Cuba Sanctions and Crypto: How Government Restrictions Impact Digital Assets

When you hear Cuba sanctions, economic restrictions imposed by the U.S. and other nations on Cuba’s government and financial systems. Also known as U.S. embargo on Cuba, it blocks most financial transactions between Cuban entities and foreign banks, including crypto exchanges. But here’s the twist: sanctions don’t just stop money—they change how people use it. In Cuba, where traditional banking is limited, crypto isn’t a luxury. It’s a lifeline. People use it to receive remittances, buy essentials, and bypass state-controlled currency systems. Yet, because of sanctions, even legitimate crypto use gets tangled in red tape. Exchanges avoid Cuban users. Wallets get flagged. And the result? A gray market where crypto moves in silence, often through peer-to-peer networks or intermediaries in Mexico or Panama.

These restrictions don’t exist in a vacuum. They’re part of a larger global trend where governments treat cryptocurrency as a threat to control. Look at North Korea crypto theft, state-sponsored hacking operations targeting exchanges to fund military programs. Also known as TraderTraitor group, it stole $1.5 billion from Bybit in 2025, using crypto to bypass sanctions and buy weapons. That’s the flip side of what’s happening in Cuba. One side uses crypto to survive. The other uses it to attack. And in between? asset forfeiture, when governments seize crypto from criminals—or sometimes from ordinary users under vague legal claims. Also known as crypto seizures, it happens in the U.S., EU, and even places like Turkey and Nigeria, where laws change overnight. Cuba’s sanctions are just one piece of this puzzle. The same tools used to punish nations are now used to freeze wallets, shut down exchanges, and criminalize blockchain activity.

What you’ll find below isn’t just about Cuba. It’s about how power, money, and technology collide. You’ll read about how Cuba sanctions mirror restrictions in Nigeria, Turkey, and Singapore. You’ll see how hackers exploit these same gaps to steal billions. You’ll learn why some governments hold onto seized crypto instead of selling it—and what that means for your own holdings. This isn’t theory. It’s real. People are using crypto to eat, pay rent, and send money home—while regulators watch, freeze, and sometimes confiscate. The rules aren’t fair. They’re not clear. But they’re here. And if you’re using crypto anywhere in the world, you’re already in the middle of it.

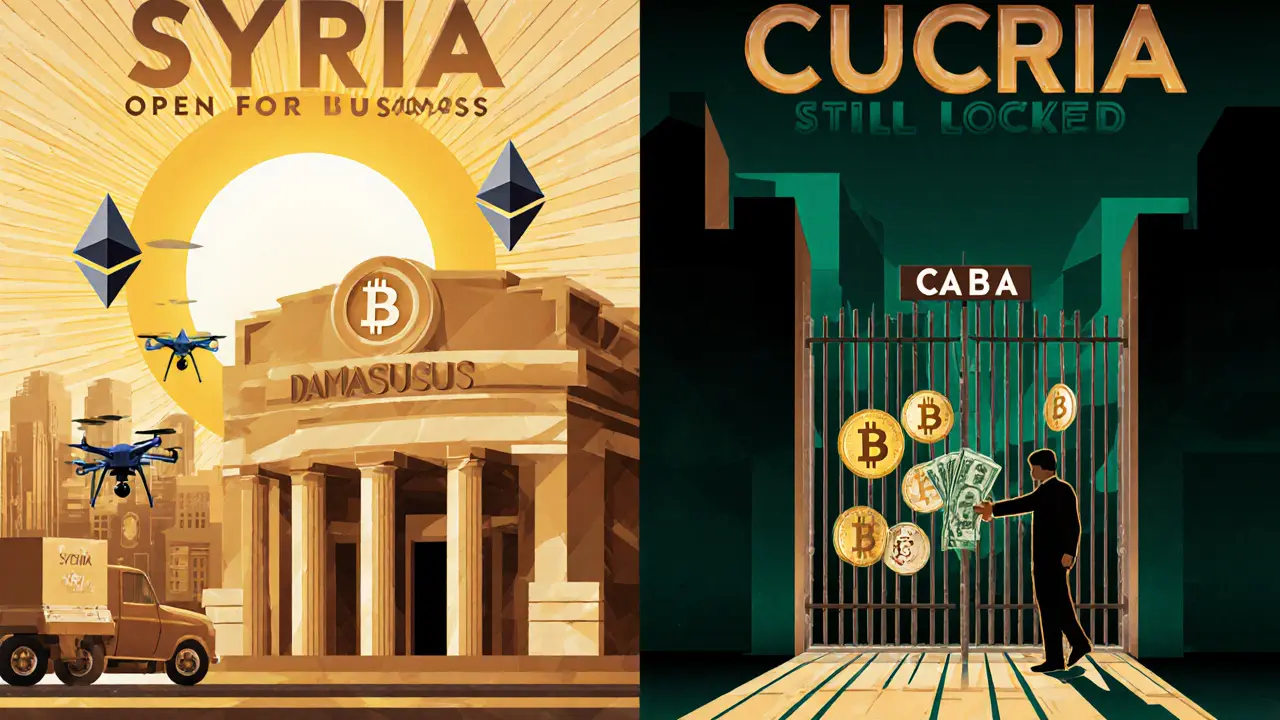

International Sanctions and Crypto Restrictions in Syria and Cuba in 2025

In 2025, the U.S. lifted most sanctions on Syria but tightened them on Cuba. Crypto use in Syria is now more accessible but still legally unclear, while Cuba remains isolated with no formal crypto infrastructure. Compliance remains critical.