Costa Ricans don’t wait for permission to use crypto. While most countries scramble to build walls around digital money, Costa Rica lets its people move freely - buying Bitcoin, trading NFTs, sending remittances, and running crypto businesses with almost no rules. There’s no national crypto license. No mandatory registration. No government app to approve your wallet. And yet, crypto is everywhere.

It’s not chaos. It’s adaptation. People use what’s already there: banking laws, business registration rules, and common sense. The Central Bank of Costa Rica says Bitcoin isn’t legal tender. That’s fine. No one asked for permission to use it as money anyway. If you can send dollars via wire transfer, you can send Bitcoin. The system doesn’t care what’s in the box - just that the box gets delivered.

How Crypto Moves in Daily Life

Take Maria, a freelance graphic designer in San José. She gets paid in USDT from clients in the U.S. and Europe. She doesn’t convert it to colones right away. Instead, she keeps it in a non-custodial wallet. When she needs to pay rent, she uses a local crypto debit card linked to her wallet. The card automatically converts Bitcoin or USDT to colones at the point of sale. No bank approval needed. No form to fill out. Just tap and go.

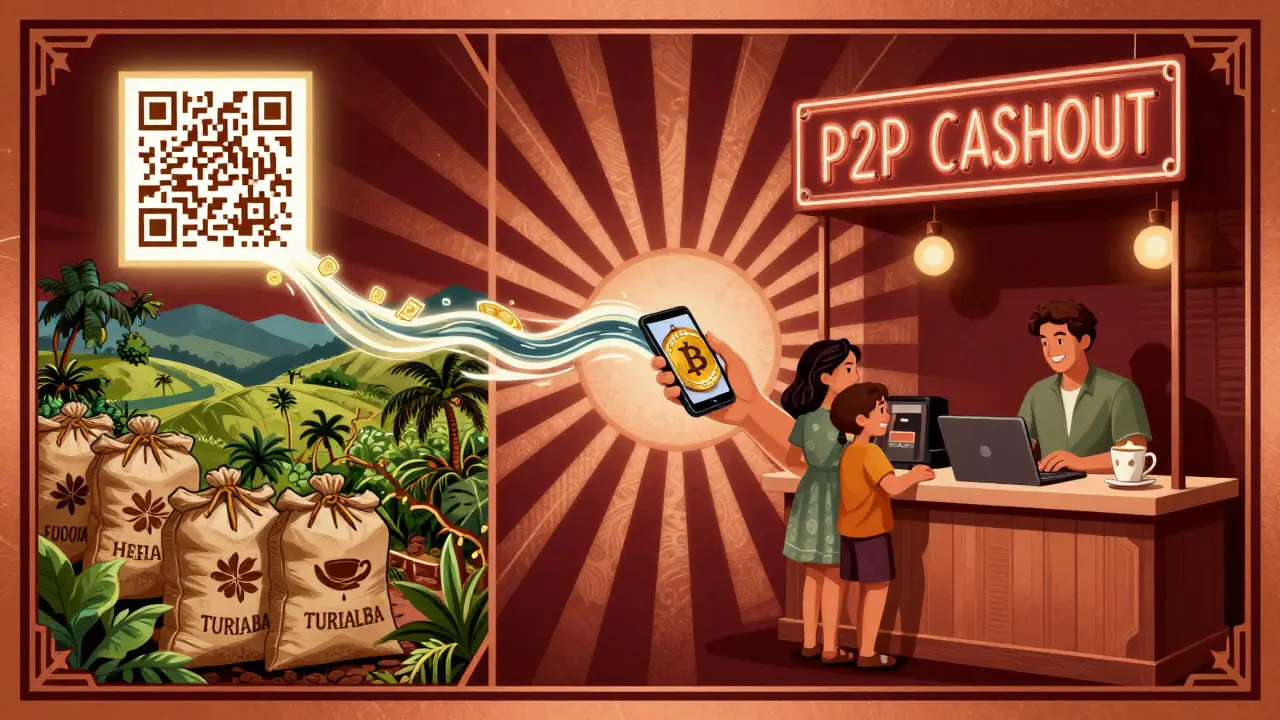

Or consider the small coffee farm in Turrialba. Instead of waiting weeks for international payments through traditional banks - and paying 5% in fees - they now accept Bitcoin directly from overseas buyers. A QR code on their website lets customers pay in crypto. The farm owner doesn’t even need to understand blockchain. A third-party processor handles the conversion to colones within minutes. The farm saves 80% on transaction costs. That’s not innovation - that’s survival.

