Syria Sanctions and Crypto: How Geopolitics Shapes Digital Asset Markets

When governments impose sanctions on countries like Syria, a nation under long-standing international economic restrictions due to civil conflict and human rights violations. Also known as the Syrian regime, it has been targeted by the U.S., EU, and UN since 2011 for supporting terrorism and using chemical weapons. These sanctions don’t just block bank accounts—they extend to digital assets. Crypto isn’t immune. In fact, it’s become a tool both for evasion and enforcement.

Sanctions on Syria intersect with crypto in three key ways: asset forfeiture, the legal seizure of digital holdings linked to banned entities, crypto seizures, the physical recovery of wallets or private keys by authorities, and cryptocurrency regulation, how nations enforce compliance across borders using blockchain analysis tools. The U.S. Treasury’s OFAC list includes crypto addresses tied to Syrian actors. Exchanges like Binance and Kraken freeze accounts linked to these addresses. Even if someone in Syria uses a VPN or a non-KYC platform, their transaction patterns can still be flagged by chain analysis firms like Chainalysis or Elliptic.

It’s not just about punishing Syria—it’s about setting a global precedent. When the U.S. seized $1.5 billion from North Korean hackers in 2025, it showed that digital assets are treated like cash in a bank vault. The same logic applies to Syria. If a wallet receives funds from a sanctioned entity, it’s at risk. This affects even innocent users who accidentally interact with tainted addresses. That’s why tools like wallet screening and compliance checks are now standard for any serious crypto platform.

What you’ll find below are real cases of how crypto moves through sanctioned zones, how governments track it, and what happens when digital assets get frozen. From hacked exchanges to private wallets holding unclaimed tokens, these stories reveal the hidden battlefield where geopolitics meets blockchain.

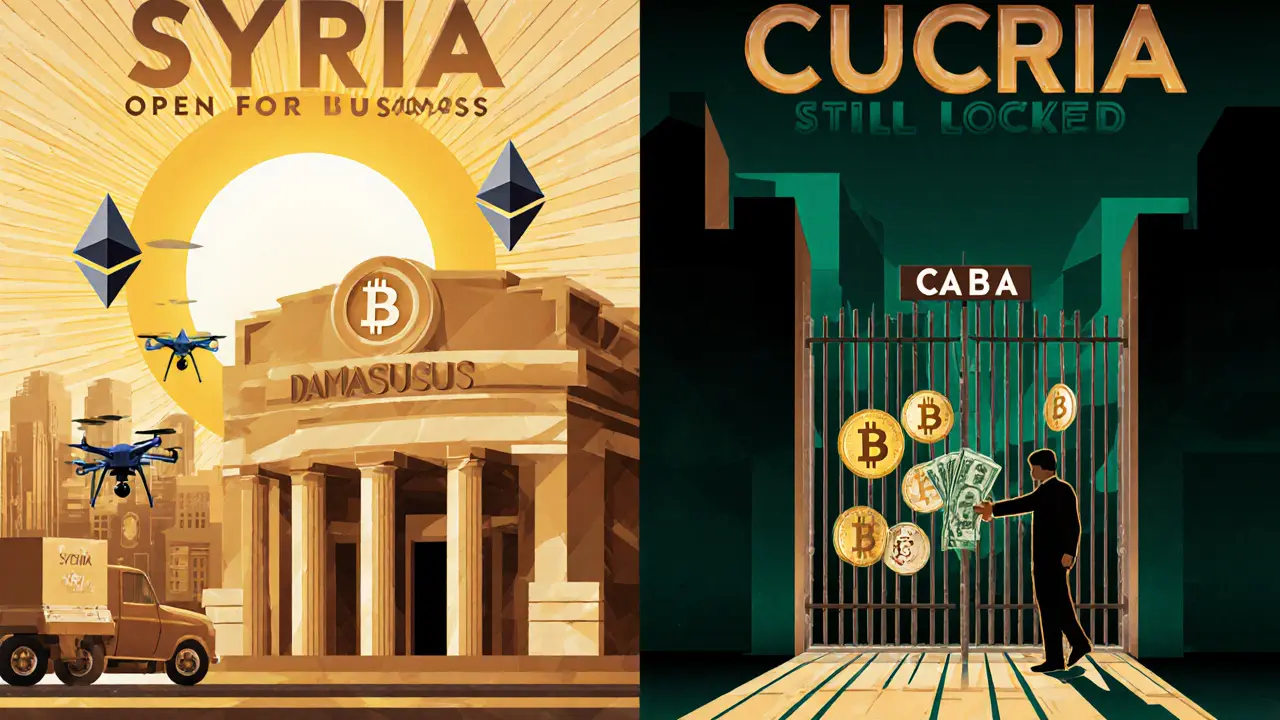

International Sanctions and Crypto Restrictions in Syria and Cuba in 2025

In 2025, the U.S. lifted most sanctions on Syria but tightened them on Cuba. Crypto use in Syria is now more accessible but still legally unclear, while Cuba remains isolated with no formal crypto infrastructure. Compliance remains critical.