DEX Explained: What Decentralized Exchanges Are and Why They Matter

When you trade crypto on a DEX, a decentralized exchange that lets users trade directly from their wallets without relying on a central company. Also known as a decentralized crypto exchange, it removes banks, brokers, and account freezes—putting control back in your hands. Unlike traditional platforms like Binance or Coinbase, a DEX doesn’t hold your money. You sign trades with your own private key. That means no one can freeze your funds, no KYC forms, and no shutdowns from regulators—unless the whole network goes down.

But not all DEXes are built the same. Some, like Uniswap, a popular automated market maker on Ethereum that lets anyone add liquidity and trade tokens, run on open protocols. Others, like the now-defunct OpenLedger DEX, a BitShares-based platform that failed because of high fees and zero trading volume, collapsed under poor design. The difference? Liquidity, user experience, and whether the code actually works for real people. A good DEX doesn’t just look technical—it needs enough traders and tokens moving so you can buy or sell without your price sliding 20% in seconds.

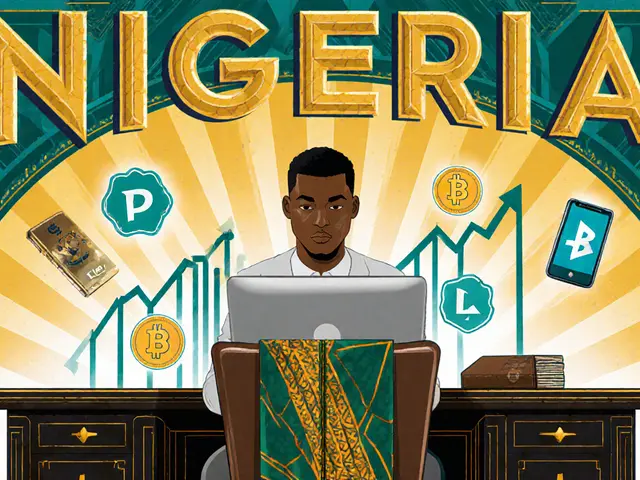

That’s why you’ll see posts here about failed DEXes, risky tokens traded on them, and how scams hide behind the "no central control" label. You’ll find stories about tokens like MBLK and B3X that exist only on DEXes because no centralized exchange would list them. You’ll also see how DeFi protocols like Hifi Finance use DEX infrastructure to offer fixed-rate loans, and how users in places like Nigeria and Nepal rely on DEXes when banks shut them out. This isn’t theory—it’s what happens when people trade without permission.

Some DEXes are safe. Others are digital ghost towns with fake volume and bots pretending to be traders. The posts below don’t sugarcoat it. They show you what works, what’s dead, and what’s a trap disguised as innovation. Whether you’re trying to buy a meme coin on Solana or testing a new DeFi tool, you need to know how DEXes really behave—before you send your crypto into the void.

ViperSwap Crypto Exchange Review: Low-Cost DEX on Harmony Blockchain

ViperSwap is a low-cost decentralized exchange on the Harmony blockchain, offering near-zero transaction fees and the highest fee-sharing rewards in DeFi. Perfect for small traders, but limited to Harmony-native tokens.

Arbitrum One DEX Review: How to Swap Crypto with Low Fees on Arbitrum

Arbitrum One isn't a crypto exchange - it's the fastest, cheapest Layer-2 network powering DEXs like Camelot and Uniswap. Learn how to swap tokens with $0.30 gas fees and avoid common pitfalls.