that got decimated by Russia and Turkey and ISIS and half a dozen militias? And now we’re calling that ‘cooperation’?? 😭😭😭 And Cuba? Cuba’s just sitting there with its 1950s cars and its 1970s internet and its grandmas trading Bitcoin for canned beans on Telegram while the U.S. calls them ‘rogue’?? This isn’t foreign policy-it’s a soap opera written by a drunk lobbyist who thinks ‘regime change’ is a Netflix genre. We’re not playing chess. We’re playing Jenga with the global economy and we’re all just watching while the tower wobbles. And now crypto’s the glue holding it together? No. No no no. It’s the match. And someone’s about to light it.

Hope Aubrey

November 15, 2025 AT 13:31Let’s be real-Syria’s crypto boom is just a new laundering pipeline. OFAC’s already watching. And Cuba? They’re the ultimate crypto anarchists. No banks. No rules. Just vibes and wallets. But here’s the kicker: if you’re sending crypto to Cuba, you’re already on the radar. The system’s rigged. And we’re all just pawns in a game where the house always wins.

andrew seeby

November 17, 2025 AT 00:04bro i just sent 0.5 btc to my aunt in havana last week and she got it in 3 mins 😎 no bank, no fees, no paperwork. they’re using crypto like it’s the 90s dial-up internet-slow, sketchy, but it works. also 🤝🙌

Pranjali Dattatraya Upadhye

November 18, 2025 AT 03:13Isn’t it fascinating how crypto exposes the absurdity of geopolitical hypocrisy? Syria’s people can now receive remittances legally, yet their banks still fear compliance nightmares. Cuba’s citizens, meanwhile, are forced into shadows-not because they’re criminals, but because their government refuses to kneel. The real revolution isn’t in blockchain tech-it’s in the quiet resilience of ordinary people who outsmart sanctions with nothing but a phone and a QR code. 🌱

Kyung-Ran Koh

November 18, 2025 AT 23:03As someone who’s worked with diaspora communities in both countries, I’ve seen firsthand how crypto isn’t just a tool-it’s a lifeline. In Syria, it’s about rebuilding trust after decades of isolation. In Cuba, it’s about survival. The U.S. government treats both as policy puzzles, but real people? They’re just trying to eat, pay rent, and keep their kids in school. Let’s stop pretending sanctions are clean or moral. They’re messy. They hurt the innocent. And crypto? It’s the only thing keeping hope alive in places where the system forgot them.

Compliance matters-but so does compassion. Let’s not confuse bureaucracy with justice.