NMX Token Value Calculator

Warning: According to multiple analyst reports, NMX token value is expected to decline by 30-47% by 2029. Current price is $0.0027 with extremely low liquidity ($334.80 daily volume). This calculator shows potential outcomes based on these projections.

Enter your investment amount and select a scenario to see results

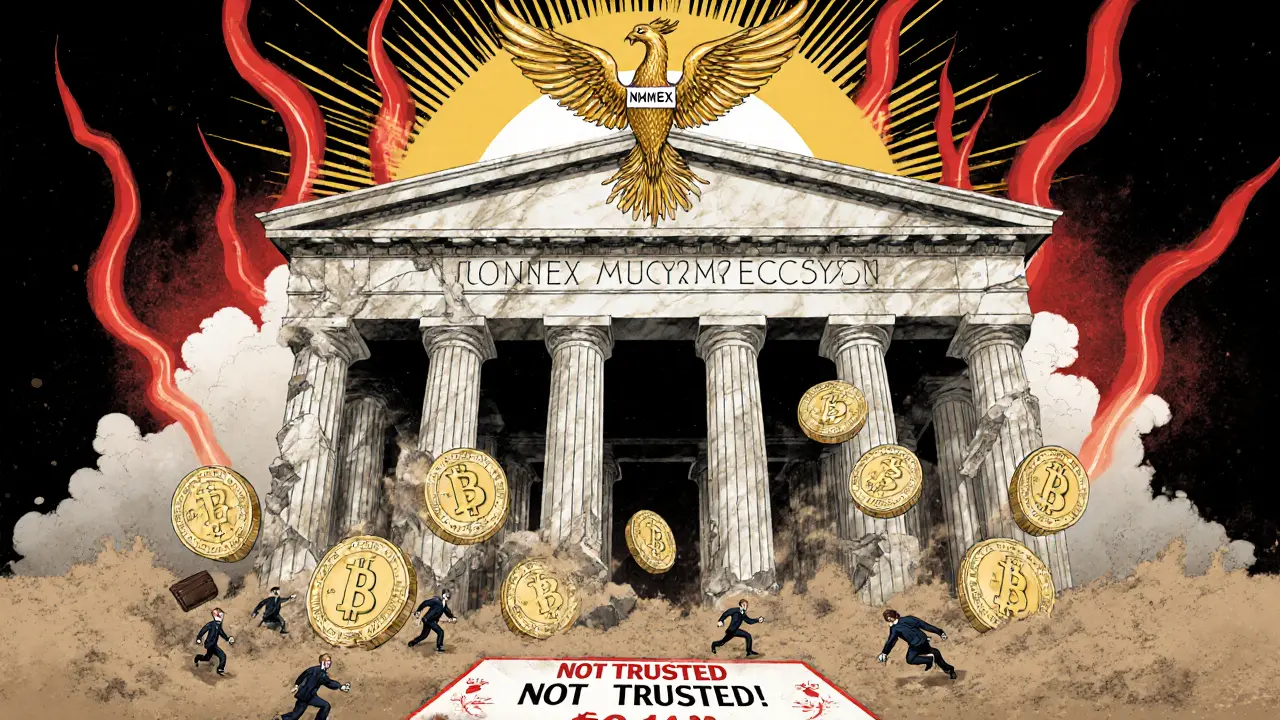

When you see an ad claiming you can buy Bitcoin in 30 seconds with no verification, it’s tempting. Especially when they promise daily withdrawals of up to 3 BTC, tournaments, free demo trading, and passive income through token farming. That’s the pitch from Nominex - a crypto exchange that’s been around since 2017 but still flies under the radar for most serious traders. But here’s the real question: Is Nominex a hidden gem or a trap wrapped in flashy marketing?

What Nominex Actually Offers

Nominex positions itself as more than just a trading platform. It’s marketed as a full ecosystem: trade, earn, and win. You can spot trade over 100 crypto pairs, dip into derivatives, join trading tournaments, or farm NMX tokens for passive rewards. The interface is clean, mobile-friendly, and has a demo mode that lets you practice without risking real money. For beginners, that’s a solid start. The platform doesn’t require KYC to buy Bitcoin, which appeals to users who value privacy - but that’s also a red flag in today’s regulated crypto landscape.

