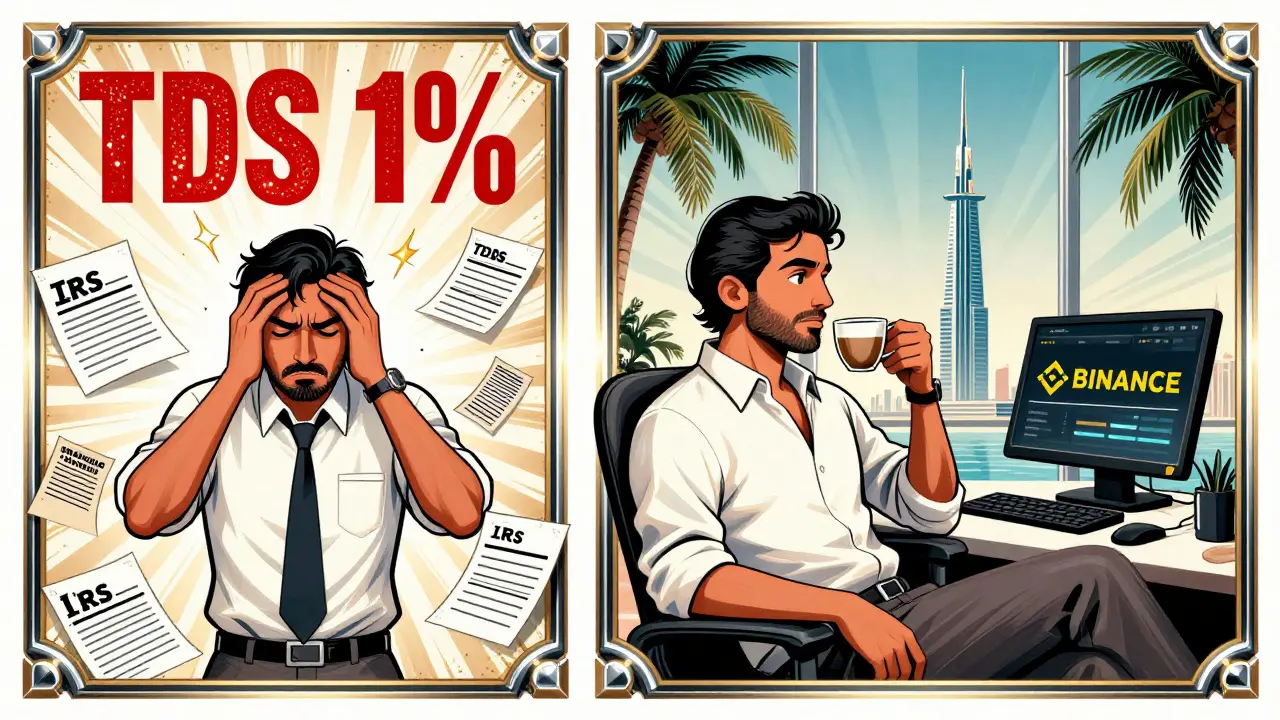

For years, Indian crypto traders have watched their profits shrink under a 30% flat tax on every gain-no deductions, no loss offsets, no exceptions. Add a 1% TDS on every sale over ₹50,000, and suddenly your $50,000 profit becomes $35,000 after taxes and withholdings. Meanwhile, just a short flight away in Dubai, the same profit? Zero tax. No capital gains. No income tax. No hidden fees. Just pure, clean returns.

The Indian Crypto Tax Trap

India’s crypto tax rules, introduced in 2022, were never meant to encourage adoption. They were designed to discourage. Every time you trade Bitcoin, sell Ethereum, or even use crypto to buy coffee, the government takes 30% of your profit. No matter if you held it for a day or five years. No matter if you lost money on other trades. Losses don’t matter. Trading fees? Not deductible. Even the 1% TDS gets locked in upfront-so if you sell $10,000 worth of crypto, $100 disappears before you even see your money.Compare that to stocks or mutual funds. There, long-term gains are taxed at just 10% after a ₹1 lakh exemption. Crypto? No such luck. You’re treated like a gambler, not an investor. And the IRS-style reporting? Every exchange in India now sends your transaction history to the tax department. You can’t hide. You can’t delay. You pay-every time.

Dubai’s Crypto Paradise

Dubai doesn’t just have sunshine and luxury malls. It has a tax code that laughs at India’s rules. Personal crypto traders in the UAE pay 0% tax on gains. Not 5%. Not 10%. Zero. Whether you made $10,000 or $10 million, the government doesn’t touch it. No filing. No forms. No audits for individual traders.The UAE doesn’t just tolerate crypto-it built an entire ecosystem around it. The Virtual Assets Regulatory Authority (VARA) sets clear rules for exchanges, wallets, and trading platforms. Major players like Binance, Bybit, and Kraken have offices in Dubai. Banks like Emirates NBD and Mashreq now offer crypto-friendly services. You can open a bank account, trade on regulated platforms, and even get paid in crypto-all legally.

And it’s not just about trading. If you’re serious, you can set up a company in a free zone like DMCC or IFZA. For under $10,000, you can register a business that owns your crypto assets. If your annual revenue stays under AED 375,000 ($102,000), you pay 0% corporate tax. Above that? Just 9%. Still way below India’s effective rate when you add in personal and corporate layers.

The Real Math: How Much Can You Save?

Let’s say you’re a trader who makes $100,000 in crypto profits this year. In India:- 30% tax on profits = $30,000

- 1% TDS on sales = $1,000 (withheld upfront)

- Net take-home = $69,000

In Dubai? You keep every dollar. $100,000. Full. No deductions. No surprises. That’s $31,000 extra in your pocket-just from tax savings.

