Bitcoin isn’t just a digital asset anymore-it’s becoming a real way to pay for things. In 2025, businesses from small cafes in Boulder to multinational tech firms are accepting Bitcoin for goods and services. Why? Because it’s faster, cheaper, and more secure than traditional payment systems in key areas. You don’t need to be a tech expert to use it. You just need to understand what’s changed.

Bitcoin Payments Are Actually Fast Now

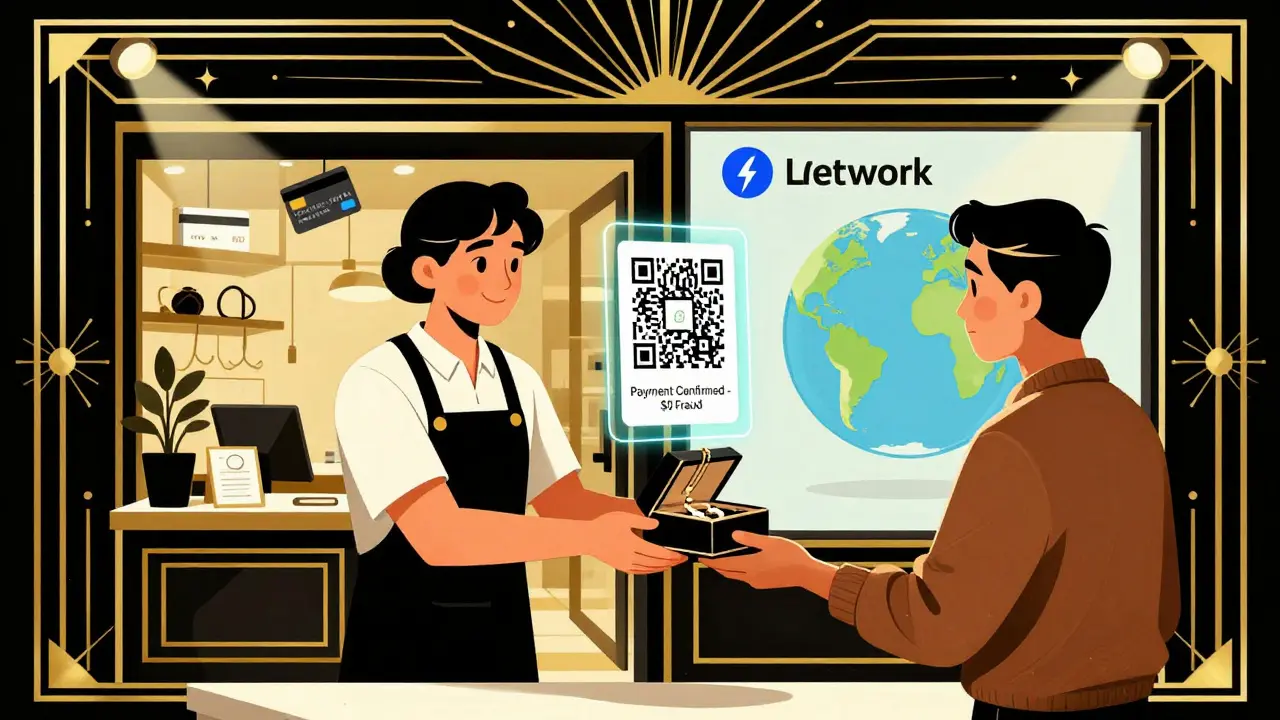

A few years ago, people laughed at the idea of using Bitcoin to buy coffee. Why? Because on-chain transactions took 10 to 60 minutes. That’s too slow for a line at Starbucks. But that’s not the full story anymore. The real shift came with the Lightning Network. It’s a second-layer solution built on top of Bitcoin that lets you send payments in under a second. As of August 2025, it handles 1.2 million transactions daily across 65,000 active nodes. Fees? Around $0.0003 per transaction. That’s less than a penny. You can send $5 to a friend in another country, and it clears instantly. No bank delays. No middlemen. No surprise fees.Businesses Are Holding Bitcoin-And It’s Making Them Money

It’s not just individuals buying Bitcoin. Companies are stacking it like gold. As of Q3 2025, businesses hold 1.3 million BTC-6.2% of all Bitcoin ever created. That’s a 21x increase since 2020. MicroStrategy alone holds 214,800 BTC, which gained $1.2 billion in value during the first nine months of 2025. Why? Because Bitcoin isn’t just a payment tool. It’s a treasury asset. When you accept Bitcoin as payment, you can choose to convert it to USD right away-or hold it. If the price rises, your balance grows. If it drops, you still got paid for your product or service. No chargebacks. No reversals. No fraud.Cross-Border Payments Just Got a Lot Cheaper

