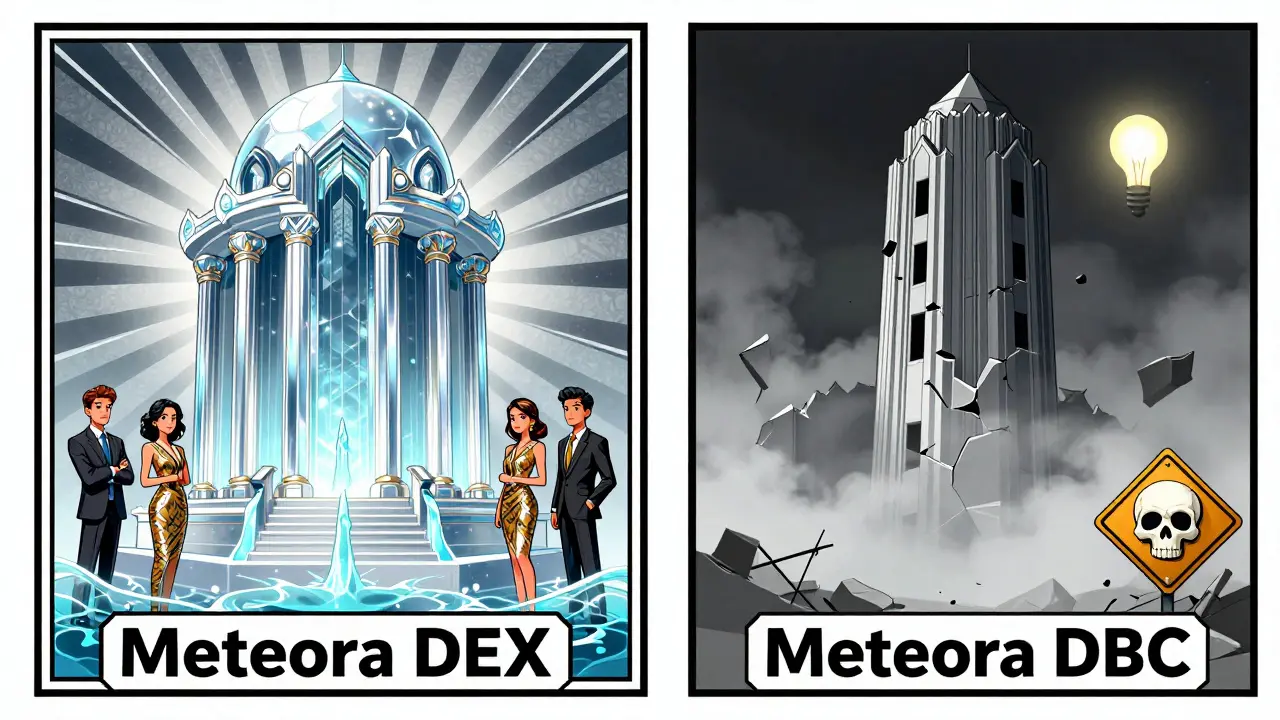

There’s a crypto exchange called Meteora DBC - and if you’re looking for a solid review, you’re going to hit a wall. Most people searching for Meteora are actually looking for Meteora DEX, the well-known Solana-based liquidity protocol. But Meteora DBC? That’s a different beast. And right now, there’s very little public information about it.

What Is Meteora DBC?

Meteora DBC is listed as a cryptocurrency exchange with a 24-hour trading volume of around $11 million and roughly 141,706 weekly website visits. That’s not tiny - but it’s nowhere near the scale of top-tier exchanges like Binance or even Solana-native platforms like Raydium or Jupiter. The only real public trace of it is a Discord server: https://discord.gg/WwFwsV. No official website, no whitepaper, no clear team bios, no roadmap. Just a Discord and some volume stats.Don’t Confuse It With Meteora DEX

This is critical: Meteora DBC is not Meteora DEX. They’re not even the same type of platform. Meteora DEX is a decentralized liquidity layer built on Solana. It’s used by traders and liquidity providers to access advanced AMM pools, dynamic fee structures, and yield-optimized vaults. It’s got a $800 million TVL, $200 million in daily swaps, and a solid reputation in the DeFi space. Experts call it a game changer. Meteora DBC? It looks like a centralized exchange - a place where you deposit funds, trade pairs, and withdraw. But unlike Coinbase or Kraken, there’s zero transparency. No KYC policy mentioned. No list of supported coins. No fee schedule. No security audits published. No history. No team.Why the Lack of Info?

