Crypto Aquatorium Archive: September 2025 Crypto Trends and Tools

When you look at Crypto Aquatorium, a curated hub for digital asset insights, tool reviews, and blockchain education. Also known as a crypto knowledge center, it’s where people go to cut through the noise and find real value in a crowded market. September 2025 was a quiet month—not because nothing happened, but because the real moves were happening under the surface. While headlines screamed about price spikes, the community here focused on what actually matters: which wallets are still secure, which airdrops are legit, and which DeFi protocols are building real liquidity—not just hype.

Airdrops, free token distributions tied to specific actions like holding a coin or using a dApp. Also known as token giveaways, they’re still one of the most accessible ways for new users to get into crypto without spending money. That month, three major airdrops rolled out—each with clear eligibility rules, no fake Twitter bots, and real token utility. One rewarded users who held a specific NFT for over 90 days. Another gave tokens to people who used a lesser-known DEX for at least 10 trades. These weren’t scams. They were smart, targeted rewards. And DeFi, a system of financial apps built on blockchain that let you lend, borrow, or trade without banks. Also known as decentralized finance, it’s what makes crypto more than just speculation. saw real shifts in liquidity pools. Two protocols reduced fees by 40% after user feedback. One even started offering yield in stablecoins instead of volatile tokens. That’s not random—it’s evolution.

And then there’s blockchain, the public ledger technology that powers crypto, records transactions, and keeps everything tamper-proof. Also known as distributed ledger, it’s the foundation everything else runs on. In September, several smaller chains improved their transaction speeds by switching to new consensus methods. Not because they were chasing Ethereum, but because their users asked for faster, cheaper trades. That’s the pattern here: real people, real needs, real updates. No fluff. No promises of moonshots. Just steady, useful progress.

What you’ll find in this archive isn’t a list of top coins or fake predictions. It’s a collection of guides that helped people actually use crypto better—how to check if an airdrop is safe, which exchange has the lowest hidden fees, how to track liquidity changes without a fancy dashboard. These aren’t posts for gamblers. They’re for people who want to understand what’s going on, not just chase the next big thing.

What is Y8U (Y8U) Crypto Coin? Price, Use Case, and Risks Explained

Y8U is a low-cap crypto token aiming to let users earn money by sharing data for AI training. But with almost no trading volume, no development activity, and only one exchange listing, it's a high-risk speculative asset with little real-world use.

Benefits of Blockchain Energy Trading

Blockchain energy trading lets households and businesses buy and sell renewable power directly, cutting costs, reducing waste, and empowering communities with transparent, automated peer-to-peer energy markets.

ko.one Crypto Exchange Review: Is It Safe or a Red Flag?

ko.one is not a verified crypto exchange. No official records, audits, or user reviews exist. This review exposes it as a likely scam and shows how to spot safe alternatives like Coinbase and Kraken.

How to Buy Crypto for Fiat in Nigeria: Step-by-Step Guide for 2025

Learn how to buy crypto with Nigerian Naira in 2025 despite CBN restrictions. Step-by-step guide on safe platforms, payment methods, and avoiding scams.

What is Smolecoin (SMOLE) Crypto Coin? A Realistic Look at the Solana Meme Coin

Smolecoin (SMOLE) is a Solana-based meme coin with a cute mole theme. It has no real utility, high volatility, and low liquidity. Learn how to buy it, earn it for free, and why it's not an investment.

EU Stablecoin Restrictions Explained: What USDT and Other Tokens Can No Longer Do in Europe

The EU's MiCA regulation banned non-compliant stablecoins like USDT from trading on EU platforms as of early 2025. Only tokens with strict 1:1 backing and transparency, like USDC and EURC, are allowed. Here's what it means for users and the future of crypto in Europe.

Privacy Coin Regulations and Delisting: What You Need to Know in 2025

Privacy coins like Monero and Zcash are being delisted from major exchanges due to global regulatory crackdowns. Learn why they're targeted, where you can still trade them, and what this means for your financial privacy in 2025.

What is Ponke (PONKE) crypto coin? A beginner’s guide to the Solana meme coin

Ponke (PONKE) is a Solana-based meme coin with no utility, just a chaotic monkey-Pepe mascot and a passionate community. Learn its price history, where to buy it, and why people still hold it despite massive losses.