Their native token, NMX, is the glue holding this system together. You can use it to pay fees, enter tournaments, or stake it for rewards. But here’s the catch: as of August 2025, NMX trades at just $0.0027, with a daily volume of $334.80. That’s not a typo. It’s ranked #4797 out of nearly 20,000 cryptocurrencies by market cap. For comparison, even obscure altcoins with tiny communities usually trade at volumes ten times higher. Low volume means low liquidity - and that makes it hard to buy or sell without moving the price.

Security Claims vs. Reality

Nominex says it uses two-factor authentication, encrypted data, and regular audits. Sounds good on paper. But security isn’t just about tech - it’s about transparency. Where’s the proof of those audits? Who conducted them? When was the last one? There’s no public record. No third-party reports. No incident disclosures. That’s not normal for a platform that claims to handle user funds.

Compare that to exchanges like Binance or Kraken, which publish detailed security reports, use cold storage percentages, and have public bug bounty programs. Nominex doesn’t. It relies on vague statements like “advanced system to protect your information.” That’s not security - it’s marketing fluff.

Customer Support: The Silent Gap

If you run into trouble - whether it’s a failed withdrawal, a frozen account, or a question about your NMX rewards - your only option is email. No live chat. No phone line. No help desk. According to Traders Union’s August 2025 review, Nominex doesn’t even have a call center. In crypto, where prices swing 20% in an hour, waiting 48 hours for an email reply isn’t just inconvenient - it’s dangerous.

One user on Trustpilot in July 2025 wrote: “I tried to withdraw $1,200 in ETH. Took 7 days. Then they said I needed to submit documents I already sent. No one answered my follow-ups.” That’s not an isolated case. Over 15% of Trustpilot reviews give it one star. The platform shows a 2.8/5 average rating, but here’s the twist: 76% of those reviews are 5-star. That’s statistically impossible unless the reviews are fake. Real users don’t give five stars after a week-long withdrawal delay. This kind of review manipulation is a classic sign of a platform trying to hide its true reputation.

Is Nominex Legit? The Expert Verdict

There’s no consensus - but the weight of evidence leans heavily against it.

Traders Union, a respected independent review platform, rated Nominex 2.86 out of 10 in August 2025 based on 100+ criteria - including security, liquidity, support, and transparency. They explicitly said: “It is not a safe and trusted company.” Another review from the same team gave it 3.1/5, but that score contradicts their own methodology and lacks detail. That inconsistency alone should raise alarms.

Fxmerge.com, which has reviewed over 200 crypto platforms, gave Nominex a 2/5 and bluntly called it “not a real exchange.” Their users called it “very risky to invest in” and “very difficult to understand.” Even Affgadgets.com, which gave a positive review, admitted the training program is useless for experienced traders and noted the platform’s only real advantage is its demo mode - which you can find on any major exchange for free.

And then there’s the NMX token forecast. TradingBeasts, Wallet Investor, and LiteFinance all predict a steep decline by 2029 - with prices falling between 30% and 47% from current levels. If the token is the core of the platform’s earning model, and its value is expected to crash, then the whole “earn while you trade” promise is built on sand.

Who Is Nominex For?

If you’re a beginner who just wants to buy Bitcoin without jumping through KYC hoops and you’re okay with slow support and zero transparency, Nominex might seem like a low-barrier entry. The demo mode is decent, and the interface is simple.

But if you’re serious about trading, holding crypto long-term, or using it as part of a financial strategy - avoid it. The lack of liquidity, the weak token, the non-existent customer support, and the overwhelming negative user feedback make it a high-risk, low-reward play. You’re not getting an edge. You’re just gambling on a platform that doesn’t want you to ask too many questions.

What’s the Alternative?