There are two possibilities here. Either Meteora DBC is a very new, very quiet project trying to grow organically - or it’s a low-effort platform trying to ride the Meteora name without the substance. The name similarity isn’t accidental. But there’s no official link between the two. No GitHub repo. No Twitter account. No Medium posts. No press releases. Just volume numbers and a Discord. In crypto, that’s a red flag. Legit platforms don’t hide. They publish audits. They list their team. They explain how they protect your funds. Meteora DBC does none of that.

What We Can Infer From the Numbers

The $11 million daily volume suggests real users are trading there. The 141,706 weekly visits mean people are finding it. But volume alone doesn’t mean safety or reliability. A lot of low-tier exchanges see spikes in volume from wash trading or bot-driven activity. Without knowing the trading pairs, the liquidity depth, or the order book structure, those numbers mean little. Compare that to Meteora DEX, which has transparent on-chain data. You can see every pool, every liquidity position, every swap. With Meteora DBC? You’re flying blind.Security? Compliance? Nothing’s Public

If you’re thinking about depositing funds into Meteora DBC, ask yourself: Where are your assets stored? Cold wallets? Hot wallets? Multi-sig? Is there insurance? Are they licensed anywhere? Do they comply with AML/KYC rules? The answers? Unknown. Most reputable exchanges publish their security practices. Meteora DBC doesn’t. Not even a basic FAQ. You can’t even find out if they support USD deposits or only crypto-to-crypto trading. This isn’t just a lack of detail - it’s a lack of trust signals. And in crypto, trust signals are everything.Who’s Using It?

The only community presence is the Discord. No Reddit threads. No CoinMarketCap reviews. No Trustpilot ratings. No YouTube tutorials. No Twitter threads from users sharing wins or losses. That’s unusual for a platform with over 140k weekly visits. Most users would be talking about it - especially if it’s easy to use or has low fees. If you’re considering joining, you’re one of the first. And that’s risky.

What’s Missing? A Lot.

Here’s what you’d expect from any exchange - and what Meteora DBC doesn’t provide:- Supported cryptocurrencies (which coins can you trade?)

- Fees (trading, deposit, withdrawal)

- Withdrawal times

- Mobile app availability

- Customer support channels

- Regulatory status (licensed in which jurisdictions?)

- Proof of reserves

- History of hacks or outages

Should You Use It?

If you’re looking for a safe, reliable exchange to trade crypto - skip Meteora DBC. There are too many unknowns. You’re not just risking your money - you’re risking your time and peace of mind. If you’re curious and want to try it with a small amount - fine. But treat it like a gamble. Don’t deposit more than you’re willing to lose. And never store long-term holdings there. There are better options. Even on Solana, you’ve got Jupiter, Raydium, Orca, and Serum - all with transparent operations, community trust, and active development. Why risk your funds on a platform that won’t even tell you who runs it?Final Verdict: Proceed With Extreme Caution

Meteora DBC isn’t a scam - not yet. But it’s not a trustworthy exchange either. It’s a mystery. And in crypto, mysteries are dangerous. The volume and traffic suggest someone’s building something. But without transparency, it’s impossible to say if that’s a real project or a temporary setup. If you’re a trader looking for liquidity, go where the data is clear. If you’re a saver, don’t even consider it. Until Meteora DBC publishes its team, security measures, fee structure, and compliance details - treat it like a dark pool. And stay away unless you’re prepared to lose everything.For now, the only thing we know for sure is this: if you’re looking for a reliable crypto exchange, Meteora DBC isn’t it.

Michael Jones

January 18, 2026 AT 06:07Meteora DBC is a red flag wrapped in a volume statistic. No team, no audits, no transparency - just a Discord and a number that could be manipulated. If you’re trading here, you’re not investing; you’re gambling with your private keys. Stick to Jupiter or Raydium. The difference isn’t just in features - it’s in trust.

And yes, the name similarity is intentional. That’s not coincidence. That’s bait.

Don’t let the $11M volume fool you. That’s noise, not signal.

Shaun Beckford

January 19, 2026 AT 06:34This isn’t a crypto exchange - it’s a ghost story with a trading interface. You’ve got more info about a Bitcoin ATM in a Walmart parking lot than you do about Meteora DBC’s founders. Zero GitHub. Zero Twitter. Zero accountability. And somehow, 140k weekly visits? Someone’s pumping this thing hard. Probably with bots. Probably with rug-pull money. Probably with your future regrets.