Sending money across borders used to cost 6% to 10%. Think Western Union, Wise, or your bank’s international wire. Bitcoin cuts that to 3.5%. In countries like Nigeria, the Philippines, or Venezuela, where people rely on remittances from family abroad, this matters. A worker in the U.S. sending $500 home to their family in Manila used to pay $30 in fees. Now, with Bitcoin and Lightning, they pay $1.75. The recipient gets the full amount almost instantly. No waiting days. No paperwork. No limits. That’s why adoption is exploding in South Asia and North Africa-even where governments try to ban crypto.Small Businesses Love It Because There Are No Chargebacks

One of the biggest headaches for small merchants is chargeback fraud. A customer buys something, gets the product, then claims they never received it. The credit card company sides with the buyer. The merchant loses the item and the money. Visa’s 2025 report shows chargeback fraud rates above 1.2% for transactions under $10,000. Bitcoin doesn’t have that problem. Transactions are final. Once confirmed, they can’t be reversed. That’s why 50% of small and medium businesses now accept Bitcoin or stablecoins-up 45% from last year. Coffee shops, online retailers, freelance designers-they’re all using it because it protects them from scams. One Reddit user, who runs a small online store selling handmade jewelry, said: “I used to lose $800 a month to chargebacks. Since switching to Bitcoin, my fraud rate dropped to zero.”

It’s Easier Than Ever to Accept Bitcoin

You don’t need to run a node or understand blockchain. Setting up Bitcoin payments today takes less than two hours. Platforms like BitPay, Coinbase Commerce, and Strike integrate directly with Shopify, WooCommerce, Square, and even PayPal. Merchants get a QR code or a button on their website. When a customer pays, the system instantly converts Bitcoin to USD and deposits it into their bank account. No price risk. No volatility exposure. That’s why the average merchant onboarding time dropped from 14 days in 2020 to just 3.2 days in 2025. Even physical stores can use simple terminals that look like regular credit card readers. No blockchain knowledge needed.Bitcoin Beats Stablecoins in Key Ways

Stablecoins like USDC and USDT dominate merchant payments-they process $1.25 trillion monthly. But they’re not the same as Bitcoin. Stablecoins are issued by companies like Tether or Circle. They rely on centralized banks and audits. If the issuer gets hacked or regulated out of existence, your payment could vanish. Bitcoin? No company controls it. No CEO can freeze your funds. No government can shut it down. That’s why Bitcoin still leads in peer-to-peer transactions-67% market share. And for high-value payments over $10,000, Bitcoin’s irreversibility and decentralization make it the safer option. Businesses that care about censorship resistance-like journalists, activists, or crypto-native startups-choose Bitcoin because it can’t be blocked.Regulation Is No Longer the Barrier

In 2020, businesses were scared of legal risk. Now, 68 countries have clear rules for crypto payments. The U.S. gave Bitcoin a clear accounting treatment in 2024 with Accounting Standards Update 2024-06. That means companies can list Bitcoin on their balance sheets like cash or gold. The SEC hasn’t sued a single business for accepting Bitcoin. In fact, major banks like JPMorgan and Goldman Sachs now offer Bitcoin custody services. Regulatory clarity turned Bitcoin from a legal gray area into a legitimate payment method.

People Are Ready to Use It

A 2025 survey by Triple-A found that 67% of Bitcoin owners plan to use it more for payments in 2025. Among people aged 25 to 34, 60% already use Bitcoin to pay for services. Urban areas lead adoption-80% of users live in cities. Reddit’s r/Bitcoin community, with over 1.2 million members, shows 78% positive sentiment around payments. People aren’t just holding Bitcoin. They’re spending it. For rent. For groceries. For freelance gigs. Trustpilot reviews for Bitcoin payment processors average 4.3 out of 5. The top complaints? Volatility during checkout (which merchants solve with instant conversion) and confusing tax reporting (which apps like Koinly and TokenTax now automate).What’s Next?