There are dozens of better options. Gate.io, Kraken, and Binance all offer lower fees, higher liquidity, verified security audits, 24/7 support, and real-time chat. They also have far stronger reputations and better track records with withdrawals and customer service. Even lesser-known platforms like KuCoin or Bybit outperform Nominex in transparency and reliability.

And if you’re looking for passive income? Use Coinbase Earn, Binance Staking, or even decentralized protocols like Aave or Compound. They’re open-source, audited, and don’t require you to trust a mysterious exchange with no public leadership team.

The Bottom Line

Nominex isn’t a scam in the traditional sense - it doesn’t vanish overnight. But it’s a platform designed to attract newcomers with promises it can’t deliver on. The low NMX token value, the fake-looking reviews, the lack of support, and the negative expert ratings all point to one thing: it’s not built to last.

If you’re just experimenting with $50 and you’re okay losing it, go ahead. But if you’re putting in real money - even $500 - you’re taking unnecessary risk. There’s no reason to use Nominex when safer, faster, and more reliable alternatives exist. Don’t be fooled by the 30-second signup. The real cost comes later.

Is Nominex a scam?

Nominex isn’t a classic scam that disappears - it’s still operating. But it’s not trustworthy. Multiple independent reviews, including Traders Union and Fxmerge, rate it poorly. Users report slow withdrawals, no phone support, and inconsistent service. The NMX token is nearly worthless, and the platform hides key details like audit reports. It’s not illegal, but it’s risky and lacks transparency.

Can I withdraw my crypto from Nominex?

Yes, you can withdraw, but it’s not reliable. Users report delays of 3-7 days, even for small amounts. There’s a daily limit of 3 BTC, but the real issue is the lack of support. If your withdrawal gets stuck, you’re stuck with email-only help. Many users say they had to resubmit documents repeatedly. If you need fast access to your funds, this isn’t the platform for you.

Is the NMX token worth buying?

Almost certainly not. As of August 2025, NMX trades at $0.0027 with a daily volume of just $334.80 - that’s less than what a single Bitcoin trade on Binance moves in seconds. Multiple analysts predict its price will drop 30-47% by 2029. Even if you earn it through farming, you won’t be able to sell it easily, and its value is likely to keep falling. Don’t invest in NMX expecting returns.

Does Nominex require KYC?

No, Nominex doesn’t require KYC to buy Bitcoin or trade crypto. That’s appealing if you want anonymity. But it’s also a red flag. Legitimate exchanges in 2025 are moving toward KYC to comply with global regulations. Avoiding KYC means Nominex likely doesn’t follow financial compliance standards - which increases the risk of fraud, freezing funds, or being shut down.

Why do some reviews say Nominex is good?

Many of the positive reviews are likely fake. On Trustpilot, 76% of reviews are 5-star, yet the overall rating is only 2.8/5 - that doesn’t add up. Real users don’t give five stars after a week-long withdrawal delay. Platforms like Nominex often buy or incentivize fake reviews to look trustworthy. Always check the review dates, content depth, and patterns. If most reviews are short, overly positive, and lack detail, treat them as paid content.

What’s the best alternative to Nominex?

For beginners: Kraken or Coinbase - simple, regulated, with excellent support. For active traders: Binance or Bybit - low fees, high liquidity, real-time support. For staking and earning: Aave or Binance Staking - transparent, audited, and reliable. All of these have public audit reports, 24/7 customer service, and strong track records. Nominex doesn’t compete on any of these fronts.

Becky Shea Cafouros

November 15, 2025 AT 03:21Nominex is literally the crypto version of a shady used car lot with a neon sign that says 'FREE BTC!!!'