Remittances are a huge driver. Over $1 billion flows into Costa Rica each year from workers abroad. Traditional services like Western Union charge $20 to send $200. With crypto, it’s $2. People use peer-to-peer platforms like Paxful or LocalBitcoins. A relative in Florida sends Bitcoin. The recipient in Heredia cashes out at a local exchange kiosk - often just a guy with a laptop in a coffee shop. No ID required. No paperwork. Just a phone number and a scan.

The Legal Gray Zone

Costa Rica has no law that says, "You can use crypto." But it also has no law that says, "You can’t." That’s not a loophole. It’s a feature. The country’s financial system operates under Law No. 7786, which governs financial institutions, AML, and CFT. Crypto businesses don’t need a special license - they just need to follow the same rules as money transfer services or currency exchanges.

So, if you run a crypto exchange in San Pedro, you must:

- Verify the identity of every customer (KYC)

- Report suspicious transactions

- Keep records of all trades for 10 years

- Have a registered business address

That’s it. No capital requirements. No audits. No government inspection. If you meet those basic standards, you’re legal. There are over 30 active crypto exchanges in Costa Rica, most run by locals who started in their garages. Some have grown into full teams. One, called CryptoCosta, processes over $10 million monthly in trades. They don’t advertise. They don’t need to. Word spreads fast.

Businesses Are Built on Flexibility

Companies don’t wait for regulators. They build around them.

GameFi studios in Cartago launch NFT-based games where players earn tokens redeemable for real goods - like solar panels or organic coffee. These tokens aren’t securities. They’re loyalty points. So they don’t need approval from SUGEF, the financial superintendency. The game’s website says: "Earn. Spend. Repeat." No legal disclaimer. No lawyer on retainer.

Real estate developers are tokenizing property. A beachfront lot in Tamarindo is divided into 10,000 NFTs. Each one represents 0.01% ownership. You buy one on a decentralized marketplace. You get a digital deed. You can sell it anytime. The government doesn’t recognize it as legal ownership - but the buyer doesn’t care. The deed is on-chain. The location is real. And if you ever want to sell, there’s always someone in Miami ready to pay in USDC.

Even restaurants are getting in. A vegan café in Santa Ana lets customers pay with Dogecoin. They don’t hold crypto. They use a payment processor that instantly converts it to colones. The owner says, "If people want to pay with crypto, why should I make it hard?"

What’s Coming: The New Law

In July 2025, the Costa Rican legislature passed the first reading of Bill 22.837. This isn’t a ban. It’s a shift. The bill creates a formal category called Virtual Asset Service Providers (VASPs) any entity that exchanges, transfers, or stores digital assets. If you operate a crypto exchange, custody service, or token issuance platform, you’ll soon need to register with SUGEF.

Registration doesn’t mean approval. It means accountability. You’ll have to:

- Identify every user

- Track every transaction

- Report high-risk activity

- Update risk assessments quarterly

It’s not about stopping crypto. It’s about bringing it into the same system as banks. The goal? To prevent money laundering and match international standards. Costa Rica wants to avoid being labeled a tax haven. They’re not shutting the door. They’re installing a turnstile.

For now, the law hasn’t taken effect. So businesses still operate under the old rules. Many are preparing. Some are waiting. A few are leaving - not because they’re scared, but because they don’t want to deal with bureaucracy.