Now scale that up. Someone making $500,000 a year? In India, they pay $150,000 in taxes. In Dubai? They pay $0. That’s $150,000 they can reinvest, buy property, or save. That’s not a lifestyle change. That’s financial freedom.

Relocating Isn’t Just About Taxes

Moving to Dubai isn’t just about dodging taxes-it’s about building a future. Once you register a company in a UAE free zone, you can apply for a residence visa. That means you can legally live there, open a local bank account, and operate your trading business under a UAE entity. You’re no longer a foreigner hiding behind a VPN. You’re a registered business owner in a global financial hub.Dubai’s infrastructure supports crypto traders in ways India can’t match. High-speed internet. 24/7 trading access. International banking. Legal recourse if something goes wrong. Crypto conferences. Meetups with other traders. Access to venture capital. You’re not isolated-you’re connected.

And the lifestyle? It’s real. Safe streets. Top-tier healthcare. World-class schools. No pollution. No traffic chaos. You can live in a high-rise with a view of the Burj Khalifa and still pay less in rent than you’d pay for a small apartment in Mumbai or Bangalore.

The Catch: It’s Not Simple

This isn’t a get-rich-quick scheme. Moving isn’t cheap. Setting up a company in DMCC costs $8,000-$15,000. You need a local agent. You need to open a UAE bank account-which can take months. You need to file annual reports. You need to keep detailed records of every trade, even if you don’t pay tax.And here’s the big one: India still taxes you on worldwide income if you’re a tax resident. That means if you haven’t officially changed your tax residency, the Indian tax department can still come after you. You must prove you’re no longer living in India-sell your property, close your bank accounts, stop receiving salary, and establish physical presence in Dubai for at least 183 days a year.

Most people hire a specialist-either a UAE-based tax advisor or an international firm with crypto expertise. You can’t wing this. One mistake, and you risk double taxation or penalties from both countries.

What About the New UAE Reporting Rules?

You’ve probably heard about CARF-the Crypto-Asset Reporting Framework. Starting in 2025, UAE exchanges and custodians will start collecting data on users’ identities and transaction histories. By 2028, that data will be shared automatically with other countries, including India.But here’s the key: CARF is about reporting, not taxing. The UAE still doesn’t tax crypto. They’re just telling other countries what you’re doing. So if you’re legally in Dubai, paying no tax, and following the rules-you have nothing to fear. The data will show you’re compliant. It won’t trigger a tax bill in Dubai.

The real risk? If you’re still claiming Indian residency while trading from Dubai. That’s when CARF could expose you to double taxation. That’s why professional advice is non-negotiable.

Who Should Consider This Move?

This isn’t for everyone. If you’re trading $10,000 a year, the cost of relocation isn’t worth it. But if you’re making $100,000 or more annually? The math is undeniable. The savings alone can cover your setup costs in under a year.It’s also for people who want to build something bigger. Not just trading, but launching a crypto fund, a blockchain startup, or a trading education platform. Dubai gives you legitimacy. India doesn’t.

And if you’re tired of the regulatory uncertainty in India-the sudden bans, the vague guidelines, the fear that tomorrow’s notification could shut down your entire business? Dubai offers clarity. VARA’s rules are published. They’re enforced. You know where you stand.

The Future Is Here

More Indian crypto traders are moving to Dubai every month. Some are solo traders. Others are teams of developers and analysts. Some are families relocating for long-term stability. They’re not running away. They’re building something better.India’s tax policy hasn’t changed. Dubai’s infrastructure keeps getting stronger. Exchanges are expanding. Banks are opening crypto desks. Legal firms are specializing in crypto residency. The ecosystem is growing.

If you’re serious about crypto and tired of paying 30% of your gains to the government, the choice isn’t complicated. You can keep fighting a broken system-or you can move to a place where your profits actually belong to you.

Can I still trade crypto from India after moving to Dubai?

You can, but you shouldn’t. If you’re a UAE tax resident, you must declare your income in Dubai and stop filing as an Indian resident. Continuing to trade from India while claiming Dubai residency risks triggering tax audits in both countries. The cleanest path is to close your Indian trading accounts, move your assets to a UAE-registered entity, and trade exclusively through UAE platforms.

Do I need to sell my Indian assets before moving?

You don’t have to, but you should. Selling property, closing bank accounts, and ending employment in India helps prove you’ve severed tax residency. If you keep an Indian address or receive salary from an Indian company, the tax department may still consider you a resident. For full compliance, establish physical presence in Dubai for at least 183 days per year and document it with utility bills, lease agreements, and visa stamps.

Can I use a VPN to trade crypto from India and avoid taxes?

No. Using a VPN doesn’t change your tax residency. The Indian tax department tracks transactions through exchange reports and TDS records. If you’re physically in India, you’re still liable for taxes. The only legal way to avoid Indian crypto taxes is to change your tax residency and operate from a jurisdiction like Dubai where crypto is tax-free.

How long does it take to set up a crypto business in Dubai?

It typically takes 4-8 weeks. First, you choose a free zone (DMCC, IFZA, etc.), submit documents, pay fees, and get your license. Then you open a UAE bank account-which can take another 2-6 weeks depending on the bank. After that, you transfer your crypto assets to a wallet under your company’s name. The entire process requires professional help to avoid delays or compliance errors.

Is Dubai’s zero-tax policy permanent?

There’s no indication it’s changing. The UAE has invested billions into becoming a global crypto hub. Abandoning zero tax on crypto would undermine that strategy. While CARF introduces reporting, it doesn’t introduce taxation. The government has repeatedly confirmed that individual crypto gains remain untaxed. For now, the policy is stable and backed by law.