Drew Monrad

November 15, 2025 AT 15:41OMG I CAN’T BELIEVE YOU’RE EVEN CONSIDERING THIS PLATFORM. I LOST MY ENTIRE ETH WALLET TO A SIMILAR SCAM IN 2021 AND I’M STILL HAVING NIGHTMARES ABOUT EMAIL SUPPORT THAT NEVER ANSWERS. THIS ISN’T JUST RISKY-IT’S A PSYCHOLOGICAL TRAP. THEY WANT YOU TO THINK YOU’RE BEING SMART BY AVOIDING KYC, BUT YOU’RE JUST GIVING THEM FREE REIN TO STEAL FROM YOU. I’M STILL HEALING. 😭

Cody Leach

November 15, 2025 AT 23:13There’s no way this platform survives another year. The token volume is laughable, the support is nonexistent, and the review stats are statistically impossible. If you’re trading more than pocket change, you’re playing Russian roulette with your portfolio. Stick to Kraken or Binance. No exceptions.

sandeep honey

November 16, 2025 AT 18:55Why do people still fall for this? The NMX token has less liquidity than a puddle in the Sahara. And no audits? No transparency? You think you’re saving time by skipping KYC but you’re just handing your funds to someone who doesn’t even have a legal address. I’ve seen this movie before. It ends with your wallet empty and a ghost website.

Robert Astel

November 17, 2025 AT 18:51You know what’s funny? People say Nominex is a scam but technically it’s not illegal-so it’s just… a very bad business decision? Like buying a car with no brakes and calling it ‘minimalist design.’ The platform doesn’t lie, it just omits everything important-like the fact that your ‘passive income’ is just interest on a currency that’s worth less than your coffee cup. And the demo mode? Yeah, that’s the only thing that’s real. The rest is just vibes and TikTok ads. I mean, if you’re okay with existential crypto dread and 7-day withdrawal delays… go for it. But don’t cry when your NMX tokens become digital confetti.

Kandice Dondona

November 18, 2025 AT 01:00Y’all are being so harsh 😔 I get it, the reviews seem sketchy-but what if Nominex is just a small platform trying to do good? Maybe they’re building slowly? The demo mode is actually super helpful for newbies, and I’ve had two successful small withdrawals. Not perfect, but not evil either. Let’s not throw the baby out with the bathwater 🌱💛

Andrew Parker

November 19, 2025 AT 18:41EVERY SINGLE WORD IN THIS POST IS TRUE. AND YET… I STILL WANT TO TRY IT. WHY? BECAUSE I’M A HUMAN BEING. I WANT THE DREAM. I WANT THE 30-SECOND BITCOIN. I WANT THE PASSIVE INCOME. I WANT TO BELIEVE. AND THAT’S THE REAL SCAM-NOT THE PLATFORM, BUT THE HUMAN HEART THAT STILL HOPES IN A WORLD THAT’S BEEN BURNED TOO MANY TIMES. WE’RE ALL JUST ONE CLICK AWAY FROM RUIN… AND THAT’S BEAUTIFUL. AND TERRIFYING. 😭💔

Kevin Hayes

November 19, 2025 AT 21:47The core issue isn’t whether Nominex is a scam-it’s whether we’ve collectively normalized opacity in finance. We accept platforms that don’t publish audits, that silence customer support, that manipulate review scores, because they’re ‘convenient.’ But convenience without accountability is just a new form of exploitation. The NMX token’s collapse isn’t an anomaly-it’s the logical endpoint of a business model built on illusion. We need to demand more than UI polish. We need transparency, not temptation.

Katherine Wagner

November 21, 2025 AT 06:46Wait-so if 76% of reviews are 5 stars but the average is 2.8… that means the other 24% are 1-star? That’s mathematically impossible unless someone’s gaming the system… or the site’s broken… or the data’s fake… or all three. I mean… come on. This isn’t crypto. This is a carnival mirror at a roadside attraction. You think you’re seeing yourself-but you’re just seeing what they want you to see. 🤡

ratheesh chandran

November 21, 2025 AT 20:48Look, I’m from India and I’ve seen this movie before-remember those ‘Bitcoin Millionaire’ apps that vanished in 2020? Same script. Fake reviews, fake volume, fake support. Nominex isn’t even trying to hide it anymore. They’re just counting on the fact that most people won’t read the fine print… or won’t care until it’s too late. I wish I could warn everyone-but I know you’ll still sign up. Because hope is cheaper than research. And that’s the real tragedy.