Category: Crypto & Blockchain - Page 4

Crypto Licensing Requirements in Philippines by SEC: What You Need to Know in 2025

As of 2025, the Philippine SEC requires all crypto exchanges serving Filipino users to obtain a license. Learn the exact requirements, penalties for non-compliance, and which platforms are now legal.

What is CoinCollect (COLLECT) crypto coin? NFT staking, tokenomics, and real-world usage explained

CoinCollect (COLLECT) is a DeFi platform that lets you earn crypto by staking NFTs. Learn how the token works, where to buy it, why trading volume is zero, and whether it's worth your time in 2025.

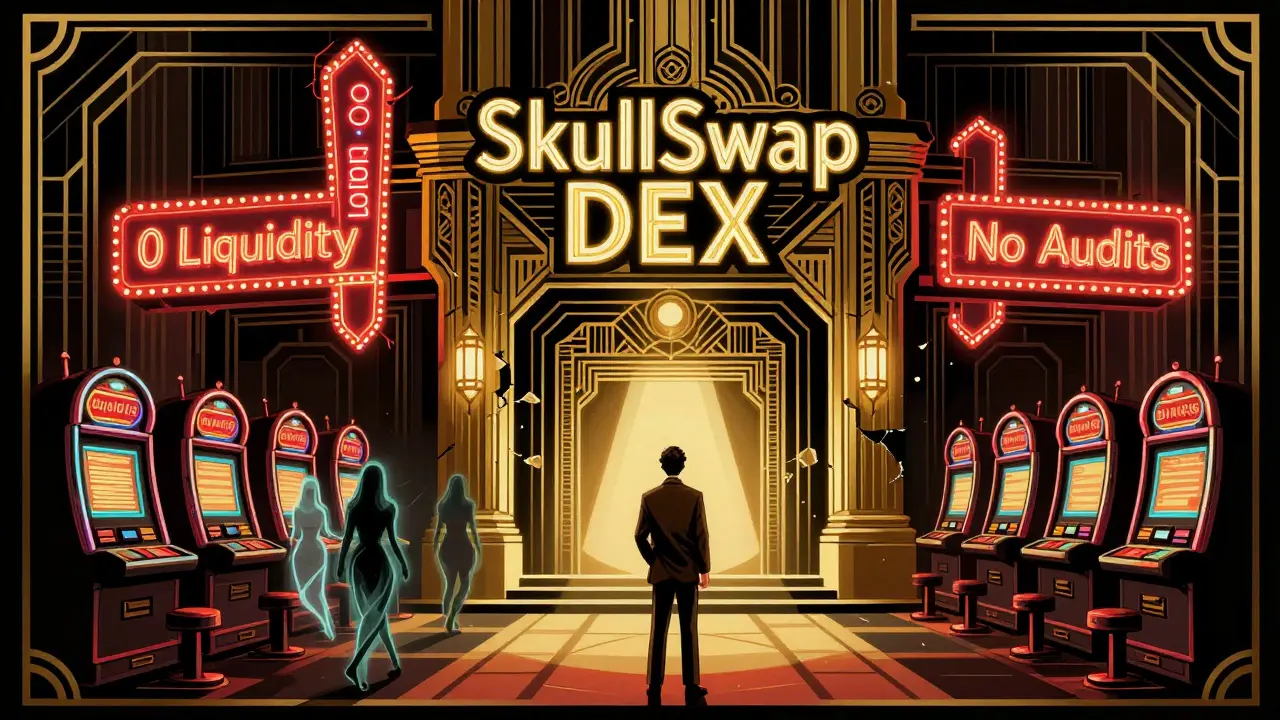

SkullSwap Crypto Exchange Review: Is This Fantom DEX Worth Your Time?

SkullSwap is a nearly dead Fantom-based DEX with microscopic liquidity, no audits, and zero community. Avoid it. Use SpookySwap or PancakeSwap instead for real trading.

Bitcoin Block Structure: Complete Technical Guide

Understand how Bitcoin blocks are built with a clear breakdown of the block header, transaction structure, and mining process. Learn why this design makes Bitcoin tamper-proof and how SegWit and Taproot evolved without breaking the core system.

Xcalibra Crypto Exchange Review: Is It Safe, Legit, and Worth Using in 2025?

Xcalibra crypto exchange is a regulated, niche platform focused on BTC, ETH, and Safex Cash trading. It’s legit for users in restricted countries, but lacks transparency on fees and security. Not for beginners.

DefiPlaza Crypto Exchange Review: A Niche DEX Built to Fight Impermanent Loss

DefiPlaza is a niche DEX built to solve impermanent loss with its CALM algorithm. After a major exploit on Ethereum, it migrated to Radix and now serves a small but dedicated community of liquidity providers. Not for beginners, but a bold experiment in sustainable DeFi.

Environmental Concerns Drive Sweden’s Tightening Crypto Restrictions

Sweden is restricting crypto mining not because it's illegal, but because of its massive energy use. Even with clean power, the country sees mining as a threat to its climate goals-and is forcing miners to adapt or leave.

Why Bitcoin Payments Are Becoming Popular

Bitcoin payments are growing fast because they're faster, cheaper, and more secure than traditional systems. Businesses are adopting them to cut fees, avoid chargebacks, and enable borderless transactions-with Lightning Network making it instant and low-cost.

CEX vs DEX: How Geographic Restrictions Affect Crypto Trading Around the World

CEXs block users by country due to regulations, while DEXs offer borderless trading - but that freedom comes with legal risks. Learn how geography shapes your crypto access and what’s changing in 2025.

Crypto Taxation in Mexico: How Income and Capital Gains Are Treated

Learn how Mexico taxes cryptocurrency income and capital gains under current law. Discover what counts as a taxable event, the $4,000 exemption, reporting rules, and how to stay compliant without overpaying.

Upbit Crypto Exchange Review: Security, Fees, and Why It Dominates South Korea

Upbit is South Korea's largest crypto exchange, known for top-tier security and strict compliance. It's ideal for Korean residents but inaccessible in the U.S. and many other countries due to regulatory limits.

Crypto Taxation in India: What You Need to Know in 2025

India taxes crypto gains at 30% plus 1% TDS and 18% GST on exchange fees. Learn how the rules work in 2025, what you owe, and how to stay compliant.