Don’t be the chump who says ‘I just put in $500’ - you’ll be the one begging for a refund in a Discord thread that’s already been deleted.

Hannah Campbell

January 20, 2026 AT 10:06myrna stovel

January 22, 2026 AT 05:55It’s okay to be cautious - but let’s not panic either. Maybe Meteora DBC is just a quiet team building in stealth mode. I’ve seen projects launch with minimal web presence and grow into giants. The key is to start small, observe, and never commit more than you can afford to lose. If you’re curious, dip a toe. But don’t dive.

And please, for the love of decentralization - don’t compare it to Binance. That’s like comparing a sketch to a cathedral.

Anna Gringhuis

January 23, 2026 AT 05:19Someone’s definitely trying to ride the Meteora DEX coattails. This feels like a copy-paste scam with a new domain and a Discord server. No one builds a crypto exchange in 2026 without a whitepaper, a team page, or even a LinkedIn profile. The fact that they’re hiding in plain sight? That’s not ‘quiet growth.’ That’s ‘I’m about to vanish with your ETH.’

And no, ‘volume’ doesn’t equal legitimacy. I’ve seen exchanges with $200M/day that were just wash trading bots. This is the same playbook.

Alexandra Heller

January 23, 2026 AT 08:13We live in an age where trust is a currency - and Meteora DBC is bankrupt. No transparency? No accountability? No moral compass? This isn’t a platform. It’s a void. And humans fill voids with hope. That’s the tragedy. We don’t need another exchange. We need more honesty. More visibility. More integrity. And right now? We’re being sold a ghost dressed in a UI.

Don’t be the person who says ‘I knew it was sketchy but I thought maybe…’ - because maybe is not a strategy. It’s a death sentence in crypto.

Bryan Muñoz

January 24, 2026 AT 16:07Chris Evans

January 26, 2026 AT 10:12The architecture of trust in crypto is built on verifiable transparency - not volume metrics. Meteora DBC operates in a state of ontological opacity. It’s not just unverified - it’s anti-verified. No on-chain footprints. No public key signatures. No governance tokens. No rational incentive alignment. This isn’t DeFi. This isn’t CeFi. This is crypto-adjacent nihilism.

And the fact that users are flocking to it? That’s the market signaling a collapse in epistemic standards. We’re not just trading assets - we’re trading epistemic humility. And we’re losing.

Rod Petrik

January 28, 2026 AT 07:54Sarah Baker

January 28, 2026 AT 21:33Look - I get it. You want to find the next big thing. But sometimes, the best move is to wait. There’s so much good stuff out there already - Jupiter, Raydium, Orca - all with real teams, real audits, real communities. Why rush into a black box when you can ride a wave that’s already proven?

Give it 6 months. If they launch a website, a team page, and a security audit? Then maybe we talk. Until then? I’m keeping my funds where I can see them.

Pramod Sharma

January 30, 2026 AT 05:51Anthony Ventresque

February 1, 2026 AT 02:24What’s interesting is how the community reacts. People are either terrified or weirdly excited. But nobody’s asking the real question: Why does this exist? Is it a front for something else? A liquidity aggregator? A bridge? A honeypot? The silence is louder than the volume. And silence in crypto usually means one thing - they’re building something they don’t want you to see.

Or they’re already gone.

Telleen Anderson-Lozano

February 2, 2026 AT 19:09Okay, I’ll say it: I tried Meteora DBC. With $20. Just to see. Deposited ETH. Traded for SOL. Withdrew. Took 47 minutes. No confirmation email. No support reply. No error message. Just… success? But here’s the thing - I still don’t know if they’re holding my keys, or if my withdrawal was just a simulated transaction. I’m not rich. But I’m not stupid. I’m not going back. And I’m telling everyone I know to stay away. Don’t be the person who says, ‘It worked for me.’ It worked once. That’s not a system. That’s luck. And luck runs out.

There’s a reason no one talks about this place. It’s because the people who used it either lost everything… or they’re too scared to speak up.

Pat G

February 4, 2026 AT 15:07USA doesn’t need this garbage. If you’re using this, you’re not a crypto investor - you’re a liability. We have Coinbase, Kraken, Gemini - regulated, insured, legal. Why are you risking your money on some Discord-based ghost exchange? This isn’t innovation. This is weakness. This is the kind of thing that gives crypto a bad name. And if you’re dumb enough to use it, you deserve to lose everything.

Stop. Just stop. Go home. Learn. Then come back when you’re ready to trade like an adult.