The upgrades keep coming. In October 2025, the SIGHASH_NOINPUT soft fork improved Lightning Network routing by 29%. A new upgrade called MAST, expected in Q2 2026, will shrink payment transaction sizes by 35%, making the network even more efficient. And by late 2026, the Graffiti protocol will let merchants add custom notes to payments-like “payment for website design” or “donation to local food bank”-without revealing private data.It’s Not Perfect-But It’s Working

Yes, Bitcoin’s base layer still only handles 7 transactions per second. That’s nothing compared to Visa’s 24,000. But you don’t need to process 24,000 payments per second to pay for a sandwich. Lightning Network handles that for you. Yes, prices swing. But merchants convert instantly. Yes, taxes are complicated. But tools now auto-generate reports. The failures? Overstock.com paused Bitcoin payments in April 2025 after a 22% price swing in four hours. They came back within three days-with better volatility buffers. That’s not a failure. That’s a learning curve.Bitcoin payments aren’t popular because they’re trendy. They’re popular because they solve real problems: slow cross-border money, high fees, chargeback fraud, and lack of financial freedom. The infrastructure is here. The users are here. The businesses are here. And the numbers don’t lie. In 2025, Bitcoin processed $380 billion in payments. By December, that number will hit $1.2 trillion. This isn’t speculation. It’s happening right now.

Can I really use Bitcoin to buy everyday things like groceries?

Yes. Thousands of stores in the U.S., Canada, Europe, and Asia now accept Bitcoin through payment processors like BitPay or Strike. You can pay for groceries at Whole Foods in select locations, buy gift cards for Amazon and Walmart, or pay your utility bill in some cities. Most transactions happen via the Lightning Network, so it’s fast and cheap. You don’t need to hold Bitcoin long-term-you just use it like cash.

Is Bitcoin payment safe from hackers?

The Bitcoin network itself has never been hacked. It’s the most secure financial network in history, running for over 15 years without a single successful breach. But your wallet can be compromised if you don’t secure it. Use a hardware wallet like Ledger or Trezor, enable two-factor authentication, and avoid storing large amounts on phones or online exchanges. Over 63% of businesses use multi-signature wallets, which require multiple approvals to move funds-adding a strong layer of protection.

Why not just use PayPal or Venmo instead?

PayPal and Venmo are convenient, but they’re not decentralized. They can freeze your account, reverse transactions, or block payments based on their policies. Bitcoin gives you full control. No one can stop your payment. No one can censor you. If you’re sending money to someone in a country under sanctions, or you’re a small business tired of chargebacks, Bitcoin is the only option that offers true financial sovereignty.

Do I have to pay taxes on Bitcoin payments?

Yes. In the U.S., the IRS treats Bitcoin as property. When you receive Bitcoin as payment, you owe income tax on its fair market value in USD at the time of receipt. If you later sell or spend it and its value has increased, you may owe capital gains tax. But tools like Koinly, TokenTax, and CoinTracker automate this. They track your transactions, calculate gains and losses, and generate IRS Form 8949. Most merchants use instant conversion to USD, so they only pay income tax-no capital gains.

What if Bitcoin’s price crashes right after I accept it?

Merchants don’t hold the Bitcoin. When a customer pays with Bitcoin, payment processors like BitPay or Coinbase Commerce instantly convert it to USD and deposit it into your bank account. You never own the Bitcoin. You just get paid in dollars. The price risk is handled by the processor, not you. That’s why over 83% of businesses use this method. It’s like accepting a credit card-you get paid in your local currency.

Is Bitcoin payments only for tech-savvy people?

No. The average user doesn’t need to know anything about blockchain. Mobile wallets like BlueWallet, Phoenix, and Strike have simple interfaces. You scan a QR code, enter the amount, and tap pay. It’s as easy as Apple Pay. For businesses, setup takes under two hours with no coding. The complexity has been hidden behind user-friendly apps. Bitcoin payments are becoming as normal as swiping a card.

Greg Knapp

December 17, 2025 AT 02:24Shruti Sinha

December 18, 2025 AT 18:54Florence Maail

December 20, 2025 AT 15:20Chevy Guy

December 22, 2025 AT 03:41Emma Sherwood

December 22, 2025 AT 09:10Kayla Murphy

December 23, 2025 AT 01:35George Cheetham

December 24, 2025 AT 03:18Craig Nikonov

December 25, 2025 AT 04:25Cheyenne Cotter

December 26, 2025 AT 17:56Donna Goines

December 28, 2025 AT 00:34Amy Copeland

December 28, 2025 AT 20:12Sally Valdez

December 29, 2025 AT 03:32Terrance Alan

December 30, 2025 AT 15:32Heather Turnbow

January 1, 2026 AT 09:42Sue Bumgarner

January 2, 2026 AT 03:33