BB EXCHANGE Crypto Exchange Review: What You Need to Know Before Trading

BB EXCHANGE is not a real or verified crypto exchange. Despite claims of 6% yields, no legitimate platform by this name exists. Avoid fake sites and stick to trusted exchanges like Coinbase or Kraken.

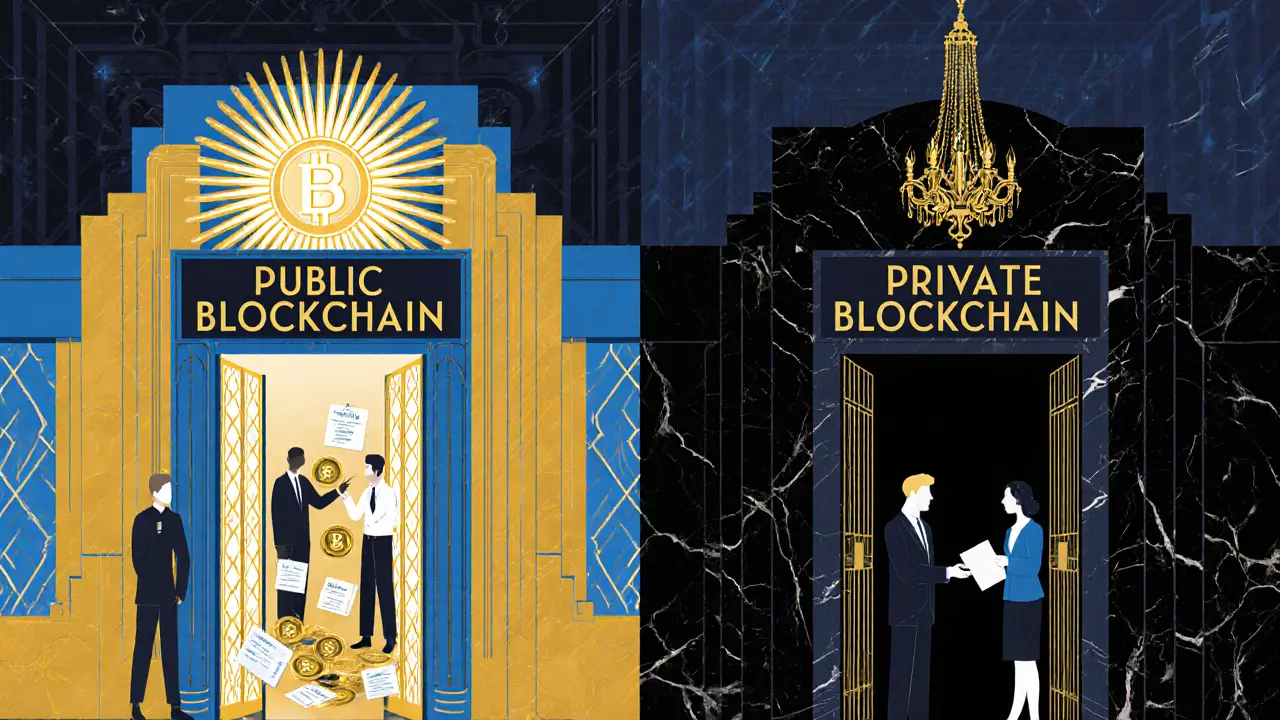

When to Use Public vs Private Blockchain: A Practical Guide for Businesses and Developers

Learn when to choose public or private blockchain based on real-world needs like transparency, speed, privacy, and cost. No fluff-just clear guidelines for businesses and developers.

Arbitrum One DEX Review: How to Swap Crypto with Low Fees on Arbitrum

Arbitrum One isn't a crypto exchange - it's the fastest, cheapest Layer-2 network powering DEXs like Camelot and Uniswap. Learn how to swap tokens with $0.30 gas fees and avoid common pitfalls.

HiveSwap (HIVP) Crypto Token Review: What It Really Is and Whether It's Worth Trading

HiveSwap (HIVP) isn't a crypto exchange - it's a high-risk, low-cap token with no utility or team. Learn why it's not worth investing in and what real alternatives you should consider instead.