Why It Works

Costa Rica isn’t a crypto paradise because it’s lawless. It’s a crypto paradise because it’s practical.

The country has:

- No capital gains tax on crypto

- No VAT on digital asset transactions

- Strong internet infrastructure

- Political stability

- A culture of entrepreneurship

People aren’t using crypto because they hate banks. They’re using it because it’s faster, cheaper, and more reliable than the alternatives.

When you’re sending money to family across the border, speed matters. When you’re a small business owner, fees matter. When you’re trying to build something new, red tape matters.

Costa Ricans didn’t wait for permission. They used what worked.

What Happens If You Get Caught?

Short answer: You probably won’t.

The government doesn’t have the resources to chase individual crypto users. There are no crypto police. No raiding teams. No surveillance software scanning wallets. If you’re just buying Bitcoin to pay for groceries, you’re invisible.

But if you’re running a large exchange without KYC? That’s a different story. SUGEF has started investigating unregistered platforms. In late 2025, they shut down one operation that processed over $50 million in unverified transactions. The owner was fined. The business closed. But no one went to jail. It was treated like a financial compliance issue - not a criminal one.

Most people stay under the radar. And that’s fine. The system isn’t designed to catch them.

What’s Next?

Costa Rica is at a turning point. The crypto ecosystem is mature enough to need structure. But not so big that it can’t adapt.

The new law will make things harder for big players. But for regular people? It won’t change much. You’ll still be able to buy Bitcoin. Send remittances. Use crypto debit cards. Pay for coffee with Dogecoin.

The difference? The exchanges you use might ask for your passport. The apps might add a verification step. The kiosks might start printing receipts.

That’s not a step backward. It’s just growing up.

Is it legal to buy Bitcoin in Costa Rica?

Yes. There is no law banning the purchase, sale, or holding of Bitcoin or any other cryptocurrency in Costa Rica. Individuals can buy crypto through local exchanges, peer-to-peer platforms, or even ATMs. The Central Bank does not recognize crypto as legal tender, but that doesn’t make it illegal - it just means it’s not official money.

Do I need to pay taxes on crypto in Costa Rica?

No, Costa Rica does not currently tax capital gains from cryptocurrency. There is no capital gains tax, no VAT on crypto transactions, and no income tax applied to personal crypto holdings. However, if you operate a crypto business - like an exchange or mining operation - you must register as a company and pay standard corporate taxes. For individuals, crypto remains tax-free.

Can I open a bank account for my crypto business in Costa Rica?

It’s difficult, but possible. Traditional banks are cautious about crypto-related businesses and often refuse accounts. Some entrepreneurs use offshore banks or fintech partners that specialize in crypto. Others operate entirely in crypto, using stablecoins for payments and avoiding banks altogether. A few licensed VASPs have successfully opened accounts by working with specialized financial institutions that understand compliance frameworks.

Are NFTs and GameFi projects legal in Costa Rica?

Yes. NFTs and GameFi projects are not regulated as securities unless they promise financial returns or profit-sharing. If they’re treated as digital collectibles, game items, or access tokens, they’re fully legal. Many local developers have launched NFT art collections and blockchain games without any government involvement. As long as they don’t claim to be investments, they fly under the radar.

Will the new VASP law shut down small crypto users?

No. The new law targets service providers - exchanges, custodians, and token issuers - not individual users. If you’re buying Bitcoin for personal use, sending crypto to a friend, or using a crypto debit card, you won’t be affected. The regulation is about businesses, not people. Most users won’t even notice the change.

Is Costa Rica safer for crypto than other countries in Latin America?

Yes, currently. Compared to El Salvador (which made Bitcoin legal tender but created heavy compliance burdens) or Brazil (which has strict AML rules and frequent audits), Costa Rica offers more freedom with fewer restrictions. It’s not as regulated as Argentina or Mexico, and it’s far more stable than Venezuela or Colombia. For now, it’s the most balanced crypto environment in Central America.

Ace Crystal

February 8, 2026 AT 22:03